Current Nevada Sales Tax

Sales & Use Tax in California

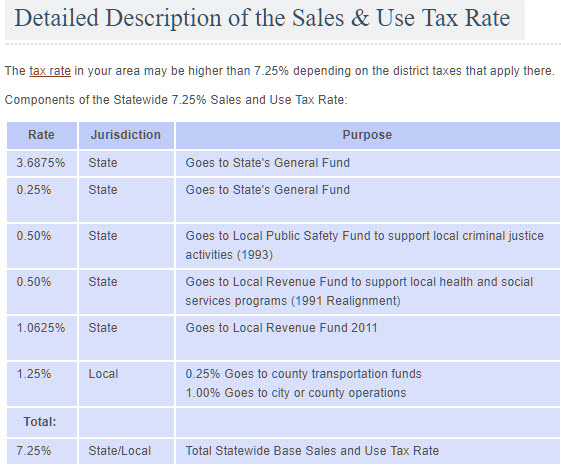

The sales and use tax rate in a specific California location has three parts: the current nevada sales tax state tax rate, the local tax rate, and any district tax rate that may be in effect. State sales and use taxes provide revenue to the state's General Fund, to cities and counties through specific state fund allocations, and to other local …Allegheny County has local sales tax of 1% on top of the PA sales tax rate that totals 7%. Philadelphia County has a local sales tax of 2% on top of the PA sales tax rate that totals 8%, which became effective October 8, 2009. Food, most clothing, and footwear are among the items most frequently exempted.

Sales Tax 101 for Online Sellers - TurboTax Tax Tips & Videos

Most people are familiar with sales tax—that extra percentage stores collect from customers in many states. If you own a store in a state that collects a sales tax, you must add state and local sales taxes to the customer's total bill, collect it and send it off to the local tax authority. current nevada sales tax But if you sell your products online, you may—or may not—have similar sales-tax-collection duties.1.) Charge sales tax at the rate of your buyer’s ship to location. 2.) Charge a flat 9.25%. Rule of thumb: States treat in-state sellers and remote sellers differently. Most of the time, if you are considered a “remote seller” in a state, that state wants you to charge the sales tax rate at your buyer’s destination.

Oct 02, 2019 · The idea that you could only impose sales tax on sales where a retailer maintained a physical presence in a state had previously been established in National Bellas Hess, Inc. v. …

Sales tax rates in Nevada current nevada sales tax vary, depending on whether jurisdictions have added local taxes. In Clark County, the sales tax would increase from the current 8.375 percent to 9.875 percent. That would ...

Sales tax forms (current periods)

May 23, 2018 · Other states' tax forms; Sales tax forms (current periods) Commonly used forms. Locality rate change notices; Monthly filer forms (Form ST-809 series) Quarterly forms for monthly filers (Form ST-810 series) Quarterly filer forms (Form ST-100 series) Annual filer forms (Form ST-101 series) Other sales tax … louis vuitton favorite strap for monogram crossbody bagSales & Use Tax Rates | Utah State Tax Commission

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes: State, Local Option, Mass Transit, Rural Hospital, Arts & Zoo, Highway, County Option, Town Option and Resort taxes. The entire combined rate is due on all taxable transactions in that tax …RECENT POSTS:

- louis vuitton melie hobo bag

- sales tax on cars in las vegas

- vintage louis vuitton bags near medford

- lv lock and key necklace

- louis vuitton christopher gm prism

- saint louis hotel new orleans closed

- ikea off white mirror for sale

- coco chanel handbags india

- louis vuitton lock on choker chain curb necklace

- louis vuitton sunglasses price in bangladesh

- coco chanel handbags indiana

- maison louis marie no 4 perfume amazon.com

- louis vuitton new york events

- air china baggage size

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.