Nevada Sales Tax On Motor Vehicles

When you buy an expensive item of personal property like a top-grade motorhome or RV, the sales tax can be enormous. For example, if you live in Louisiana, which has a 9% sales tax, and purchase a $350,000 motorhome, you’d have to pay over $31,000 in sales taxes. This was the situation faced by a Louisiana taxpayer.

Mar 29, 2018 · New Hampshire is one of just five states that do not have a sales tax, so you’re in luck when you need to purchase a vehicle. As long as you are a resident of New Hampshire, you won’t need to pay sales tax on the purchase of your car, even when you go to register it.

Fees - Division of Motor Vehicles

Delaware law allows out-of-state vehicle owners a credit on a sales tax, transfer tax or some similar levy paid to another state on the purchase of a vehicle within 90 days prior to registering the vehicle in Delaware. The vehicle must have been titled/registered in the other state nevada sales tax on motor vehicles within 90 days prior to registering the vehicle in Delaware.Sales tax is due on the sale, lease, and rental of motor vehicles when they're sold in Idaho unless a valid exemption applies. This guide explains sales and use tax requirements for motor vehicle dealers.. See the separate guides for:

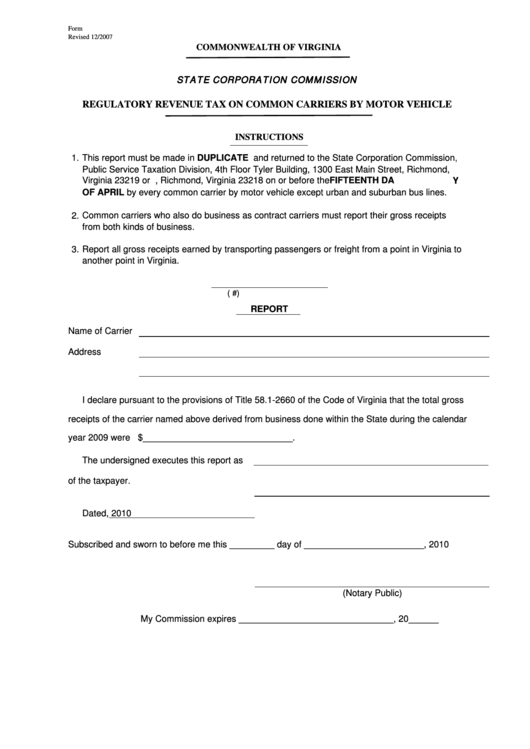

Used Motor Vehicle Sales - Utah State Tax Commission

Used motor vehicle sales. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically, beginning with returns due Nov. 2, 2020.Jan 01, 2018 · Oregon's vehicle taxes. Two Oregon vehicle taxes began January 1, 2018: The vehicle privilege tax is a tax for the privilege of selling vehicles in Oregon.; The vehicle use tax applies to vehicles purchased nevada sales tax on motor vehicles from dealers outside of Oregon that are required to be registered and titled in Oregon.; One-half of 1 percent (.005) is due on the retail price of any taxable vehicle. best cornhole bags fabric

Generally, taxpayers may add to the table amount any sales taxes paid on: • A motor vehicle, but only up to the amount of tax paid at the general sales tax rate; and an aircraft, boat, home (including mobile or prefabricated), or substantial addition to or major renovation of a home, if the tax rate is the same as the general sales tax rate ...

