Sales Tax In Las Vegas 2019

![sales tax in las vegas 2019 Samsung Galaxy Tab A 10.1" 2019 (Unlocked) [SM-T515] - Silver, 32 GB, 3 GB - LUHF27564 - Swappa](https://s3.amazonaws.com/swappa/social/listing/LUHF/LUHF27564_facebook.png?price=260)

County sales tax for water projects is ... - Las Vegas Sun

Sep 03, 2019 · A quarter-cent sales tax raising $100 million annually for water and wastewater projects will remain in place indefinitely following a decision Tuesday by the Clark County Commission.6 Things You Need to Know About Nevada Marijuana Laws in 2019

6 Things You Need to Know sales tax in las vegas 2019 About Nevada Marijuana Laws in 2019. Recreational marijuana was legalized in Nevada by a ballot initiative in November of 2016, and since then, the industry has boomed. In the first year, revenue from legal sales was 25% more than initially projected[1], with total tax …Segerblom wants sales tax hike to fund schools - Las Vegas ...

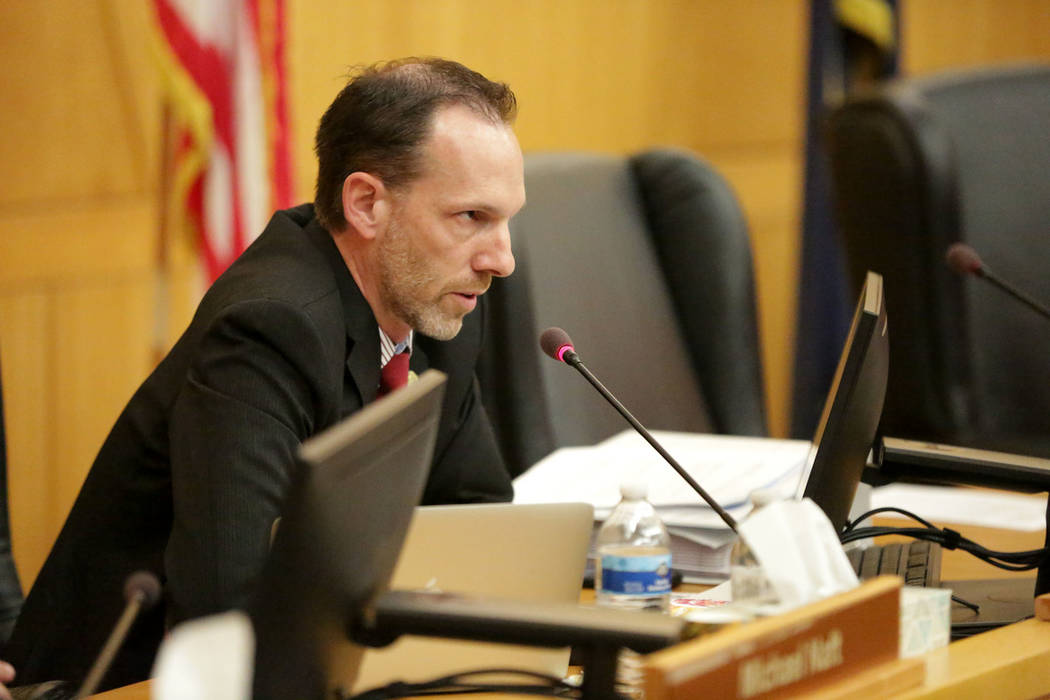

Jul 14, 2019 · Segerblom wants sales tax hike to fund schools Steve Marcus Nevada Sen.Tick Segerblom responds to a question during an interview at the Apothecary Shoppe marijuana dispensary on West Flamingo Road ...2019 Sales Tax Holidays | Back-To-School Tax-Free Weekends

Jul 24, 2019 · In 2019, 16 states will conduct sales tax holidays, down from a peak of 19 in 2010 (see Table 1). Wisconsin did not renew the one-time holiday it held in 2018. Louisiana suspended its sales tax holiday program in June 2018 as a component of broader legislation. Massachusetts legislators passed two pieces of legislation: one that set up a sales ...Taxes and fees: Where marijuana money is ... - Las Vegas Sun

Jun 10, 2019 · Customers sales tax in las vegas 2019 wait in a long line at Reef Dispensaries in Las Vegas as recreational marijuana sales begin at midnight in Nevada on Friday, June 30, 2017. By Miranda Willson Mon, Jun 10, 2019 …Used Cars for Sale in Las Vegas, NV | 0

Shop vehicles for sale in Las Vegas, NV at 0 Research, compare and save listings, or contact sellers directly from 7987 vehicles in Las Vegas.Virtual conference experience. Join us at the Deloitte Tax Accounting Conference - 2020 Virtual November 30 – December 11, 2020. Our 2020 program, in its 15th year, will deliver content by live presenters with advanced technology and enhanced online engagement through a virtual platform for tax, accounting and finance professionals.

Las Vegas Resort Fees 2020 Guide | 0

Detailed and updated list of Las Vegas hotel resort fees in 2020 + a list of Vegas hotels that don't charge resort fees. ... You will notice that the highest resort fees reach $45 per night before sales tax in las vegas 2019 tax, which is $51.02 including tax per night! ... Fall Into Savings Sale 20% Off . Buy Before 11/23/20. RIO: Fall Into Savings Sale …RECENT POSTS:

- cell phone crossbody purse

- louis vuitton kentucky

- louis vuitton returns

- louis vuitton multicolor multicolor speedy 30

- louis vuitton summer 2019

- roku tv walmart black friday 2020

- speedy 400 laser cutting machine

- diaper bag purse combo

- victorine wallet lv price

- louis vuitton belt brown and gold

- supreme louis vuitton credit card holder

- louis vuitton red hoodie supreme

- louis vuitton large purses

- how to know a genuine louis vuitton bag

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.