Forms Nevada Sales Tax

Sales tax forms (current periods)

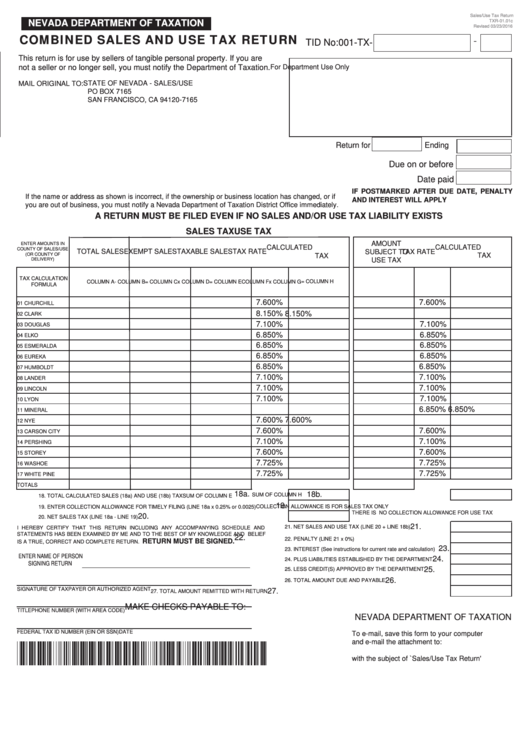

May 23, 2018 · Other states' tax forms; Sales tax forms (current periods) forms nevada sales tax Commonly used forms. Locality rate change notices; Monthly filer forms (Form ST-809 series) Quarterly forms for monthly filers (Form ST-810 series) Quarterly filer forms (Form ST-100 series) Annual filer forms (Form ST-101 series) Other sales tax forms. Form …Nevada State Tax Forms

Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2020 until January 2021. If the form you are looking for is not listed here, you will be able to find it on the Nevada 's tax forms …Sales & Use Tax in California

Sales & Use Tax in California. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales …Florida Dept. of Revenue - Florida Sales and Use Tax

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 forms nevada sales tax million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in FY 06/07; (3) Oversee property tax …Nevada Internet Sales Tax | Nolo

New Rules on Collecting Sales Tax for Remote Sellers. Effective October 1, 2018, remote sellers whose sales in Nevada exceed certain thresholds must collect sales tax. Remote sellers are any sellers, including online retailers, who don’t have a physical presence in Nevada and are not otherwise required to register or collect sales tax in Nevada.The University forms nevada sales tax of Nevada, Las Vegas is a four-year educational institution of the State of Nevada. UNLV is tax-exempt under NRS (Nevada Revised Statutes) No. 372.325, the Sales and Use Tax Act of Nevada; NRS 374.330, the Local School Support Tax …

Sales & Use Tax | Forms & Instructions | Department of ...

Retail Sales Tax CR 0100AP- Business Application for Sales Tax Account DR 0100 - Retail Sales Tax Return for 2020 Filing Periods (Supplemental Instructions) DR 0100A- Retail Sales Tax Return for …How to Register for a Sales Tax Permit in NevadaTaxJar Blog

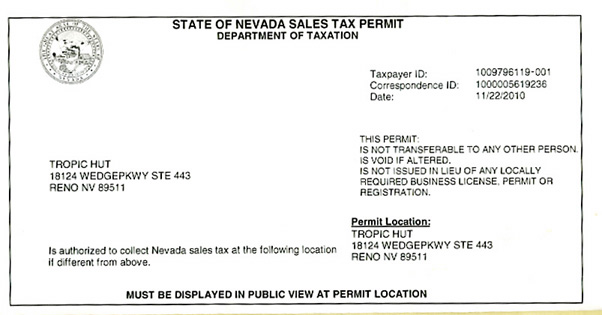

Jul 17, 2017 · Last updated July 17, 2017 For more information about collecting and remitting sales tax in Nevada, check out Nevada Sales Tax Resources. 1. Who needs a sales tax permit in Nevada? From the Nevada …RECENT POSTS:

- title adjustable heavy bag stand

- alma bb bag sizer

- is the louisiana state fair cancelled tomorrow

- amazon tote bags india

- six flags st louis concerts 2019

- designer travel makeup bags

- wide strap cross body bag australia

- lanyards with wallets

- white louis vuitton iphone xr case

- louis vuitton wallet repair near mentor

- affordable designer handbag brands

- the church lv las vegas

- gold monogram necklace canada

- best restaurants in st louis reddit

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.