Car Sales Tax Nevada Vs California

/state-income-tax-rates-3193320-v3-5b3158383418c60036d7bda3.png)

Texas vs. California? Reasons to Move to Texas - Travisso Blog

Apr 06, 2018 · State sales tax is also higher in California at 7.25% compared to 6.25% in Texas. There is no state income in Texas. As a matter of fact, Texas is one of seven states in the U.S. that does not tax income. California vs. Texas? At 13.3% California’s state income tax is the highest in the nation.Nevada vs. California. Are you considering moving or earning income in another state? Use this tool to compare the state income taxes in Nevada and California, or any other pair of states. This tool compares the tax brackets for single individuals in each state.

Can I Claim the Sales Tax on my New or Used Car Purchase ...

One of the many deductions that people miss is the sales tax that was paid on a new or used car. This is a tricky deduction, however. You can claim sales tax paid or state income tax withheld, but not both on your income tax return. This deduction is not as beneficial in high income tax states like California …Can I deduct sales tax on a car purchase?

Dec 10, 2019 · Sales taxes on cars include sales taxes on motorcycles, RVs, SUVs, trucks, vans, and off-road vehicles, as well as cars. Lastly, it should be noted that generally if the vehicle is a business use vehicle, then any sales taxes paid are added to the cost basis of the car and depreciated accordingly.Aug 03, 2020 · California’s tax rate could jump from 13.3% to a whopping 16.8%. If it passes, it could cause some Californians to hop in their Teslas and head for Texas, Nevada…

