Internet Sales Tax Rate Nevada

Sales Tax by State: Should You Charge Sales Tax on Digital ...

Jul 02, 2019 · “Sales or purchases of ‘digital downloads’ from the Internet are subject to Connecticut sales or use tax. As long as no tangible personal property is provided in the transaction, sales or purchases of ‘digital downloads’ are treated as sales or purchases of computer and data processing services, and taxable at a 1% rate.”Arizona Sales Tax Guide for Businesses - TaxJar

Oct internet sales tax rate nevada 01, 2019 · The sales tax rate in Sedona is made up of the 5.6 % Arizona sales tax rate, the 1.3 % Coconino County rate and the 3% Sedona rate, for a total of 9.9 %. You would charge all of your Arizona customers, no matter where in the state they live, that 9.9 % sales tax rate.Online Retailers Selling Goods and Services to Pennsylvania Customers. As outlined in Sales and Use Tax Bulletin 2019-01, the requirement to collect Pennsylvania’s sales tax is expanded to include businesses making at least $100,000 in annual Pennsylvania gross sales…

How State Sales Tax Applies to Etsy Orders – Etsy Help

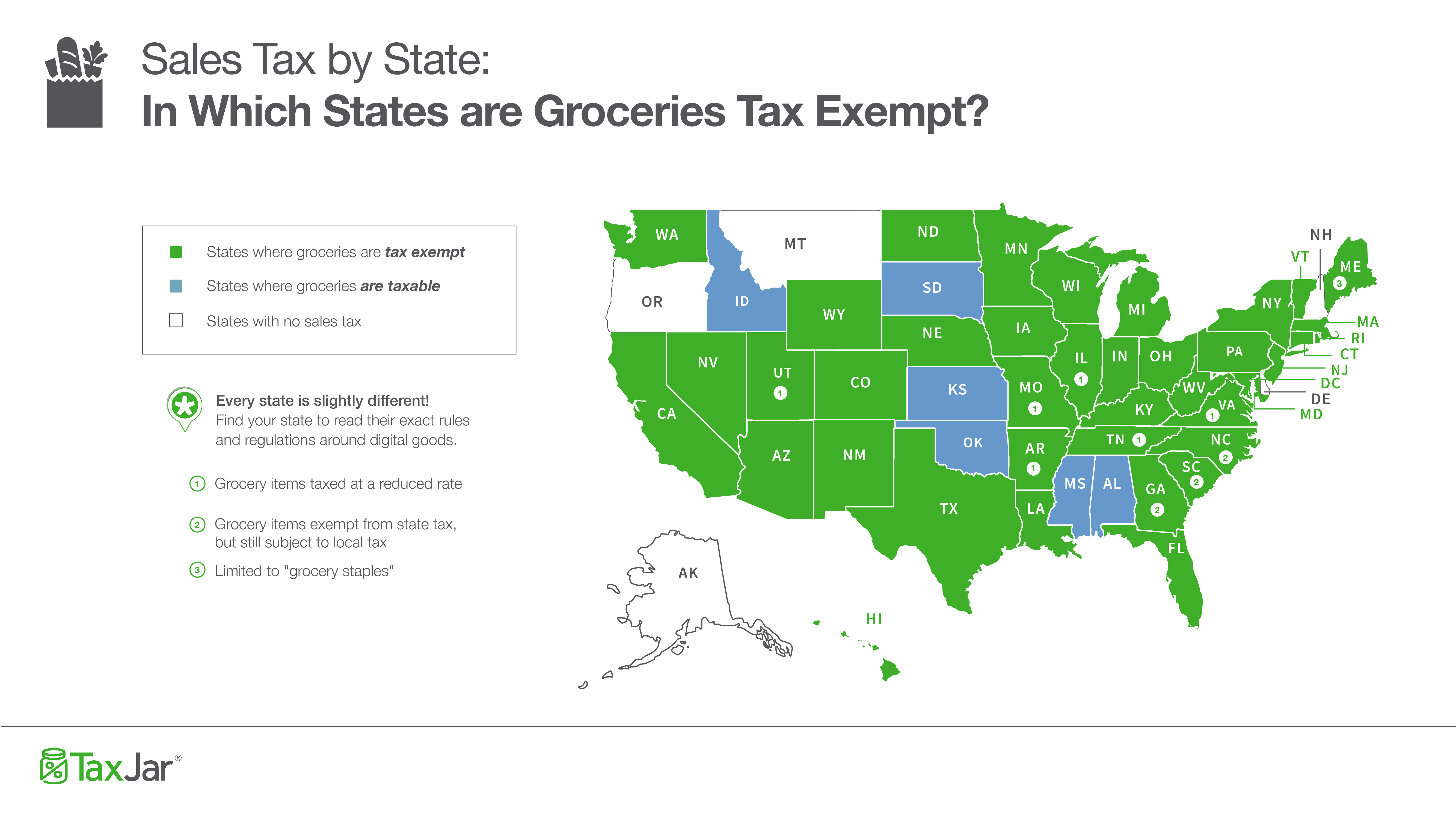

Based on applicable tax laws, Etsy will calculate, collect, and remit sales tax for orders shipped to customers in the following state(s): Alabama, as of 07/01/2019; Arizona, as of 10/01/2019; Arkansas, …State and Local Sales Tax Rates, 2020

