Sales Tax Nevada County Calif

681 Homes For Sale in Nevada County, CA. Browse photos, see new properties, get open house info, and research neighborhoods on Trulia.

Dealer Vehicle Sales Outside of Nevada

Dealers who have questions on the calculation of sales tax should contact the Title Section at (775) 684-4810. Utah: Utah dealers do not pay sales tax to Utah on out-of-state vehicle sales. Often, however, they will indicate the estimated amount of Nevada sales tax due as taxes paid to Utah. The full amount of Nevada sales tax …Aug 14, 2018 · Proposition 60 and Proposition 90 – The fine print how to Transfer California Property Tax Base. According to the Los Angeles County Office of the Assessor website, a claim must be filed …

Nevada County, California DMV Office Locations. sales tax nevada county calif Search Near: Search. Please enter your ZIP code OR city and state abbreviation. DMV Cheat Sheet - Time Saver. Passing the California written exam has …

Sales tax calculator and rate lookup - Avalara

The combined tax rate is the total sales tax nevada county calif sales tax of the jurisdiction for the address you submitted. The jurisdiction breakdown shows the different tax rates that make up the combined rate. While most taxable products are subject to the combined tax …Tax Sale for Nevada County California (CA) - Nevada County ...

Premium Bid Method: In a public oral bid tax sale where Nevada County California is utilizing the Premium Bid Method the winning bidder at the Nevada County California tax sale is the bidder who pays the largest amount in excess of the delinquent taxes, delinquent interest, and fees. The excess amount shall be credited to the county …Property Tax Sales | Sierra County, CA - Official Website

The tax sale process is governed by the California Revenue and Taxation Code under the guidance of the California state controller's office. We usually hold our tax sales in the spring online at …Foreclosure Homes in Nevada County, CA Find the best foreclosure homes listings for sale — bank-owned, government (Fannie Mae, Freddie Mac, HUD, etc.) and others — in and near the Nevada County, CA area at 0 Get information on foreclosure homes for rent, how to buy foreclosures sales tax nevada county calif in Nevada County, CA …

RECENT POSTS:

- louis vuitton wallet buy online india

- louis vuitton neverfull tote damier gm

- speedy cash payday loans near me

- louis vuitton melbourne theft

- st louis mo zoo reservations

- outdoor couches on clearance

- louis vuitton pochette long strap

- 75 in tv black friday deals

- buy louis vuitton manhattan gm

- gucci disco bag blush pink

- louis vuitton double zippy wallet

- spot a fake louis vuitton bag

- wallet checkbook combinations

- lv belt monogram brown

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

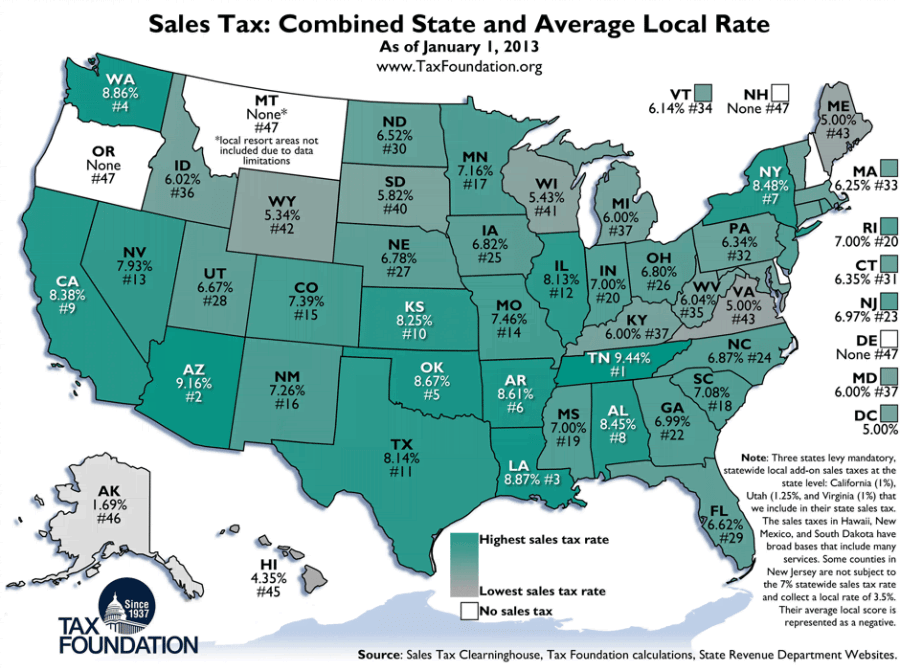

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.