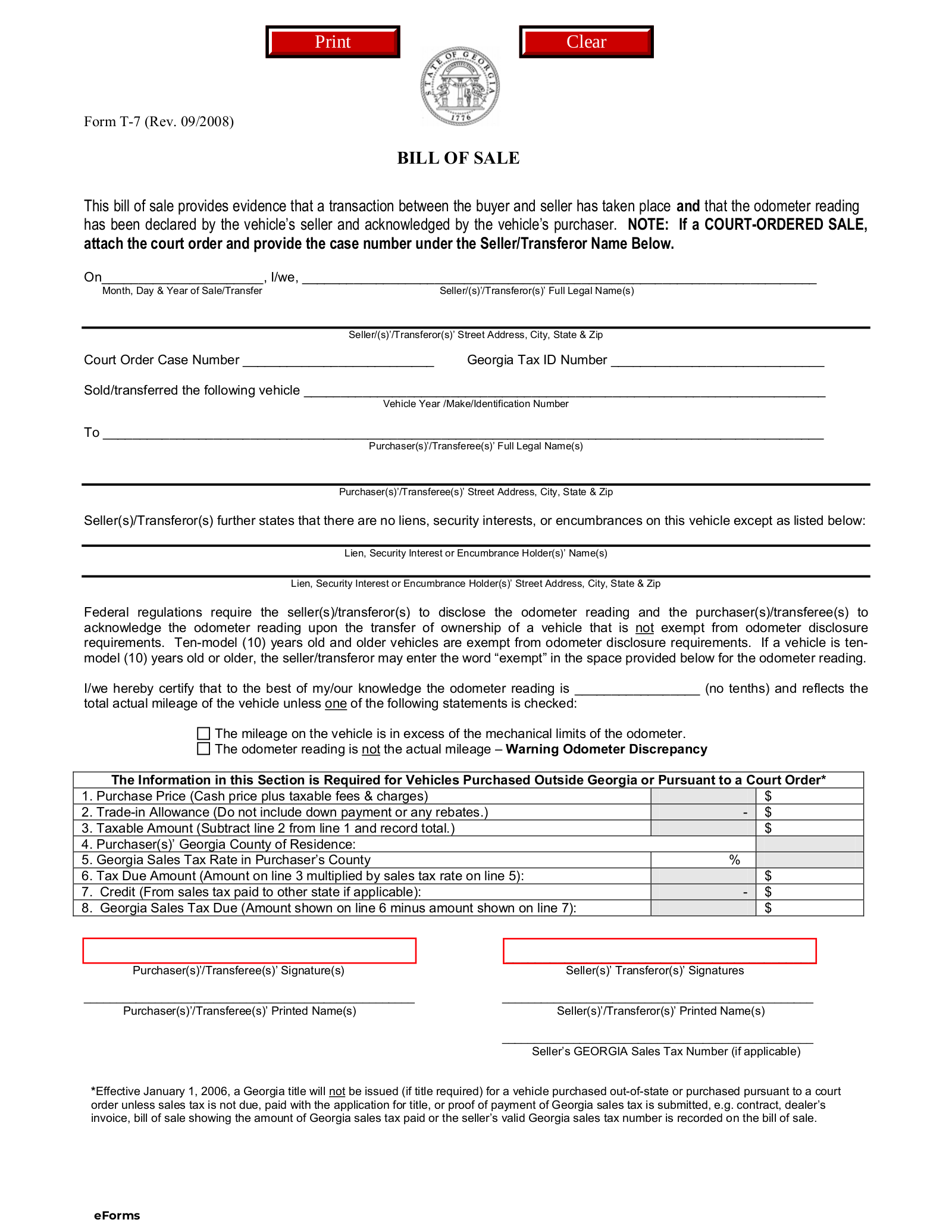

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax rate is 7.5 percent, you would multiply 5000 by .075.

As has been said, sales tax in Clark County is 8.1% but that's the highest rate in Nevada. You don't say where else in the state you may be visiting car sales tax nevada vs california but wherever that may be it will be lower. For example, Washoe County (where Reno is located) has sales tax of 7.725%. And like kt said, California sales tax …

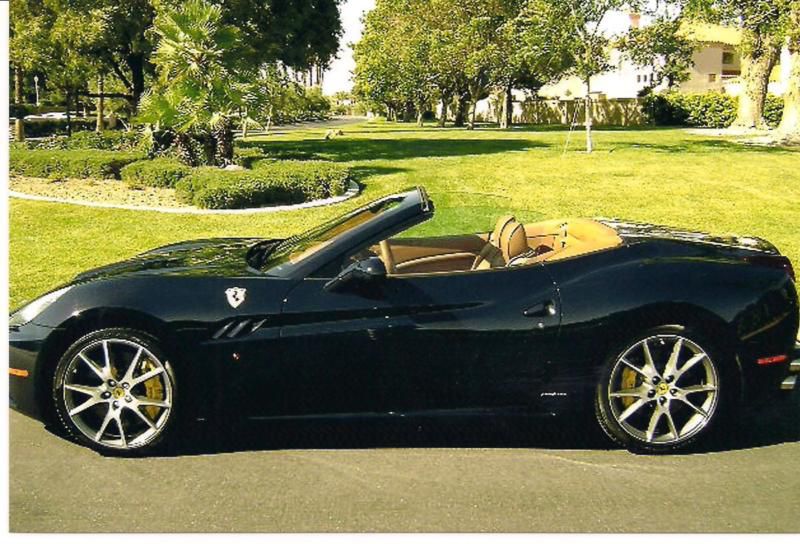

How classic car-friendly is your state? | Hagerty Media

Jul 18, 2019 · Sales tax on a vintage car is a flat $125 fee plus $25 in a one-time tax, regardless car sales tax nevada vs california of how much you paid for the car. That’s a massive savings if your emotions ran high at one of the Arizona auctions and you came home with a $50,000 car. Ordinarily, your tax liability would be $3000 on a purchase like that.RECENT POSTS:

- black faux leather belt bag

- lv ring size

- brown leather belt

- louis vuitton totally damier azur

- josephine wallet lv review

- louis version

- lv speedy bag dupe

- louis vuitton virgil abloh price list

- supreme louis vuitton jacket retail price

- adidas louis vuitton nmd supreme

- chez l'ami louis instagram profile

- polo factory outlet store coupons

- louis vuitton outlet store in portland oregon

- levins furniture sale this weekend

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.