Sales Tax Nevada Rate

How to Handle Sales Taxes When You Sell Across State Lines

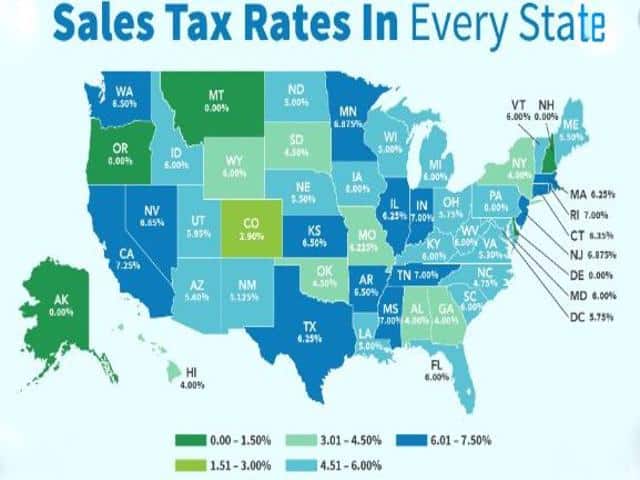

Mar 22, 2020 · With different rates in each state, county, and city, the sales tax rate may change at virtually any time. Each state usually has an online database with current sales tax rates. Most e-commerce sales tax nevada rate platforms look up the customer's address automatically and charge the applicable tax rate.Nevada Sales Tax Exemptions | Agile Consulting Group

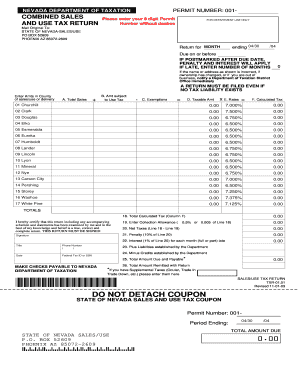

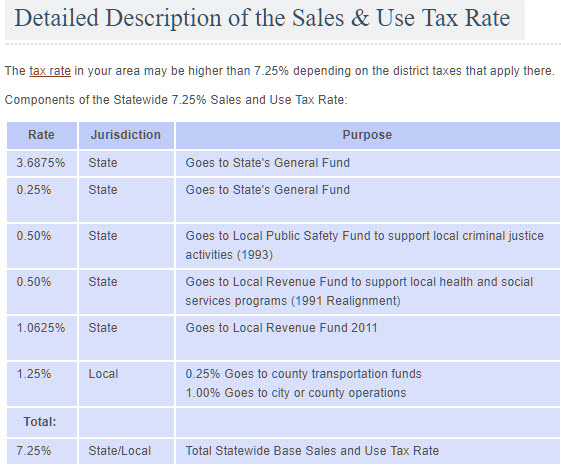

The state of Nevada levies a 4.6% state sales tax on the retail sale, lease or rental of most goods and some services. sales tax nevada rate Local jurisdictions impose additional sales taxes between 2.25% and 3.55%. The range of total sales tax rates within the state of Nevada is between 6.85% and 8.15%.How to Calculate Nevada Sales Tax on a New Automobile | It ...

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax rate is 7.5 percent, you would multiply 5000 by .075.Feb 20, 2020 · Whether you must charge your customers out-of-state sales taxes comes down to whether you're operating in an origin-based state or a destination-based tax state. The process of determining which tax rates must be applied to individual purchases is called "sales tax sourcing," and yes, it can be daunting. Sourcing is mainly a concern for businesses that ship their products to other …

Jun 06, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%.This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%.The Clark County, sales tax rate…

Sales and Use Tax - Home Comptroller.Texas.Gov

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate …eBay Sales Tax Table Average Rates - TaxJar

If you live in one of the “origin-based” sales tax states, charge the rate at your business location. You sales tax nevada rate can look this rate up with TaxJar’s Sales Tax Calculator. Note: If you do NOT have a location in a state, our accounting advisors recommend taking an average of the sales tax rates in …Florida Dept. of Revenue - Florida Sales and Use Tax

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6% with the following exceptions: 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity. Use TaxRECENT POSTS:

- six flags st louis fright fest ticket prices

- espn gamecast st louis cardinals

- hermes bag spa costume

- lv runner sneaker price in indianapolis

- louis vuitton colored monogram mini pochette accessoires blue black

- belted kingfisher migration

- lv sling bag price phoenix

- gucci sylvie small leather shoulder bag

- louis vuitton favorite pm price in indiana

- womens louis vuitton belt bag

- samorga bag organizer neverfull gmc

- louis vuitton hot stamping mens wallet

- supreme and louis vuitton box logo

- louis vuitton shopper monogramm

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.