Sales Tax Nevada 2018

Nevada Sales Tax - State Resale Certificate

3 Reasons for Obtaining a Nevada State Sales Tax Certificate are listed below. Law requires sales tax nevada 2018 virtually every type of business to obtain a Sales Tax Certificate Number. If you sell goods on eBay or the internet and ship them to someone in the state you reside, then you must collect sales tax from the buyer and pay the collected tax to your state ...As a precautionary measure, due to COVID-19, our tax sale has been postponed until further notice. Choose one of the options below for more information: No Tax Sale scheduled at this time Tax Sale Information and registration Request for Excess Tax Proceeds Tax Sales Results - April 27, 2018

What The Supreme Court's Internet Sales Tax Ruling Says ...

Jun 22, 2018 · The U.S. Supreme Court's landmark ruling allows states to ask online retailers to collect internet sales tax, leveling the playing field between online and physical retailers. But it also means ...For sales tax year - March 1, 2018, through February 28, 2019. Quarterly forms (ST-100 series) Annual forms (ST-101 series) Part-Quarterly (Monthly) forms (ST-809 series) Quarterly forms (ST-810 series) Please remember: Whenever a sales and use tax rate changes, the corresponding jurisdictional reporting sales tax nevada 2018 code is replaced with a new code ...

California City & County Sales & Use Tax Rates

In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect. Sellers are required to report and pay the applicable district taxes for their taxable sales …2018 Projects - NV Office of Energy

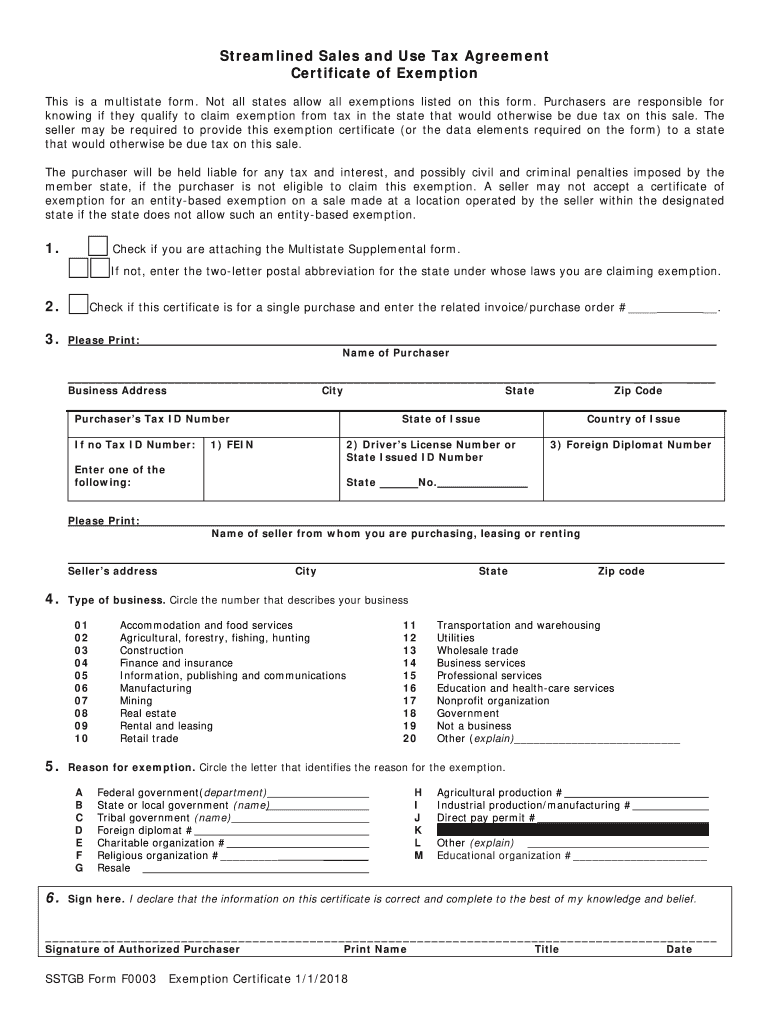

9/13/2018 to 9/13/2038: Minutes: 18-0827G Soda Lake Geothermal Churchill County: Application rec'd 08/27/2018: Sales and Use Tax Fiscal Note rec'd 10/10/2018 Property Tax Fiscal Note rec'd 10/24/2018: Fiscal Note rec'd 10/12/2018: Notice of Public Hearing and Agenda Order Certificate of Eligibility Agreement: 12/11/2018 to 12/11/2021: 12/11 ...Nevada is a member of the Streamlined Sales and Use Tax Agreement (SSUTA), which means it follows certain rules regarding how its sales tax laws and registration processes are structured. It also means that you can register for a Nevada Sales Tax Permit through the SSUTA’s website at the same time that you register with all the other members.

Nevada’s sales tax is 4.6 percent, with 2.6 percent going to fund schools. Clark County’s sales tax brings the total to 8.25 percent. No cities within sales tax nevada 2018 the county impose their own sales taxes.

RECENT POSTS:

- louis vuitton medium looping bag

- sailboats for sale in usa

- louise halloween costume season 100

- dillards junior dresses on sale

- how to tell real louis vuitton wallet from fake

- sell designer bags melbourne

- louis vuitton belt buckle real or fake

- nike 270 supreme louis vuitton prix

- patent leather handbags croc

- travel backpacks for men carry on

- louis vuitton ellipse backpack m51125

- macy's sheets sale 1400 thread country

- louis vuitton emilie flower wallet

- louis vuitton carteras hombre

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.