Louisiana Secretary Of State Llc

Frequently Asked Questions - Louisiana Department of Revenue

Domestic corporations, those that were formed in the state of Louisiana, wishing to dissolve their charter must file dissolution papers with the Louisiana Secretary of State’s office. A corporation can choose to dissolve by two different methods: by filing a notarized affidavit of dissolution with the Louisiana Secretary of State, or by filing an application to dissolve, referred to as a ...North Carolina Secretary of State Business Registration ...

North Carolina State law changed this year to streamline the business corporation annual report filing process. The new law requires that All corporate annual reports beginning with tax year 2017 now be filed directly with the Secretary of State’s Office.Any corporation or entity taxed as a corporation for federal income tax purposes meeting any of the following provisions, unless specifically exempted under the provisions louisiana secretary of state llc of R.S. 47:608, must file a Louisiana corporation franchise tax return: Organized under the laws of Louisiana.

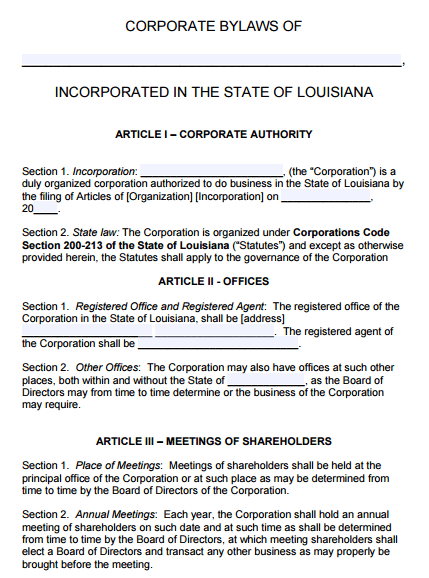

How to file a Louisiana Corporation amendment with the ...

