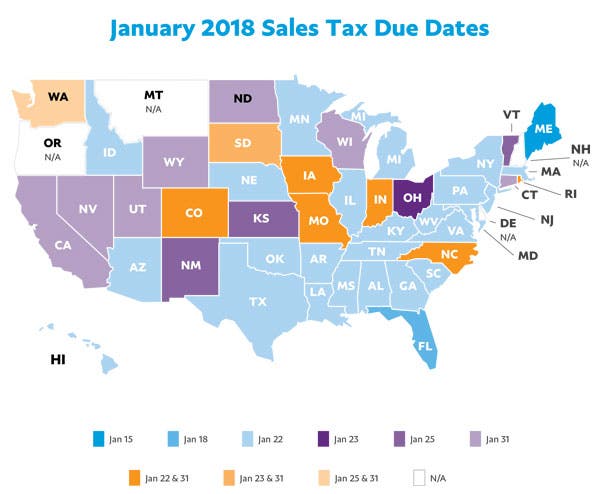

Nevada Monthly Sales Tax Return Due Date

Nebraska Tax Calendar | Nebraska Department of Revenue

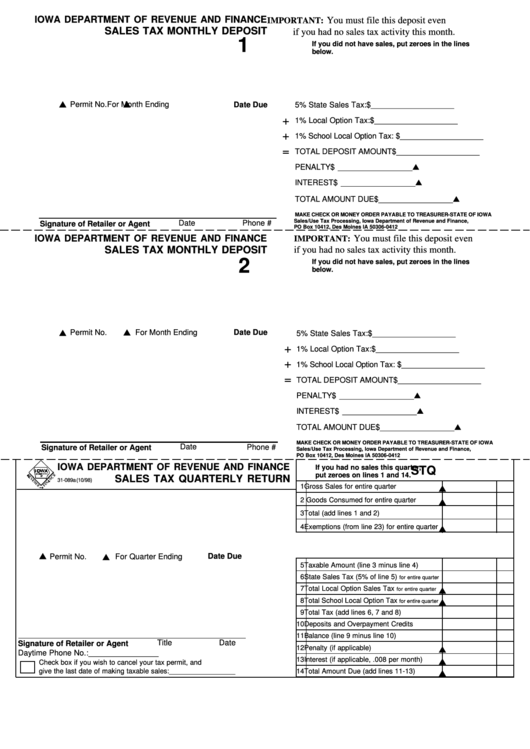

Form 1041N, Nebraska Fiduciary Income Tax Return, last date for filing for a decedent's estate or for a trust (calendar-year basis) 4/20/2021. Form 2, Business Nebraska and Local Use Tax Return. 4/20/2021. Form 10, Nebraska and Local Sales and Use Tax Return. 4/20/2021. Form E911N, Nebraska Prepaid Wireless Surcharge Return. 4/25/2021Monthly Filing & Paying | Utah State Tax Commission

Any seller with an annual sales and use tax liability of $50,000 or more must file and pay sales and use tax monthly. The return and payment are due by the last day of the month following each monthly period. nevada monthly sales tax return due date For example, sales and use tax collected during July is due by August 31 along with any other sales-related taxes and fees.The July 1, 2020, due date for Florida CIT returns is extended to August 3, 2020. The July 1, 2020, due date for Florida CIT payments or to submit a request for extension of time to file remains July 1, 2020. Florida CIT payments should be based on the corporation's best estimate of the amount of tax that would be due with the returns.

This tax calendar gives the due dates for filing returns and making deposits of excise nevada monthly sales tax return due date taxes. Use this calendar with Pub. 510. Also see the instructions for Forms 11-C, …

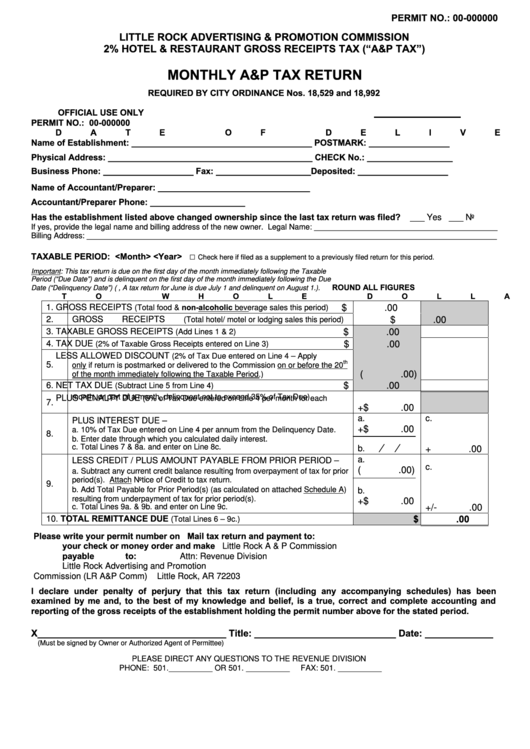

Note: For individual NYS filers, the MCTMT form is now incorporated as part of the personal NYS tax return. Due dates are now the same as NYS personal filing due dates for tax returns and estimated taxes. Dec. 20, 2020. New York State Sales Tax Returns for Quarterly Filers for September 1, 2020 – November 30, 2020 are due by December 20, 2020.

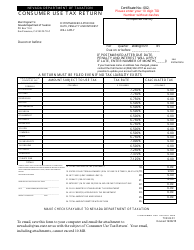

Maintain Sales/Use Tax

Additions to tax is a penalty charged for failure to pay or failure to file the required sales tax return(s) by the due date. When your sales tax return has been filed, but not paid by the required due date, you should calculate your penalty by multiplying the tax amount due by 5 percent. This penalty does not increase.RI Division of Taxation Business Tax Payments

This is not the due date. Monthly sales tax payments are still due on the 20th of each month for hte previous calendar month. Do not use quarter end dates unless you are a quarterly withholding tax filer. Do not enter due dates. Unless you are notified of a change in filing frequency, the current due dates used to file your taxes will remain ...This form is used to file Oklahoma Sales Tax Returns AFTER ...

If this tax return and remittance is not postmarked within 15 calendar days of the due date, a 10% penalty is due. nevada monthly sales tax return due date Multiply the tax amount on Line 7 by 0.10 to determine the penalty. Line 10: Total Due Total the return. Add Line 7, Line 8 and Line 9. When You are Finished Sign and date the return and mail It with your payment to: Oklahoma Tax ... berluti bags for men for saleRECENT POSTS:

- used hobo wallets

- louis vuitton supreme logo font

- louis vuitton official site.com

- louis vuitton epi leather bucket

- white lv belt 90

- lv scarf price silk

- what size belt do i need for a 38 waist

- gucci shirts for men on sale

- louis vuitton leather purses

- lv sandals for women

- lowepro camera bag slingshot 200 aw

- menards black friday gun safe sale

- everlast heavy punch bag uk

- louis vuitton camo print bag review

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.