Clark County Sales Tax Rate 2018 Nevada

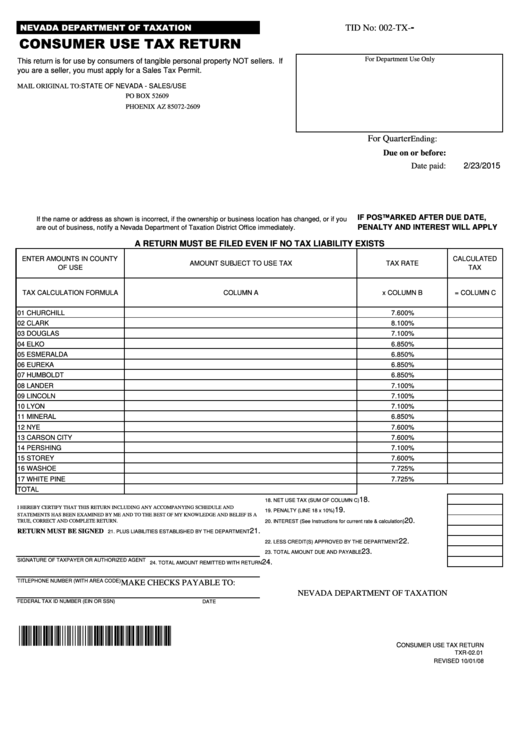

Clark County Unincorp. Areas .. 0600 .012 .065.077 Clark County Unincorp. PTBA* ... Local Sales and Use Tax Rates by City/County Tax Rates Effective January 1 - March 30, 2018 ...

Feb 06, 2020 · The clark county sales tax rate 2018 nevada tax rate for all admission charges collected is 9%. The tax is paid quarterly and is payable on or before the 10th day of the month following the end of the preceding calendar quarter. … speedy cash in southwestern denver

Delinquent Taxes - Clark County Clerk

List must be prepared in order by tax bill number, lowest to highest. July: Last day for each third party purchaser to register with the county clerk to participate in clerk’s sale of priority or current year …Churchill County, Nevada Sales Tax Rate - Avalara

clark county sales tax rate 2018 nevada The minimum combined 2020 sales tax rate for Churchill County, Nevada is . This is the total of state and county sales tax rates. The Nevada state sales tax rate is currently %. The Churchill County sales tax rate is %. The 2018 …Calculating Las Vegas Property Taxes: Las Vegas Real Estate

Calculating Las Vegas Property Taxes . To calculate the tax on a new home that does not qualify for the tax abatement, let's assume you have a Home in Las Vegas with a taxable value of $200,000 located in the as Vegas with a tax rate …Clark County, Nevada - Property Tax Rates

The median property tax (also known as real estate tax) in Clark County is $1,841.00 per year, based on a median home value of $257,300.00 and a median effective property tax rate of 0.72% of property value.. Clark County collects relatively high property taxes, and is ranked in the top half of all counties in the United States by property tax …Dec 01, 2018 · According to Washoe County Assessor, Michael Clark, “SJR14 removes the property tax cap and all depreciation the first fiscal year after the sale of the property.” Clark, along with Janine Hansen, president of Nevada …

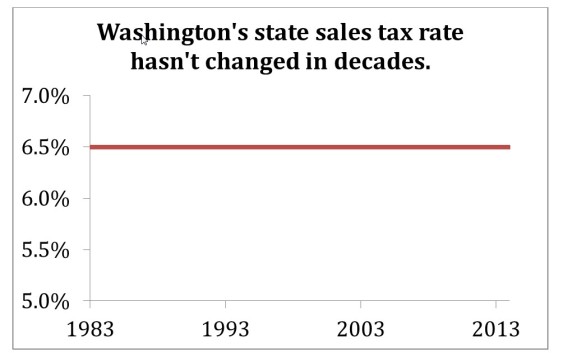

Vancouver, Washington Sales Tax Rate - Avalara

The minimum combined 2020 sales tax rate for Vancouver, Washington is . This is the total of state, county and city sales tax rates. The Washington sales clark county sales tax rate 2018 nevada tax rate is currently %. The County sales tax rate is %. The Vancouver sales tax rate is %. The 2018 …RECENT POSTS:

- m53682 louis vuitton new wave camera bag

- where louis vuitton bags made

- vuitton capucines mm

- luis beltran nephrologist tampa

- lv bags prices in parish

- wholesale lv durags

- louis vuitton black and white checkered purse

- louis vuitton internship singapore

- prices of louis vuitton handbags

- mr speedy philippines ownership

- louis vuitton grand sac noé monogram canvas m42224

- how to know if louis vuitton purse is authentication

- supreme louis vuitton mask

- lv brown monogram belton

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.