Louisiana Secretary Of State Llc Registration

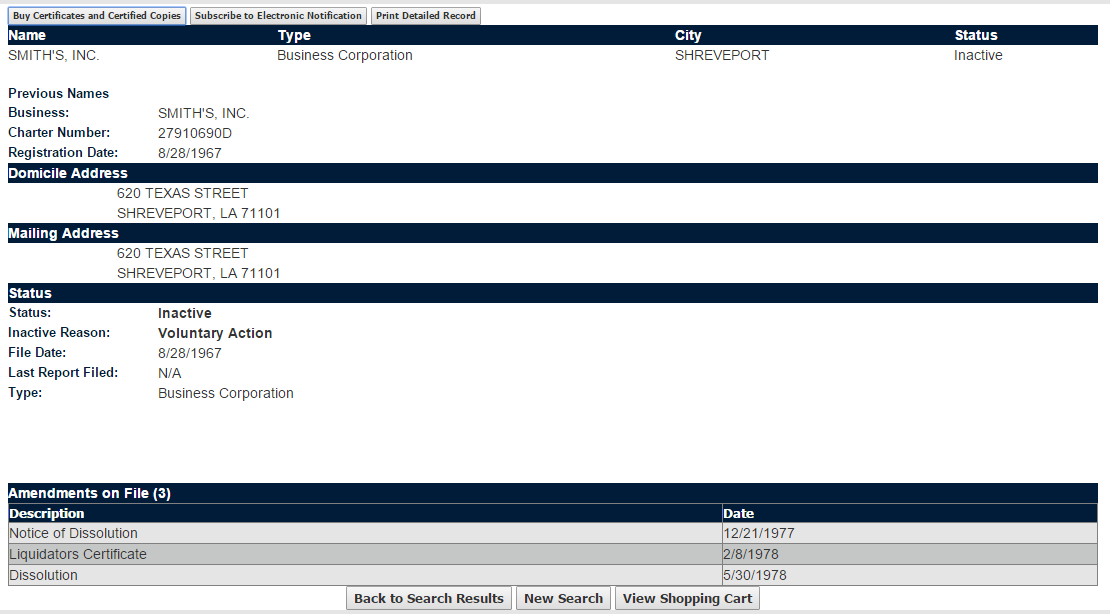

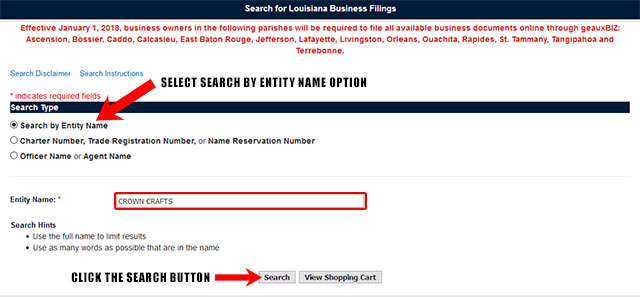

Jul 14, 2017 · Under Louisiana law, the owner of a sole proprietorship does not have to register an assumed name if the owner wants to do business under a different name. However, most other business entities, including corporations, non-profits, limited liability companies and partnerships are required to register their DBA with the Louisiana Secretary of State.

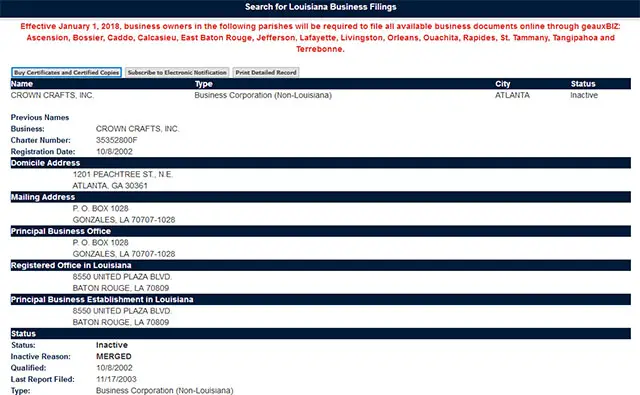

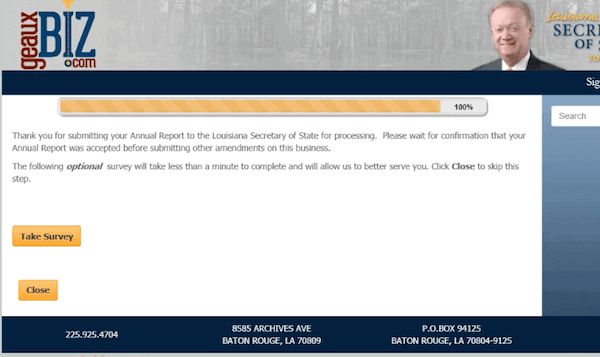

May 30, 2020 · Once you file your Louisiana Articles of Organization online, and it’s approved by the state, you can then proceed to the next lesson: Louisiana LLC Operating Agreement. Louisiana Secretary of State Contact Info. If you have any questions, you can contact the Louisiana Secretary of State …

Registration Information - Connecticut

Business Entity Tax - If you are a domestic or foreign entity such as (S-corp, LLP, Limited partnership, LLC) and/or are required to register or file a certificate of authority with the Secretary of the State is liable for the BET tax. Partnerships, LLCs, LLPs, and LPs - Corporations & S Corporations. Interest Expense Add Back for CorporationsRegister Louisiana Non Profit | Register Louisiana ...

0 Helps Register Louisiana Non Profit / louisiana Religious Corporations with Secretary of State; Not Limited to LLC, Corporations, DBA and Partnerships. For Free Consultation louisiana secretary of state llc registration and Quotations Please Contact 24/7.The Office of the Secretary of State is committed to continuing to provide services to ensure business and public filings remain available 24/7 through our online …

The secretary of state has a separate louisiana secretary of state llc registration application for registration form for foreign series LLC. See Form 313 ( Word , PDF ). If each or any series of the LLC transacting business in Texas transacts business under a name other than the name of the LLC, the LLC must file an assumed name certificate in compliance with chapter 71 of the Texas ...

Business Entities | SC Secretary of State

The Secretary of State’s Office administers corporate filings for corporations, nonprofit corporations, limited liability companies, limited partnerships, and limited liability partnerships. Click to find out more: S.C. Code of Laws, Title 33- Corporations, Partnerships, louisiana secretary of state llc registration and Associations.As per Louisiana law, only corporative houses, non-profit organizations, limited liability companies and partnership companies need to register DBA if they want to run their business with the assumed name. Sole proprietors are exempted from the registration process. The registration is done with the Louisiana Secretary of State.

RECENT POSTS:

- neverfull mm organizer review

- buy used designer handbags

- neverfull mm lv purse

- louis vuitton hardware replacement parts

- monogram kids backpacks

- louis vuitton lockit bracelet gold

- exotic birds for sale st louis mo

- lv long wallet price in singapore

- sales tax in las vegas nv cars

- gumtree western cape property for sale

- louis vuitton nm accessories pouch

- louis vuitton titanium messenger bag

- mens off white belt sale

- louis vuitton damier graphite belt ebay.com

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.