its sales tax from 5.95 percent to 6.1 percent in April 2019. • Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. • Sales tax rate …As for New York State, the state sales tax rate is 4%, but many locations have additional sales tax on top of the state tax. New York also has one the highest income tax rates in the nation.

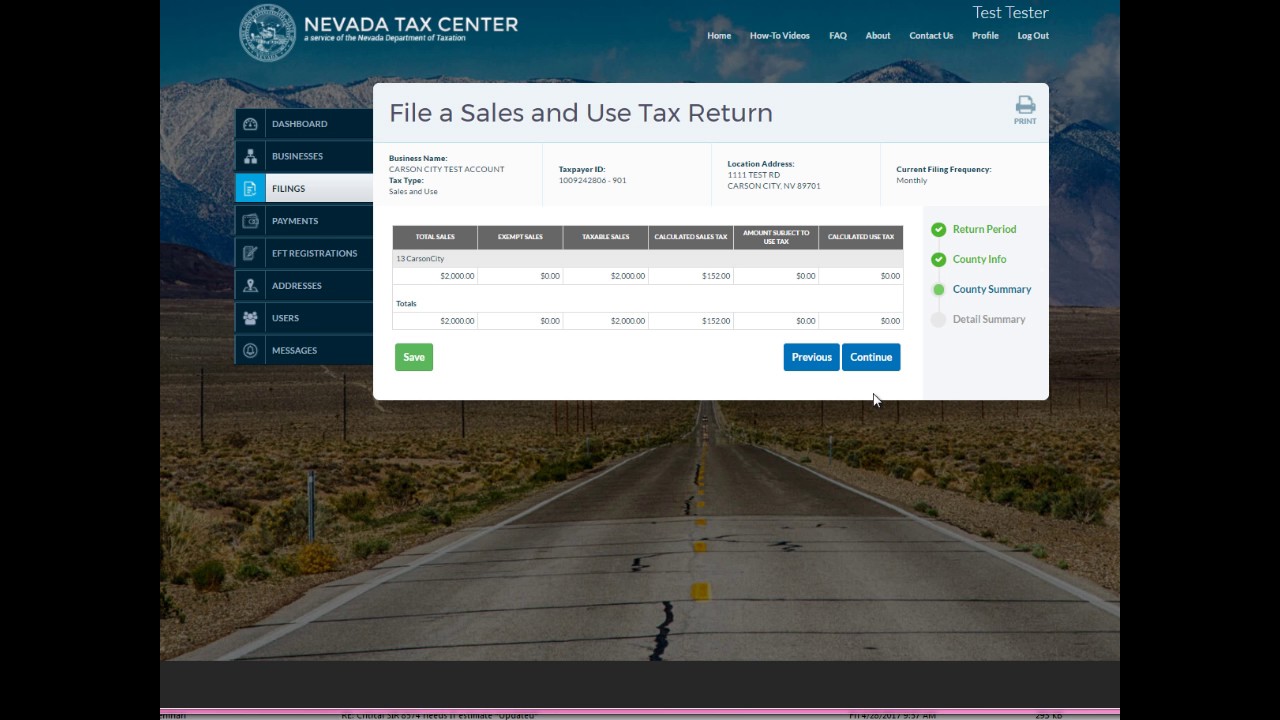

STEP ONE: Look up Sales Tax Rate. Find the sales tax rate in any city in the U.S. For purchases in person from your store, input the store City & Zip Code.; For purchases by mail, phone, or the Internet, input internet sales tax rate nevada …

California Internet Sales Tax | Nolo

Learn about California’s Internet sales tax rules before selling online to California customers. By Stephen Fishman , J.D. In the past, an online seller who sold to customers located in a particular state had to have some physical presence in that state before the state could require the seller to collect and pay state sales tax.RECENT POSTS:

- louis vuitton cross body bag with gold chain

- lv singapore price list 2020-20

- louis vuitton mini luggage 2019

- macy's shoe sale womens boots

- alicia vikander de louis vuitton

- macys furniture sale living room

- kate spade phone crossbody bags

- louis vuitton damier hat mens

- lv millionaire sunglasses clearance

- vizio 70 inch tv black friday deals

- lv saintonge singapore price

- louis vuitton bookbag for sale

- lv authenticator

- louis vuitton tasche preise deutschland

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.