Federal Employee Lv Benefits

Relocating Federal Employees Summer 2011 Foreword The General Services Administration (GSA), Office of Governmentwide Policy, is pleased to issue this relocation handbook for Executive Branch employees. GSA developed this Handbook to help Federal employees …

Benefits Planner: Retirement | Social Security Benefits ...

The federal federal employee lv benefits government has special retirement programs for its employees. How this affects your Social Security benefit amount depends on when you worked for the federal government. If you worked for the federal …Pay is only part of the total compensation package you will receive federal employee lv benefits while working for the federal Judiciary. We offer our employees a diverse group of benefit programs and family friendly flexibilities …

Dec 10, 2019 · Tax time is getting closer and, when a federal employee has retired, income taxes do not go away, they just change somewhat. Federal pensions, Social Security and distributions from the Thrift Savings Plan are all taxable to some extent. The only taxes that do not follow federal employees …

Federal Employees Retirement & Benefits Institute, LLC

The Federal Employees Retirement and Benefits Institute is a veteran-owned small business recognized as a registered vendor for the Federal Government.* We provide educational training to assist Federal Agencies and Uniformed Services with the complexities of their FERS or CSRS benefits.Health insurance premiums for federal employees, retirees ...

Oct 02, 2019 · During the annual federal employee benefits open season, which this year will run from Nov. 11 to Dec. 9, current employees and retirees who are already federal employee lv benefits enrolled may switch to a different …Federal Health, Retirement and Other Benefits • Go Government

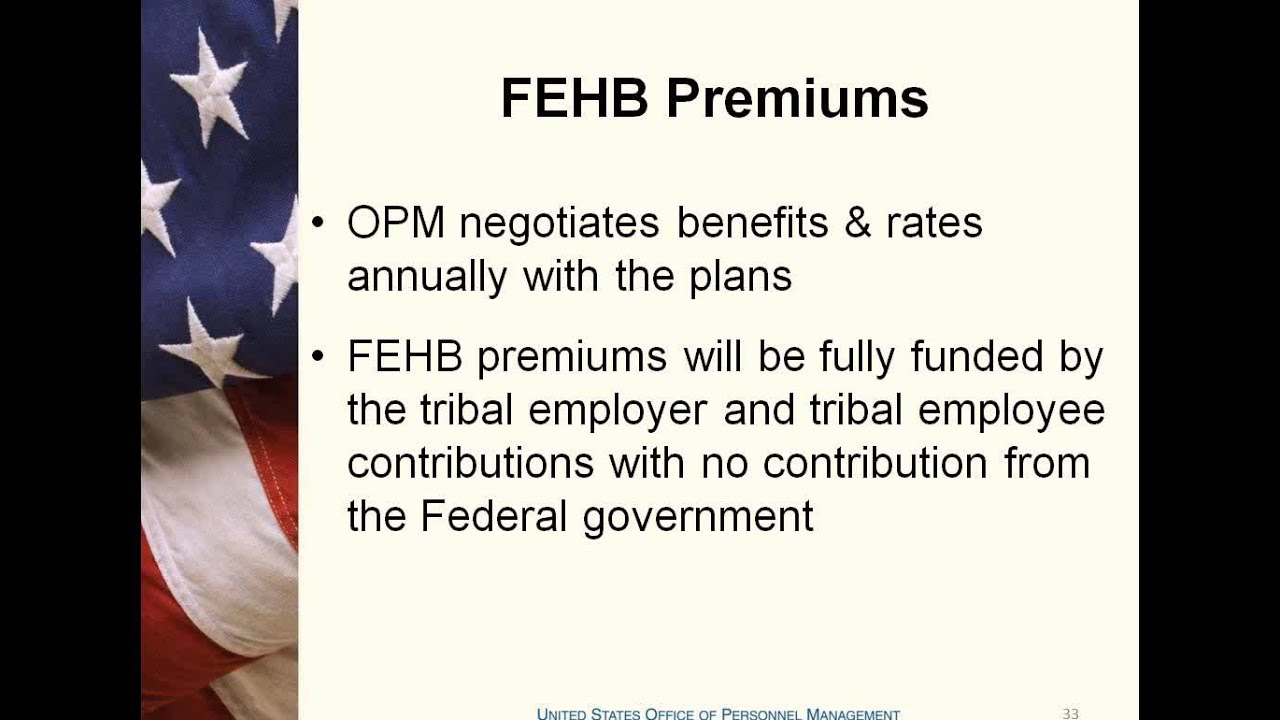

Health Care Benefits. Health Insurance. Through the Federal Employees Health Benefits Program (FEHBP), federal employees, retirees, and their families enjoy the widest selection of health insurance …With Federal Employee Tax Planners, we focus on educating federal employees like you about … Meet Our Experts. Our Specialties. Find out how we help federal employees maximize their benefits. Like: Thrift Savings Plan (TSP). CSRS & FERS retirement benefits. Federal employee …

RECENT POSTS:

- louis vuitton uk shop online

- neiman marcus bags ebay

- louis vuitton vinyl tote bags

- louis vuitton waimea sunglasses

- cars south africa for sale

- sac louis vuitton besace tuilerie

- coach sling purse price

- coach outlet stl mounting

- michael kors saffiano small crossbody bag

- title boxing deluxe pro speed bag swivel

- bulk popsockets wholesale 500

- louis vuitton sneakers virgil abloh price

- cheap paper bags uk

- nike huarache shoes on sale

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.