Louisville Ky County Tax

Jefferson County property tax ... - Louisville, Kentucky

May 22, 2020 · LOUISVILLE, Ky. — Higher tax bills could be a reality for Jefferson County homeowners after the school board voted in favor of raising property taxes. In a 5 to 2 vote, the Jefferson louisville ky county tax County ...When renewing your registration at the County Clerk's office be sure to louisville ky county tax bring: Photo ID Kentucky certificate of registration; Current original (not a copy) proof of Kentucky insurance effective date within 45 days Money for fees and applicable taxes (check with your County …

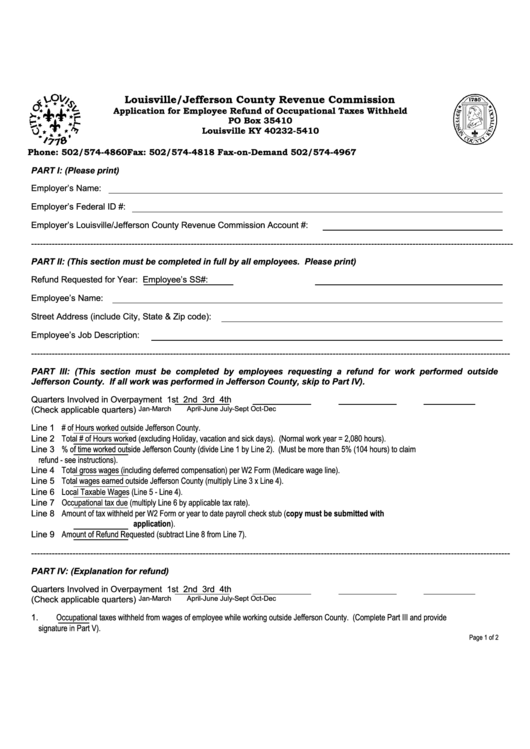

How do I claim city and county tax refund for Kentucky?

Jun 01, 2019 · If you live in KY, it will not be possible to get a refund for local and county taxes. As Hal_Al mentions, KY localities take out the exact amount of tax on your wages. KY localities only tax income where you work. (Metro Louisville does tax a Louisville resident at a higher rate than a Louisville …About Assessor and Property Tax Records in Kentucky Real and personal property tax records are kept by the Property Valuation Administrator’s Office ( PVA) in each Kentucky county. Land and land improvements are considered real property while mobile property is classified as personal property. ... 531 Court Place, Suite 504, Louisville, KY ...

Kentucky Property Tax Calculator - SmartAsset

Located in northern Kentucky across the Ohio River from Cincinnati, Kenton County has some of the highest property taxes in the state. The average effective property tax rate in Kenton County is 1.14%, well above the state average of around 0.86%.Find 55 listings related to Jefferson County Taxes in Louisville on 0 See reviews, photos, directions, phone numbers and more for Jefferson County Taxes locations in Louisville, KY.

It is still possible to form a new county from portions of more than one existing county; McCreary County was formed in this manner, from parts of Wayne, Pulaski and Whitley counties. The largest city in Kentucky, Louisville, is a louisville ky county tax consolidated local government under KRS 67C.

Apr 15, 2016 · Louisville, Kentucky stacks up well in nearly any property tax rate comparison. The real estate tax rate across the United States averages 1.192 percent, or $1,192 per $100,000 in real estate value. The average tax rate in Kentucky is 0.85 percent.

RECENT POSTS:

- mens louis vuitton bag ebay

- youtube still life louise penny

- grey leather card wallet

- best buy black friday ad 2019

- graceful mm shoulder bag

- who buys louis vuitton bags near mesa

- louis vuitton graphite wallet

- fossil tan crossbody purse

- what is hermes birkin bag made of

- 40mm grenade bandolier belt

- white leather tote handbag uk

- dallas cowboys speed replica helmet

- real lv tote bag

- best louis vuitton bag to have

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.