Lv No Sales Tax

![lv no sales tax Top 9 States with No Income Tax in 2020 [Free Guide]](https://i0.wp.com/d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/2-States-with-No-Income-Tax-and-No-Sales-Tax.png?fit=800%2C800&ssl=1)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)

Apr 03, 2019 · Sales taxes currently range 6.25-8.5%, depending on the municipality. Property taxes are bigger in Texas and average around 1.86% of a home’s value, per year.

Jun 26, 2020 · If you're registered for sales tax purposes in New York State, you must file sales and use tax returns quarterly, part-quarterly (monthly), or annually with the department. Even if your business did not make any taxable sales or purchases during the reporting period, you must file your sales and use tax return by the due date.

Louisiana's Sales Tax Holiday for Hurricane and Pandemic ...

Nov 20, 2020 · During the sales tax holiday, the state's 4.45% sales tax will not be charged on the first $2,500 of most consumer (not business) purchases. This is just in …Sales tax software makes sales tax lv no sales tax calculation automatic and easy. QuickBooks Sales tax keeps track of thousands of tax laws so you don't have to. damier ebene speedy 40

The sales tax in Las Vegas is 8.25% and is added to food and drink bills. Hotel rooms both on the Strip and Downtown come with a 13.35% tax. Taxes are also added to show tickets. advertisement. Telephones Generally, Vegas hotel surcharges on long-distance and local calls are astronomical. You are often charged even for making a toll-free or ...

Service Exemptions. Unless otherwise noted, all exemptions in this section are covered by Va. Code § 58.1-609.5.. lv no sales tax Professional, Insurance or Personal Services. Sales of inconsequential items for which no separate charge is made that are part of professional, insurance, or personal services transactions are not subject to sales tax.

If, for example, a remote seller reaches the sales amount or transaction threshold on July 15, 2019, it must register and start collecting sales tax no later than September 1, 2019. Sellers do not need to reach a certain threshold to register and collect sales tax – they lv no sales tax can always choose to do so at any time.

Internet Sales Tax: Who Has to Pay?

Nov 27, 2019 · The 1992 Quill Decision: Trying to Set a Definition of Nexus . A 1992 Supreme Court decision (the Quill v. N. Dakota case) attempted to address the issue of internet transactions.According to the Tax Foundation, the Quill decision said that business "must have a physical presence in a state in order to require the collection of sales or use tax for purchases made by in-state customers."RECENT POSTS:

- louis vuitton mask price canada

- fondation louis vuitton visite architecture

- photography jobs in st louis mo

- limited edition louis vuitton wallet

- louisiana state university shreveport medical school

- louis vuitton new arrivals 2020

- louis vuitton brazza wallet price singapore

- designer inspired louis vuitton bags

- louis vuitton shoes for cheap

- how do you know if your louis vuitton wallet is really

- louis vuitton wallet zippy xl

- gucci white gg marmont leather crossbody bag

- best thai food in st louis

- gucci belts women silver

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

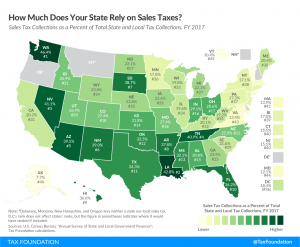

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.