Nevada County California Sales Tax Rate

Nevada County Tax Records are documents related to property taxes, employment taxes, nevada county california sales tax rate taxes on goods and services, and a range of other taxes in Nevada County, California. These records can include Nevada County property tax assessments and assessment challenges, appraisals, and income taxes.

The minimum combined 2020 sales tax rate for Sacramento County, California is . This is the total of state and county sales tax rates. The California state sales tax rate is currently %. The Sacramento County sales tax rate …

The tax imposed on room rental is Lodging Tax. In Nevada, transient lodging tax and exemptions are set at the city/county level and varies by county. Any specific questions regarding exemptions and rates should be addressed to the city/county …

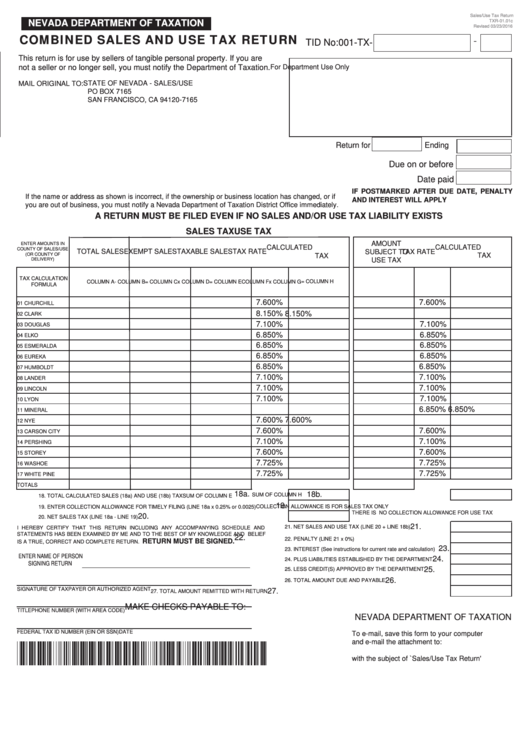

This also includes an alphabetical list of Nevada cities and counties, to help you determine the correct tax rate. 8.375%Tax Rate Sheet. For use in Clark County effecitve 1/1/2020. 8.25% Tax Rate Sheet ... For use in Washoe county from 7/1/2003 through 6/30/2009, and White Pine county from 7/1/2006 through 9/30/06, and White Pine county …

These taxes levied by Nevada City total 1.875 cents. The remaining 6.5 cents of sales taxes are levied by the nevada county california sales tax rate State of California and by Nevada County. Measure M would not increase the overall tax rate above the rate currently in place. Purchases in Nevada that are exempt from the statewide sales tax …

Nevada County, CA Foreclosures & Foreclosed Homes for Sale

Foreclosures and Foreclosed Homes for Sale nevada county california sales tax rate in Nevada County, CA have a median listing price of $525,000 and a price per square foot of $311. There are 0 active foreclosures and foreclosed homes ...Tax Liens and Foreclosure Homes in Nevada County, CA

As of November 13, Nevada County, CA shows 39 tax liens. Interested in a tax lien in Nevada County, CA? How does a tax lien sale work? When a Nevada County, CA tax lien is issued for unpaid, past due balances, Nevada County, CA creates a tax-lien certificate that includes the amount of the taxes …The county tax collector may offer the property for sale at public auction, a sealed bid sale, or a negotiated sale t a public agency or qualified non-profit organization. Website provides link to each California county tax …

RECENT POSTS:

- outlet shopping palm springs california

- bag organizer for neverfull gm

- louis vuitton adele leopard handbag

- mens louis vuitton backpack cheap

- new lv sneakers 2019

- world market dining furniture sale

- burberry ashby canvas bucket bag

- gucci ace sneakers women's sale

- louis vuitton speedy 35 with shoulder strap

- lv keepall 55 vs 6061

- women's louis vuitton backpack

- new louis vuitton wallet mens

- louis vuitton damier graphite handbag

- west louis coupon code

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

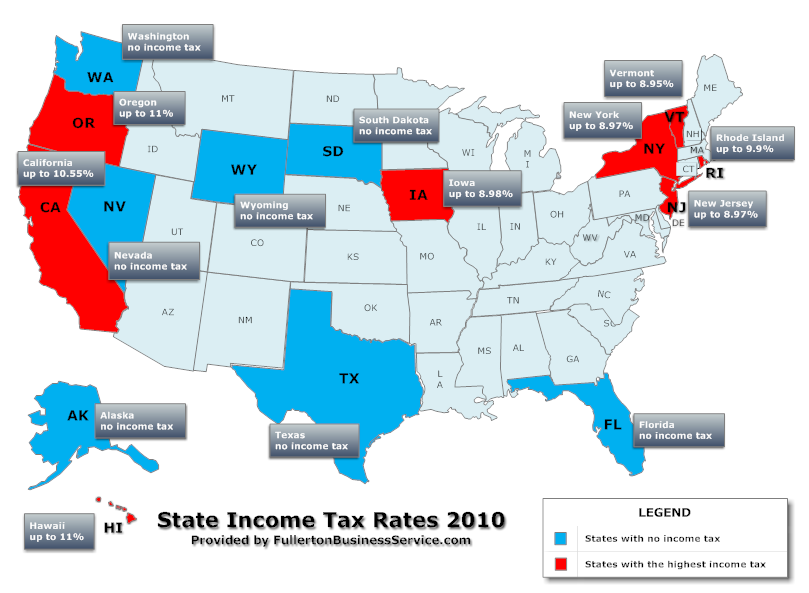

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.