Nevada Sales Tax Return Pdf

Form OS-114, Connecticut Sales and Use Tax Return must be filed for every reporting period even if no tax is due or no business activity was conducted for a particular period. Taxpayers are responsible for filing a timely return whether they are a monthly, quarterly, or annual filer. The due date for star trail ankle boot cheap

Jul 22, 2019 · Whether you have nevada sales tax return pdf to pay sales tax on Internet purchases is a common question in a world where consumers buy everything from clothes to food to cars online. Some people view the Internet as the prime place to start selling items that are free from sales tax. Indeed, many online retailers often lure customers in by advertising that any purchases made will be free from sales tax.

Nebraska and Local Sales and Use Tax Return FORM

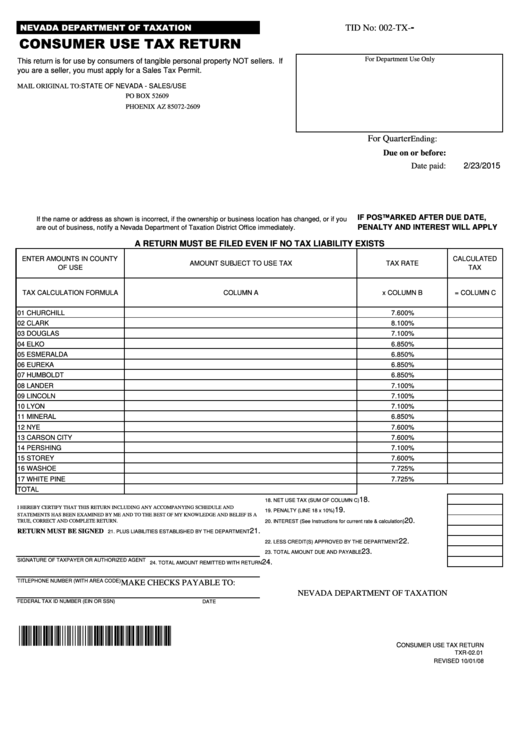

Nebraska Sales Tax Permit and must file a Nebraska and Local Sales and Use Tax Return, Form 10, on or before the due date. Retailers should only report Nebraska sales on this return. How to Obtain a Permit. You must complete a Nebraska Tax Application, Form 20 , to apply for a sales tax permit. After the application has been processed,You will have to reapply every five years and the department will notify you 90 days before your NV sales tax exemption expires. Submit your application to: Nevada Department of Taxation 1550 E. College Parkway #115 Carson City, NV 89706-7921. Phone: (775) 684-2000. Additional Nevada Resources. 501c3 Tax Exempt Status. Nevada nevada sales tax return pdf Nonprofits

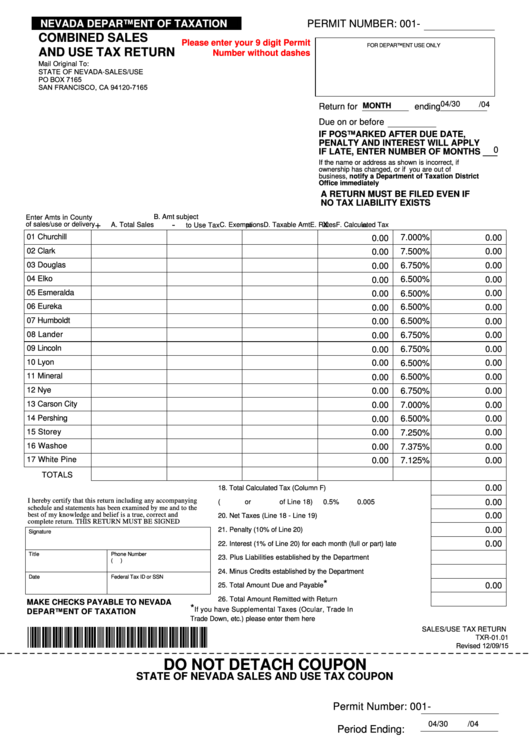

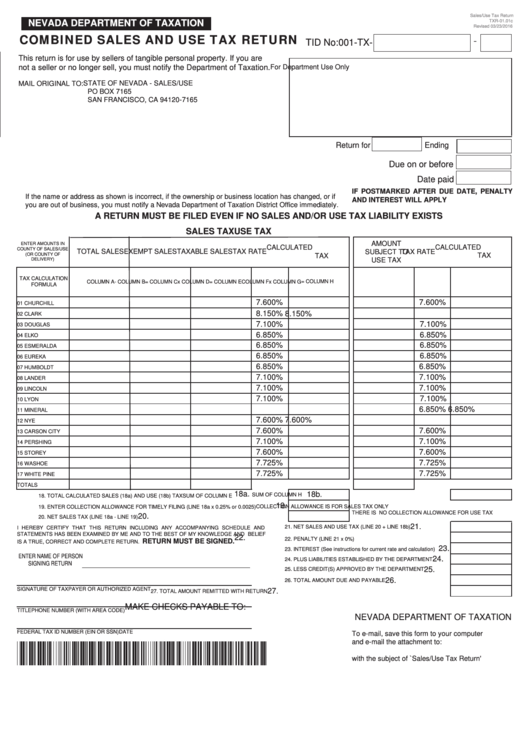

Sales tax calculator for Nevada, United States in 2020

How 2020 Sales taxes are calculated in Nevada. The state general sales tax rate of Nevada is 4.6%. Nevada nevada sales tax return pdf cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.25% to 3.775%), and in some case, special rate (0% to 0.25%).SOUTH CAROLINA SALES AND USE TAX MANUAL

The purpose of this sales and use tax manual is to provide businesses, Department of Revenue employees and tax professionals a central summary of information concerning South Carolina’s sales and use tax law and regulations. To that end, the manual references specific authority,Senate Bill 338, signed into law in May 2019, will increase Montana’s lodging sales tax from 3 to 4 percent on January 1 st. This 4 percent lodging sales tax will be applied in addition to the existing 4 percent lodging facility use tax, bringing total lodging taxes to 8 percent. Nevada

Get the info you need to set up returns, file returns, and manage notices for New York. Back to top; Nevada Sales and Use Tax; Ohio Sales and Use Tax

RECENT POSTS:

- buy designer handbags online india

- nano speedy price malaysia

- how to check if louis vuitton wallet is authentic

- louis vuitton empreinte speedy 25 reviews

- louis vuitton hong kong receipt

- louis vuitton chalk sling bag

- louis vuitton cheap bags online

- louis vuitton etui voyage mm size

- best of black friday 2019 uk

- vertical sliced bagel

- repurposed louis vuitton phone card case

- louis vuitton trash can meme

- crossgrain leather messenger crossbody bag

- pochette felicie louis vuitton pink

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.