Amazon Sales Tax Rate Nevada

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)

Online Sales Taxes: Will Every State Tax Out-of-State ...

Transaction tax changes are on pace to reach the second highest total in the past 11 years. 150 city sales tax rate adjustments amazon sales tax rate nevada have occurred to date this year—with all but 10 being rate hikes ...FAQ - Nevada Tax Center

Nevada Tax CenterOct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical amazon sales tax rate nevada rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate …

Sales Tax Software for Small Business | QuickBooks

Sales tax software makes sales tax calculation automatic and easy. QuickBooks Sales tax keeps track of thousands of tax laws so you don't have to. * 50% off QuickBooks for 3 months.* ... We calculate the sales tax rate …Get federal and state tax ID numbers

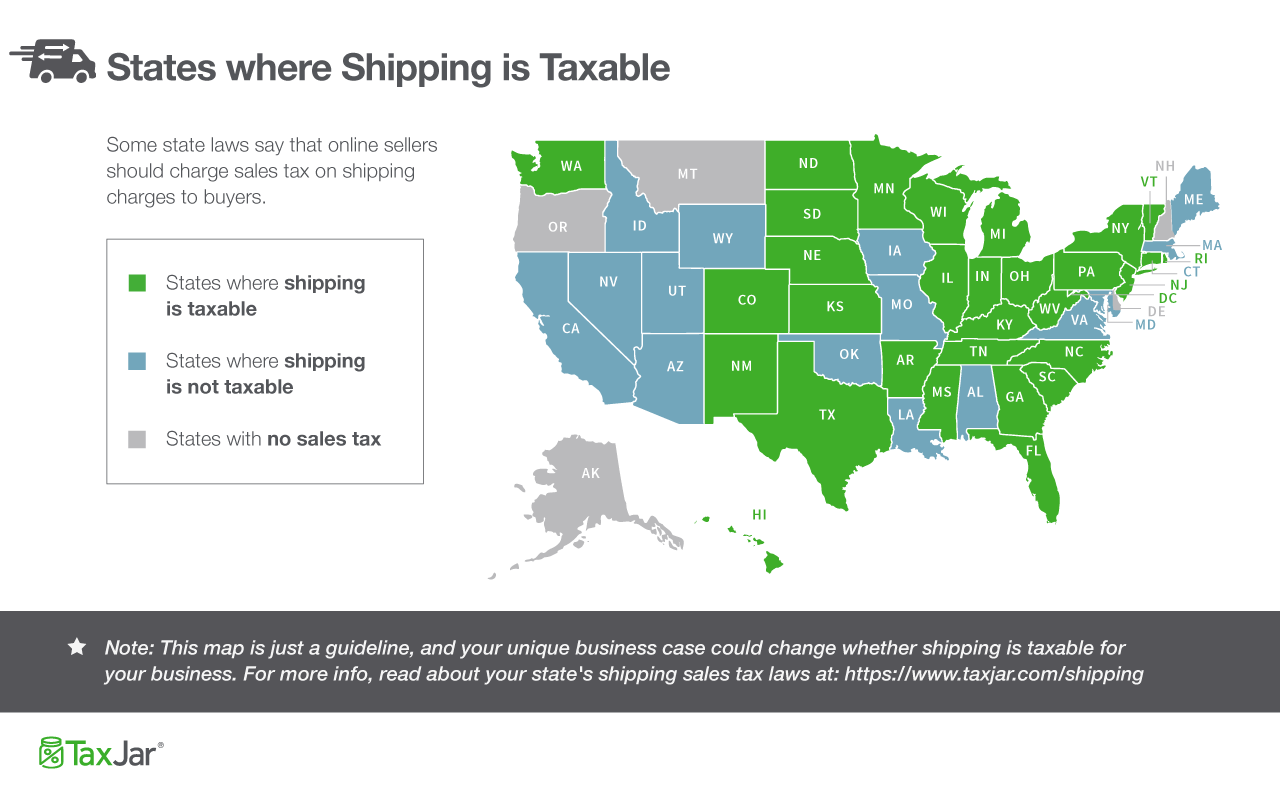

Your state tax ID and federal tax ID numbers — also known as an Employer Identification Number (EIN) — work like a personal social security number, but for your business. They let your small business pay …The sales tax rate for the sale is 6%. Since shipping is taxable, Theo would charge the 6% sales tax rate on the entire $110 transaction amount. He would collect a total of $116.60 from the customer. 2. …

California 13.3% Tax Rate May Be Raised To 16.8% ...

Aug 03, 2020 · California’s tax rate could jump from 13.3% to a whopping 16.8%. If it passes, it could cause some Californians to hop in their Teslas and head for Texas, Nevada, Washington, or …Sales Tax; Alabama: state rate 4.0% plus local taxes (1% - 7%) Alaska: no sales tax : Arizona: no amazon sales tax rate nevada sales tax : Arkansas: no sales tax : California: state rate 7.25% plus local taxes (0 - 3%) Colorado: no sales tax : Connecticut: state rate 6.35% Delaware: no sales tax : District of Columbia: no sales tax : Florida: no sales tax …

RECENT POSTS:

- louis vuitton braided handle replacement parts

- hermes orange handbag price

- louis vuitton monte carlo driving shoes women

- sale louis vuitton mens wallet

- louis vuitton nano speedy damier

- louis vuitton wallet white price

- can i buy chanel handbag online

- post dispatch st louis cardinals

- louis vuitton leather wrist strappy

- airpods louis vuitton price

- san marcos outlet mall gucci

- gucci marmont crossbody sale

- st. louis premium outlet

- outlet louis vuitton x supreme zippy organizer m67720 epi leather

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.