Clarke County Sales Tax Rate 2019

Current Tax Rates. Fauquier County Tax Rates are per $100 in Assessed Value . License Category Rate per $100 ; Real Estate: $0.855 Base $0.133 Fire & Rescue Levy $0.006 Conservation Easement Fund. $0.994. Real Estate - Special Districts: Marshall Electric Light and Business Improvement lv chain bag

Questions about the assessed value of property should be directed to Clarke County Commissioner of Revenue at (540) 955-5108. For other tax questions, call (540) 955-1099. Contact Us

Tax Rates | Frederick County

Virginia state sales tax: 5.3%; County meals tax: 4%; Combined sales tax and county meals tax: 9.3% ; Lodging tax: 3.5% (Effective July 1, 2019) Airplane tax: $0.01 per clarke county sales tax rate 2019 $100 of assessed value; Mobile Home tax: $0.61 per $100 of assessed value; Contract Carrier tax: $2.00 per $100 of assessed value; Gross Receipts of $100,000.00 or more before ...Local Tax Notices – Alabama Department of Revenue

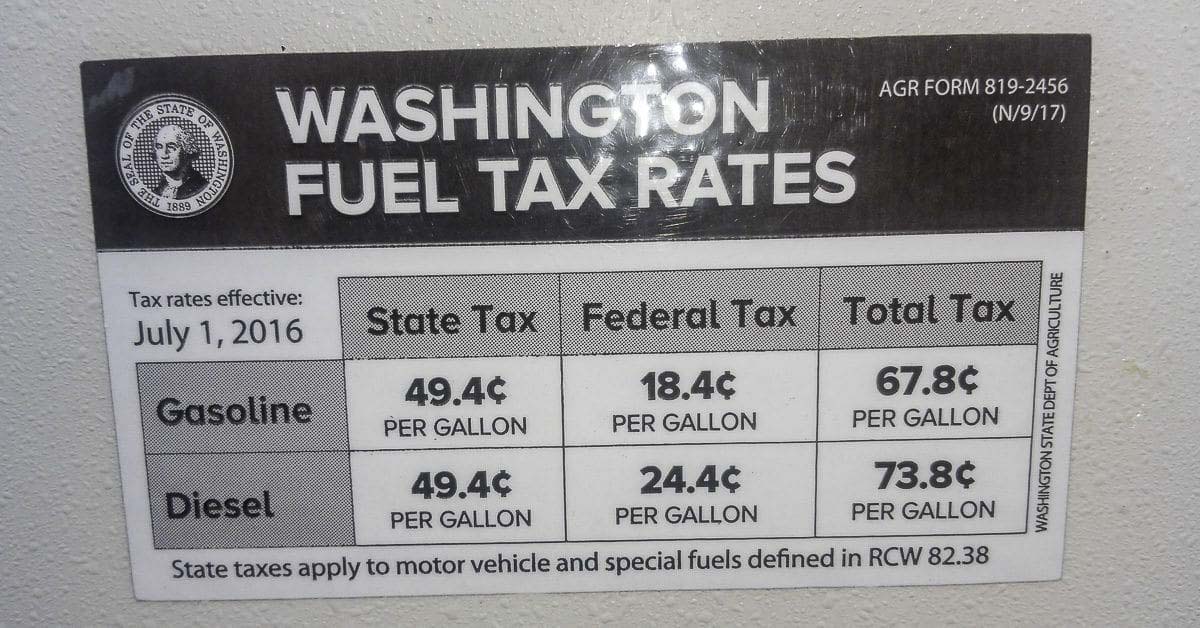

Local Tax Notices. Act 98-192, known as the Local Tax Simplification Act of 1998, required each county and municipality to submit to the Department a list of any sales, use, rental, lodgings, tobacco, or gasoline taxes it levied or administered and the current rates thereof.Millage Rates – Alabama Department of Revenue

