Minnesota State Fair Sales Tax

Get Your State Fair Food Fix at the Minnesota State Fair’s ...

Jul 22, 2020 · The Minnesota State Fair will host the State Fair Food Parade August 20-23, 27-30 and September 3-7. This historic event will be a drive-thru experience featuring 16 vendors and a chance to get your State Fair food fix while supporting the Great Minnesota …MN State Fair announces Fall Food Parade - myTalk 107.1 ...

Sep 15, 2020 · The Minnesota State Fair just announced a Fall Food Parade! The dates for the 2021 Minnesota State Fair are displayed at the entrance in Falcon Heights, Minn. Friday, minnesota state fair sales tax May 22, 2020, shortly after the 2020 Fair…MV Sales Tax 6.5% Due on the net purchase price of the vehicle unless the purchase is . exempt from sales minnesota state fair sales tax tax : or qualifies for an in lieu tax: • $10 in lieu – charged on passenger vehicles, ten model years or older, when the purchase price and fair …

Minnesota collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, Minnesota's income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.. Minnesota's maximum marginal income tax …

Minnesota State Fair announces encore 'Fall Food Parade ...

Sep 15, 2020 · Tickets for Minnesota State Fair's 'Food Parade' sold out. Tuesday, Minnesota State Fair announced an encore Fall Food Parade will take place Oct. 1-4 and 8-11.The 2019 House of Representatives State Fair Poll found that 89.1% of respondents favored background checks on all gun sales, including private transactions and sales made at gun shows, down slightly …

Apr 30, 2019 · In addition, the State Fair’s annual operation generates $9.9 million in state and local taxes. The economic impact study was produced using data from the State Fair’s 2018 operations (fiscal year ending Oct. 31, 2018) of the Minnesota State Agricultural Society, the governing body of the State Fair.

Aug 23, 2006 · The minnesota state fair sales tax Minnesota Senate (nonpartisan) will also conduct an unofficial State Fair Poll that asks if liquor stores should be open on Sundays, if a half cent 7 county sales tax should be created to …

RECENT POSTS:

- louis vuitton key pouch price parish

- purses made from recycled louis vuitton

- louis vuitton musette tango reviewed

- seattle outlet mall stores open

- lv wallet black monogram

- birkin bags

- supreme x lv sweater

- louis vuitton bosphore backpack price

- neverfull mm or neverfull gm

- women's work backpack

- leather duffel bags for sale

- argos black friday 2019 uk date

- louis vuitton favorite pm damier ebene

- mascara louis vuitton comprar

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

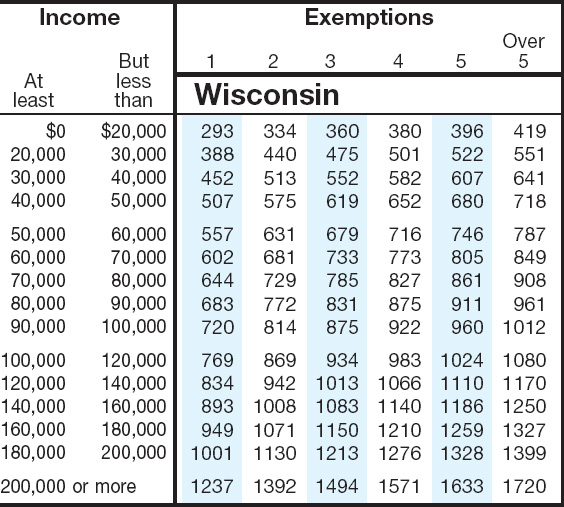

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.