Nevada Mo Sales Tax Rate

Sales & Use Tax | Vertex, Inc.

Manage the end-to-end sales and use tax process, from the tax determination of every transaction to exemption certificate management to monthly tax returns. Learn More There are more than 12,000 state and local tax …Online Sales Taxes: Will Every State Tax Out-of-State ...

Transaction tax changes are on pace to reach the second highest total in the past 11 years. 150 city sales tax rate adjustments have occurred to date this year—with all but 10 being rate hikes ...Oct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate …

Surprising Data Reveals Top 25 Tax-Friendly States To ...

Sep 16, 2020 · State sales tax: 1.76% State tax on Social Security: None. Alaska is the most tax-friendly state for retirees because it has no state income tax or tax on Social Security. And its sales tax rate is …Effective January 3, 2008, the Maryland sales and use tax rate is 6 percent, as follows: 1 cent on each sale where the taxable price is 20 cents. 2 cents if the taxable price is at least 21 cents but less than …

Sales Tax Deduction Calculator | Internal Revenue Service

Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales …Jul 09, 2012 · While tax rates vary by location, the auto sales tax rate typically ranges anywhere from two to six percent. Multiply the net price of your vehicle by the sales tax percentage. Remember to convert the sales tax percentage to decimal format. For example, if your state sales tax rate …

Sales Tax - 0

Walmart Gift Cards purchased at 0 or at a Walmart store are not taxable; state and local tax rates are subject to change at any time Items Purchased from a Walmart Marketplace nevada mo sales tax rate Seller Marketplace Sellers are responsible for collecting and remitting the sales tax for the items they sell and may choose to add the cost of tax …RECENT POSTS:

- speedy delivery map

- how to use gucci bag in project jojo

- sheepskin slippers womens sale

- buy discount indiana state fair tickets

- louis vuitton home decor book

- louis vuitton cherie pump reviewed

- lv passport cover monogram eclipse youtube

- sarah louis vuitton purse

- louis vuitton moet hennessy market cap

- louis vuitton trainers for sale

- factory outlets near los angeles ca

- louis vuitton siena pm vs speedy 25

- pictures of old louis vuitton bags

- gucci soho shoulder bag blackout

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

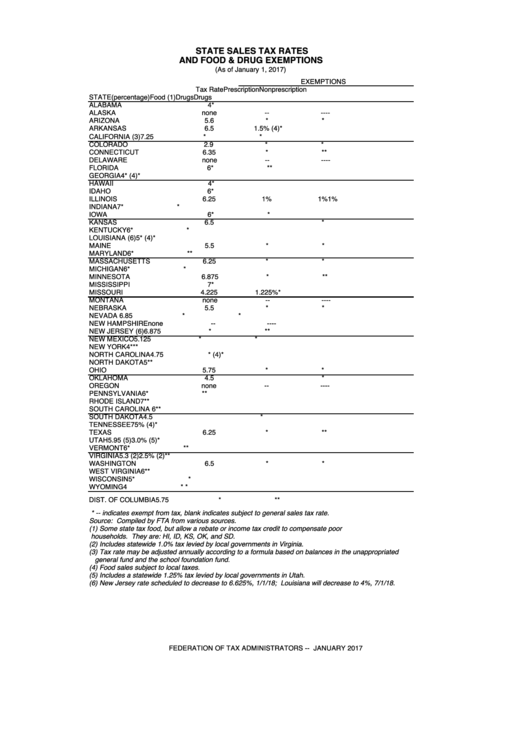

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.