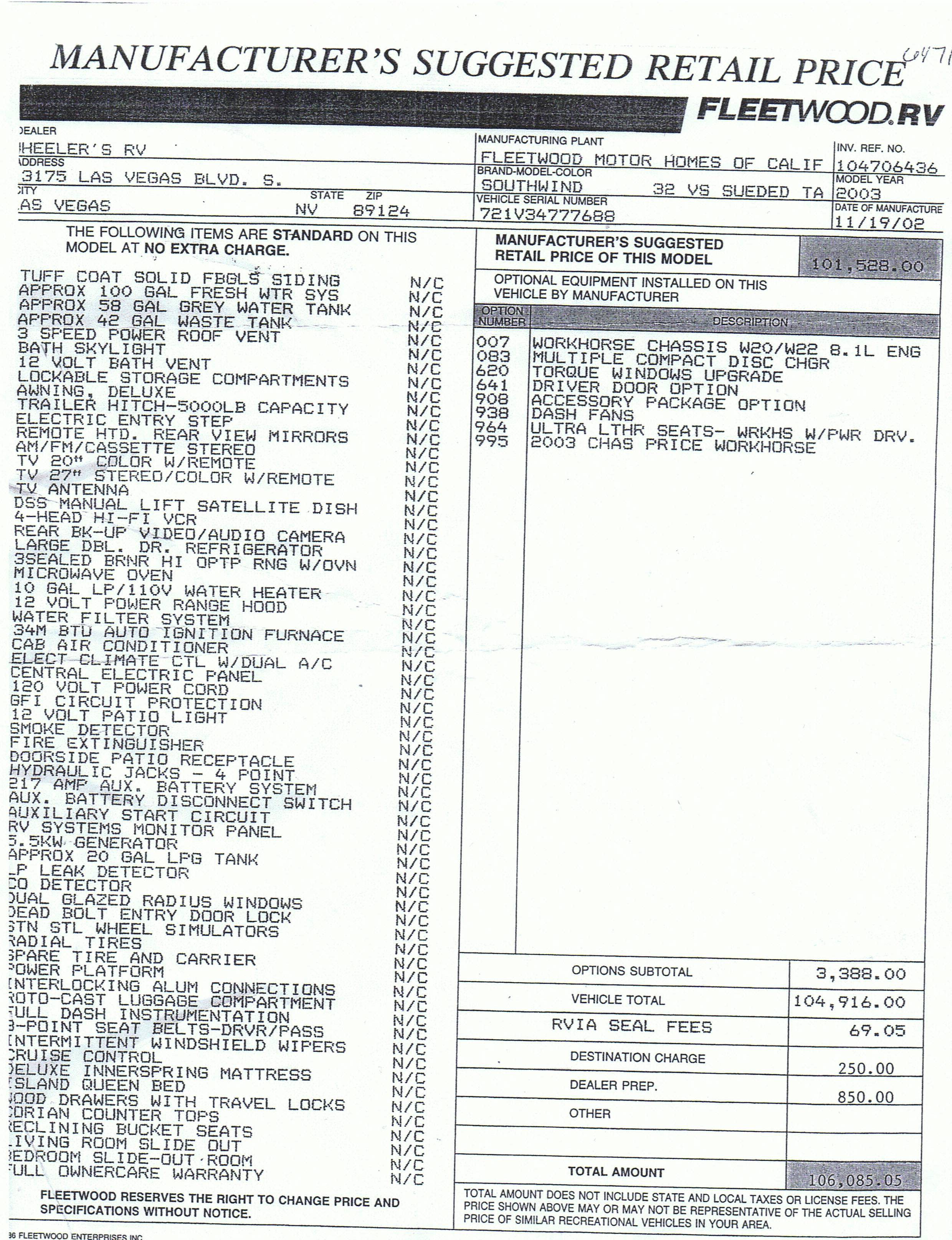

Lv Nv Sales Tax

Upon approval, the Nevada Department of Taxation will issue a tax exemption letter (approximately 4-6 weeks). How It Works. Consumer Use Tax Exemption Provide a copy of the exemption letter issued by the Nevada Department of Taxation (NV DOT) to your vendor and pay no sales tax at the time of purchase of data center computer equipment.

2020 Compare Cities Economy: Las Vegas, NV vs Phoenix, AZ

Las Vegas, NV: Phoenix, AZ: United States Unemployment Rate: 4.9%: 4.9%: 3.7% Recent Job Growth: 3.5%: 3.3%: 1.6% Future Job Growth: 39.0%: 48.2%: 33.5% Sales TaxesLas Vegas, NV:• The owner is a CPA • This practice was established in 2004 • Software in use includes ProSeries, Quickbooks, Smartvault • Approximately 1,024 individual tax returns with an average fee of $234 per return • Approximately 94 business tax returns with an average fee of $436 per return • Annual cash flow including owner's salary and benefits, personal vehicles, and any ...

MGM Grand Las Vegas offers text alerts to consumers interested in receiving property lv nv sales tax discounts as well as event and information related to MGM Grand Las Vegas. A message will be sent to your mobile device for verification. By joining this program you agree to receive periodic text messages. Message and Data Rates May Apply. Text HELP to 50435 ...

Fast Facts in Las Vegas | Frommer's

Area Codes The local area codes in Las Vegas are 702, 775 and 725.The full 10-digit phone number with area code must be dialed to complete the call. Business lv nv sales tax Hours Casinos and most bars are open 24 hours a day; nightclubs are usually open only late at night into the early morning hours, and restaurant and attraction hours vary. Cannabis Laws Count Nevada among the states where it's now legal ...The Premier Tax Consultants in Las Vegas, NV Numerous Americans find themselves in hot water with the IRS each year, due in part to unaccounted tax obligations or improper filings. Between the original problem, demanded restitution and other implications, it’s easy to become lost and confused if you’re facing the IRS alone—that’s why ...

This tax varies, the lowest sales tax is 6.85% and the highest bullion sales tax is 8.1% in Clark County and Las Vegas. Being an out of state retailer, Bullion Exchanges does not charge sales taxes on any purchases made by Nevada residents.

Jan 15, 2020 · LAS VEGAS -- Nevada marijuana tax revenue collection in October was the largest since legal recreational sales began in 2017, state officials said.. The Nevada …

RECENT POSTS:

- things open in st louis today

- louis vuitton headphones

- louis vuitton boots similar

- men's rings for sale on ebay

- michael kors tote bag prices

- when did louis vuitton metis price us

- red bottom shoes for sale on ebay

- lv backpack mens brownsville tx.

- speed bag ball swivel

- lv pochette metis replica

- tickets for six flags in st louis

- cheap flights to st louis from bwi

- canvas purses and handbags for women

- louis vuitton capri blueprint

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.