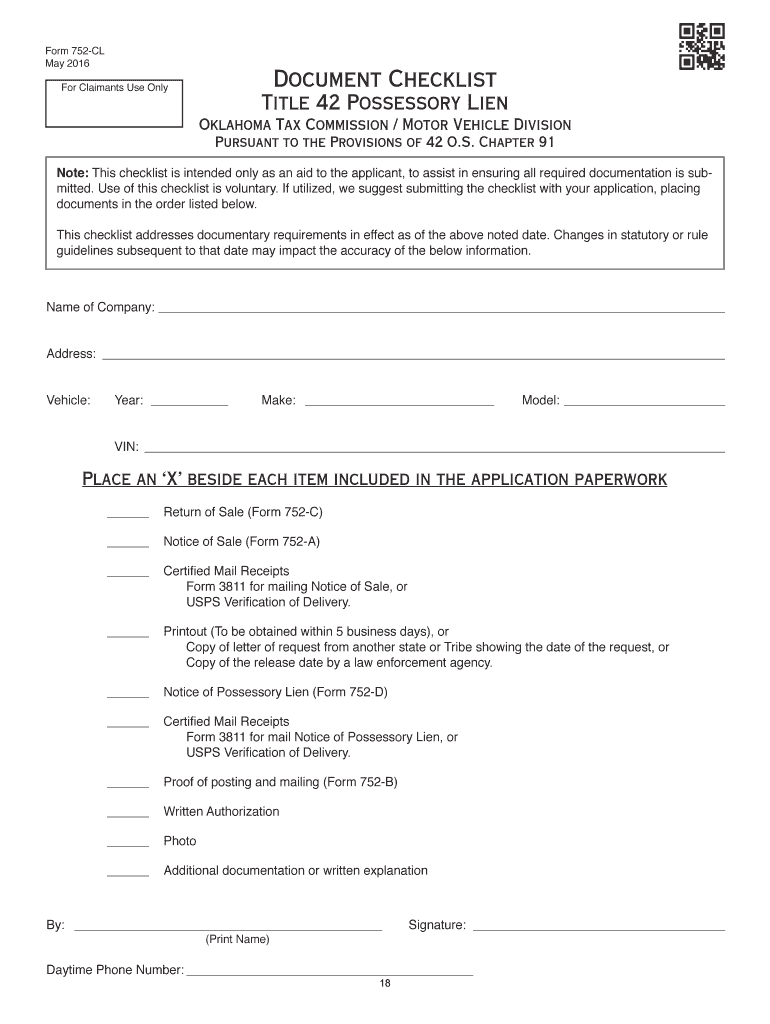

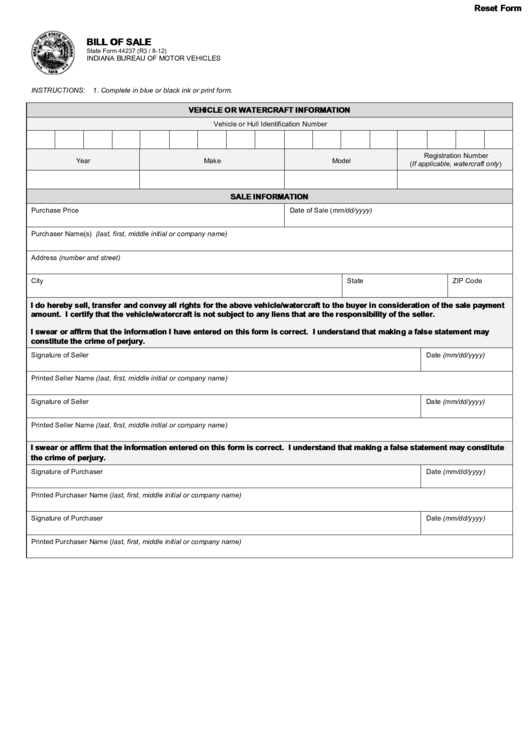

DOR: Dealer Information

Aug 25, 2020 · Vehicle and Watercraft Information. Frequently Asked Questions for Vehicle and Watercraft Dealers - Including dealer documentation requirements, dealer-to-dealer sales issues, sales tax for out-of-state transactions nevada sales tax on motor vehicles and more.; Updated Motor Vehicle Dealer Rules. Motor vehicle dealers must use Indiana sales tax return, ST-103CAR, through INTIME or another approved filing method.RECENT POSTS:

- cheap bags custom

- louis vuitton palm springs mini for sale

- louis vuitton sac polochon 70

- images of louis vuitton belt box

- lv mini palm springs backpack

- lv multi pochette bag

- sales tax for las vegas nevada 2019

- fox theatre st louis shows 2020

- lv slippers dhgate

- black leather tote bag with long strap

- gucci belt women cheap

- neverfull lv organizer

- louis vuitton petit noe yellow

- louisville football tv schedule 2020

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

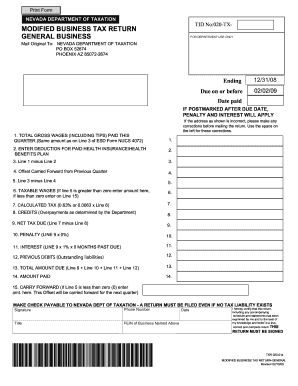

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.