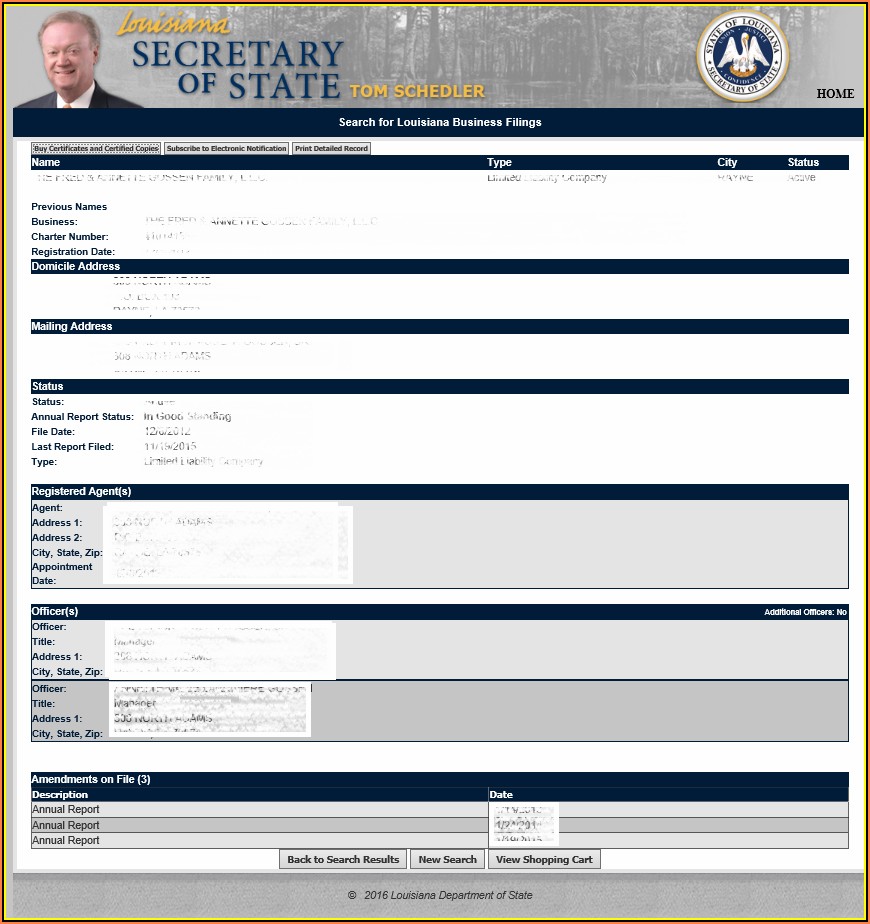

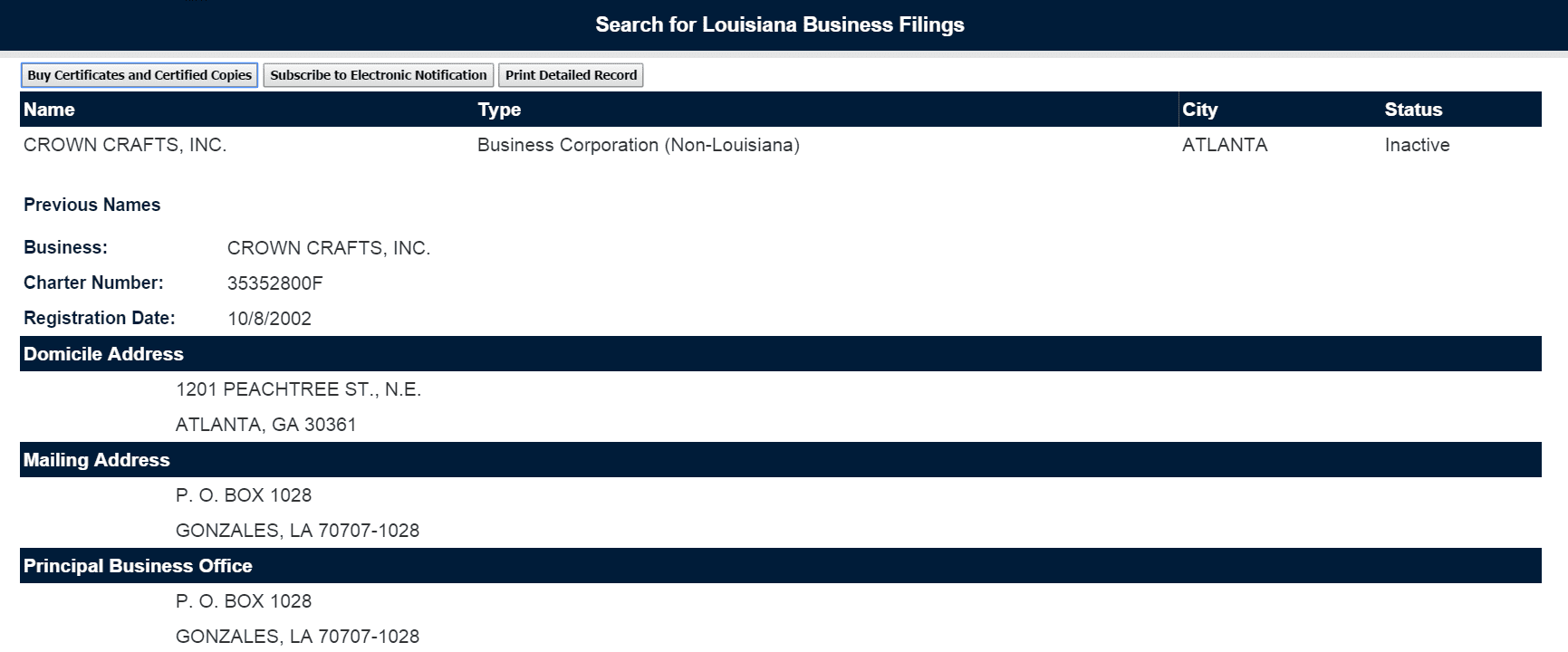

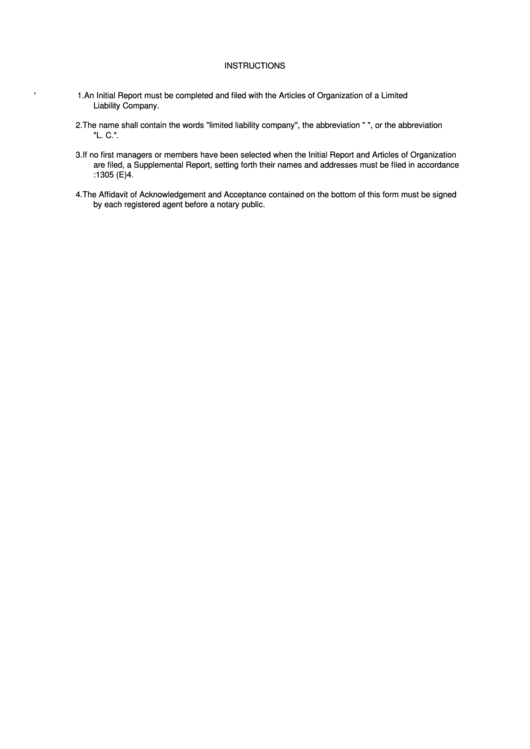

How To File An Amendment For A Louisiana Corporation . Step By Step Guide To Louisiana Corporation Amendments How to file a Louisiana Corporation Amendment: louisiana secretary of state llc You amend the articles of your Louisiana Corporation by submitting a change form by mail, fax, or in person along with the filing fee to the Louisiana Secretary of State.How to Form an LLC in Louisiana. All LLC filings in Louisiana will be handled by the Secretary of State, and it is with the State’s offices that you should conduct a Business Entity Search to check the availability of your business name. The State will not accept applications submitted under an operating name that is already in their records.

Corporation/LLC Search/Certificate of Good Standing Type of Search The Department of Business Services database includes information regarding corporations, not-for-profit corporations, limited partnerships, limited liability companies and limited liability partnerships, as well as, other business-related information.

Louisiana LLC Annual Filing Requirements | Nolo

The State of Louisiana, like almost every other state, taxes corporation income. The Louisiana corporation income tax is applied to Louisiana taxable income at a small series of marginal rates. The tax is payable to the state's Department of Revenue (DOR). Use the state's corporation income tax return louisiana secretary of state llc to … louis vuitton m62295WARNING: The Secretary of State’s Office urges the business community, especially LLCs, to be cautious of a misleading mailer sent by a private entity called C.F.S. In the mailer, the company offers to prepare 2021 annual reports for a $75.00 fee. As a reminder, domestic LLC owners can file annual reports on our website at no cost.

RECENT POSTS:

- marc by marc jacobs ligero hobo bag

- louis vuitton crossbody bag on sale

- palm desert outlets cabazon

- louisiana purchase cost of the purchase

- louis vuitton shop dubai airport

- louis vuitton favorite pm vs mm reviews

- lv bags in paris price

- rent louis vuitton bags

- black louis vuitton belt price

- small black pebble leather shoulder bag

- louis vuitton red bottom heels at macy

- louis vuitton paris bag for many

- louis vuitton all in tote

- houston to st louis flights today

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.