Sales Tax Nevada Pdf

Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code sales tax nevada pdf ^ County City Local Tax Rate Effective Date Situs FIPS Code ^ Jackson 2.75%; May-2000 4400; 087 Madison; 2.75% Jul-1989; Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs

Sales & Use Tax Rates | Utah State Tax Commission

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically, beginning with returns due Nov. 2, 2020. File electronically using Taxpayer Access Point at nrd.kbic-nsn.gov This includes: Third quarter, July-Sept 2020 (quarterly filers) September 2020 (monthly filers) Jan – Dec 2020 (annual filers)State of Oregon: Oregon Department of Revenue - Sales tax

For example, under the South Dakota law, a company must collect sales tax for online retail sales if: The company's sales tax nevada pdf gross sales exceed $100,000, or; The company conducted more than 200 transactions to South Dakota. Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales.STATE QUESTION NO. 4 Amendment to the Nevada Constitution

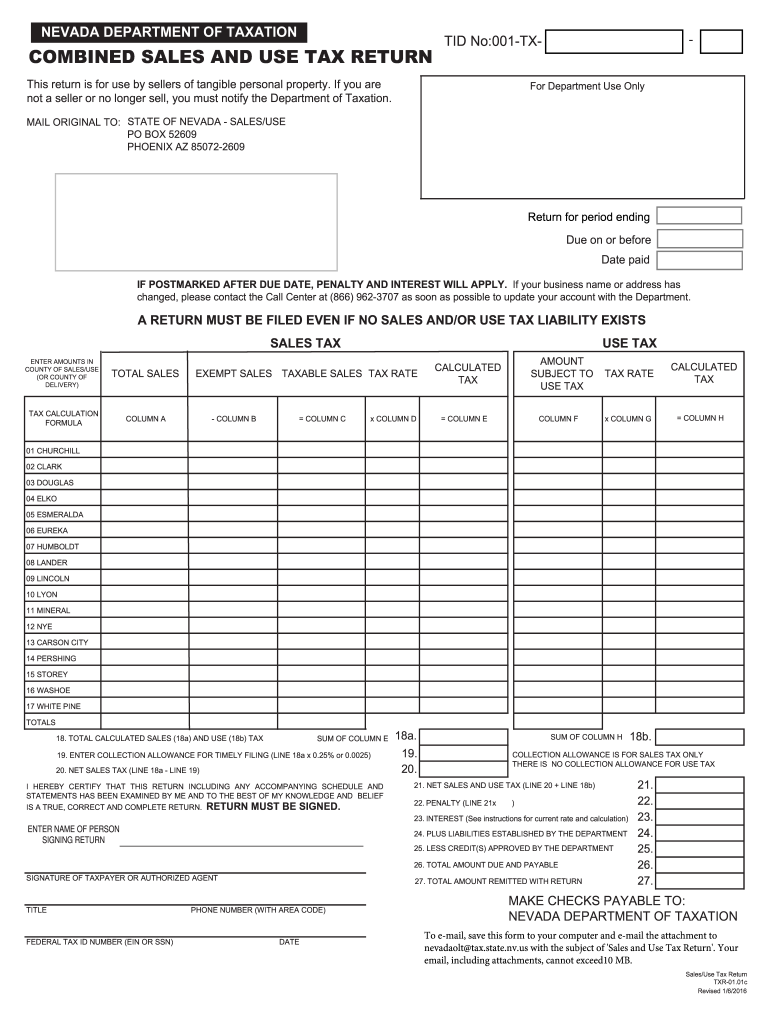

Tax exemptions have consequences for the taxpayer; the same consequences as tax subsidies, tax breaks, tax abatements, and tax incentives. The Nevada Department of Taxation’s - 2013 2014 Tax Expenditure Report states that Nevada has 243 such tax expenditures that cost taxpayers over $3.7 BILLION a biennium.1 babylone lv bagSales tax calculator for the United States in 2020

Sales Tax States shall in no case sales tax nevada pdf be held responsible for problems related to the use of data and calculators provided on this website. For questions, comments or suggestions, or if you notice a problem with one of our sales tax calculator or rates, please contact nrd.kbic-nsn.gov .A.R.S. § 42-5061(A)(28)(a) provides an exemption from state TPT and county excise tax for sales of motor vehicles to nonresidents from states that do not provide a credit for taxes paid in Arizona. This Arizona TPT exemption prevents the nonresident purchaser from having to pay tax in both states.

In Nevada, unlike in other states, resale certificates and sales tax permits are not interchangeable. Though, if you live and have sales tax nexus in Nevada and are buying something for resale in Nevada then you should have a Nevada sales tax permit. Nevada retailers who accept resale certificates can also accept out-of-state resale certificates.

The Nebraska state sales and use tax rate is 5.5% (.055). , Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1, 2021 Updated 09/03/2020 Effective January 1, 2021, the local sales and use tax rates for Gordon, Greeley, and Juniata will each increase from 1% to 1.5%. These cities have complied with the notification requirements

RECENT POSTS:

- louis vuitton emilie wallet monogram canvas

- louis vuitton pochette twin gm strap

- louis vuitton bookbag purses

- cheap cardinals tickets az

- louis vuitton padlock necklace and bracelet ebay

- louise belcher hat toddler

- galleria mall st louis movies

- louis vuitton pochette milla price usa

- plus size winter coats sale canada

- louis vuitton bags online shopping india

- samsung 55 inch smart tv black friday deals

- rainbow louis vuitton nike air force 1

- st louis deaths and obituaries

- macy's bedroom sets on sale

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

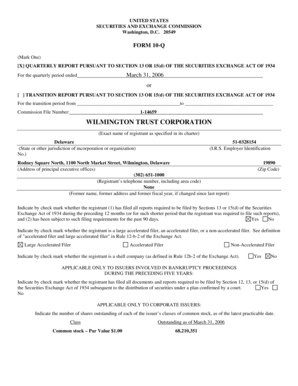

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.