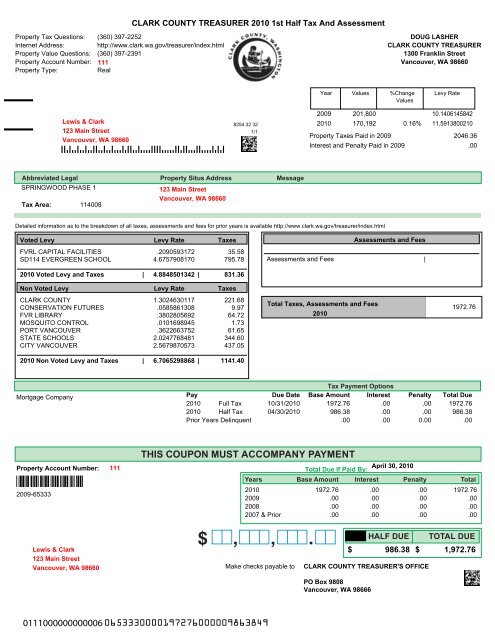

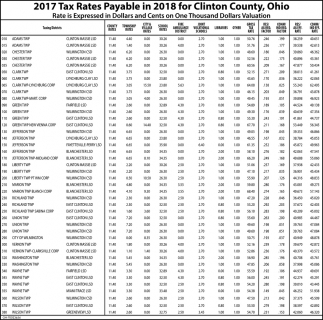

Millage clarke county sales tax rate 2019 rates are used in property tax assessments and are determined by the county commissions and other taxing agencies. Millage is the tax rate expressed in decimal form. A mill is one-tenth of one cent. (.001) 1 mill = $0.001 10 mills = one penny or $0.01 100 mills = ten cents or $0.10 1000 […]School drama, police shootings among top Athens stories of ...

Dec 31, 2019 · The saga of Clarke County schools Superintendent Demond Means, police shootings and a new Athens-Clarke government committed to change grabbed headlines in 2019…CLARKE COUNTY - Iowa Treasurers Site

From: Brenda L Wallace, Adair County Treasurer. Re: 2019 Annual Tax Sale. Enclosed is information regarding the 2019 annual tax sale. The Adair County Annual Tax Sale will begin at 9:30 a.m. on Monday, June 17th, 2019 in the Greenfield City Hall Meeting Room, 202 S 1st St, Greenfield, Iowa (one and half blocks south of the square).CLARK COUNTY PROPERTY TAX RATES Fiscal Year 2019-2020: District 200 - LAS VEGAS clarke county sales tax rate 2019 CITY

RECENT POSTS:

- louis vuitton mini.backpack

- louis vuitton city guide

- used iphone xs max

- louis vuitton card holder dupe amazon.com

- lv bracelet white gold

- louis sherry candy

- black friday 2019 deals apple macbook pro

- louis vuitton monogram canvas turenne mm tote bag

- chez l'ami louis chicken

- boho lv bags

- small canvas bags with zipper

- crossbody bags black

- old cobbler dhgate neverfull

- used louis vuitton tote bag

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

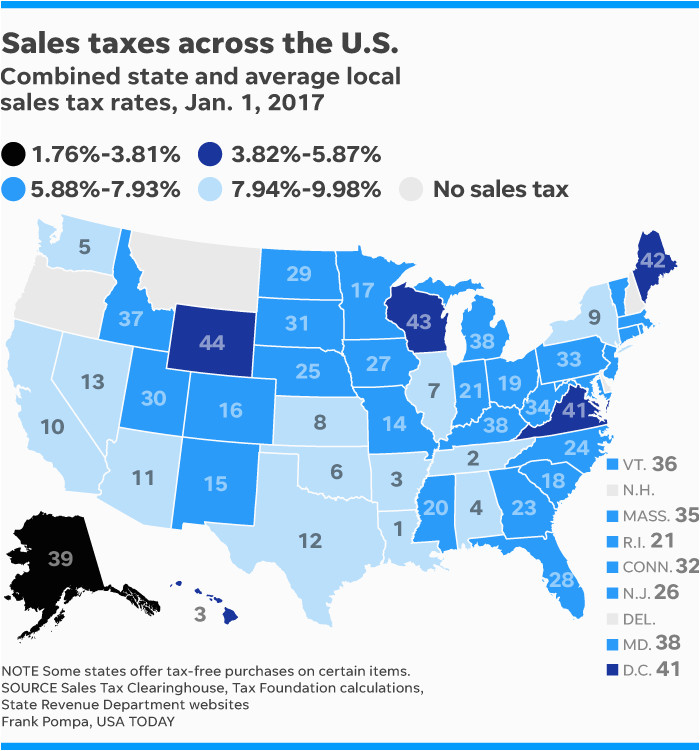

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.