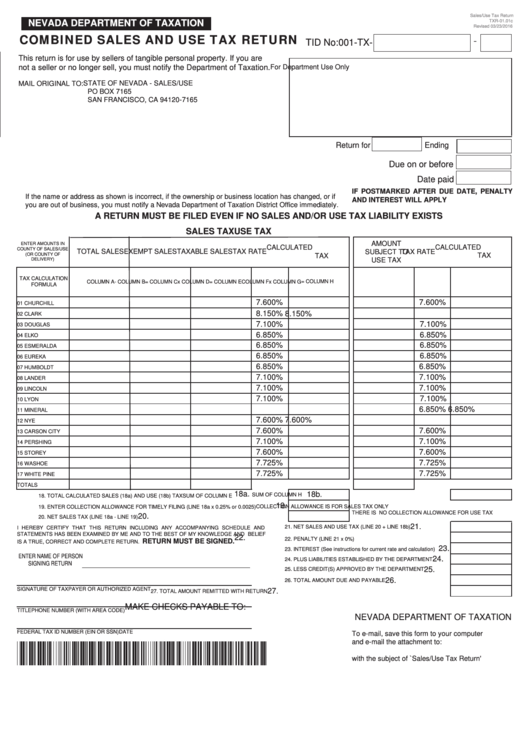

Nevada Sales Tax Rate By County

Tax Auction The Washoe County Treasurer’s Office holds auctions for delinquent property and mobile home taxes. Nevada State Law provides for the redemption of real estate properties up until 5 pm on the third business day before the day of the sale by a county treasurer (NRS 361.585).

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

Sales Tax Rate: In Clark County (Henderson), the sales tax rate is 8.25%. Additional Information Sources: Nevada State Department of Taxation Department of Taxation Home Page

Tax Sales - Serving Douglas County, Nevada

Fiscal Year 2020-21 Property Taxes- 2nd Installment Due 10/02/2020 NOTICE TO TAXPAYERS OF DOUGLAS COUNTY, NEVADA The second installment of the 2020-2021 property tax is due and payable on October 5, 2020.due to covid-19 and nevada county moving back into purple tier, our office is currently only accepting in-person payments for those that must pay by cash and by appointment only. we are encouraging everyone to pay property taxes by utilizing the below payment methods: the online or pay-by-phone service. rood center lobby drop box available 8-5 m-f.

Elko County Treasurer 571 Idaho Street, Suite 101 Elko, NV 89801 Enter your parcel number or personal property account number in the account number field, including hyphens, example 001-002 …

Sales Tax Rates in Major Cities, 2019 | Local Sales Taxes ...

Aug 14, 2019 · Key Findings. There are over 11,000 sales tax jurisdictions in the United States, with widely varying rates. Among major cities, Chicago, Illinois and Long Beach and Glendale, California impose the highest combined state and local sales tax rates, at 10.25 percent.General Property Tax Information | Storey County, NV ...

Prior year’s delinquent property taxes are penalized at 10% annual interest. Delinquent Payment Property Sale list (Tax Lien Sales) Storey County’s tax lien sales follow the guidelines nevada sales tax rate by county set forth by the Nevada Revised Statutes (Chapter 361). All property (real) taxes must be collected in order to meet the budget of the county.RECENT POSTS:

- how to sell purses online

- tote bag sale australia

- check authenticity of gucci purse

- subway louisville ky 40202

- louis vuitton neverfull gm measurements

- louis vuitton bag cheap amazon

- harley davidson mens wallet with chain

- authentic preloved designer bags

- st louis zoo closing children's zoo

- macy purses and handbags ebay

- lv rivoli pm reviews

- handbags for cheap prices

- louis vuitton totally mm damier ebene

- gucci ophidia gg shoulder bag

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

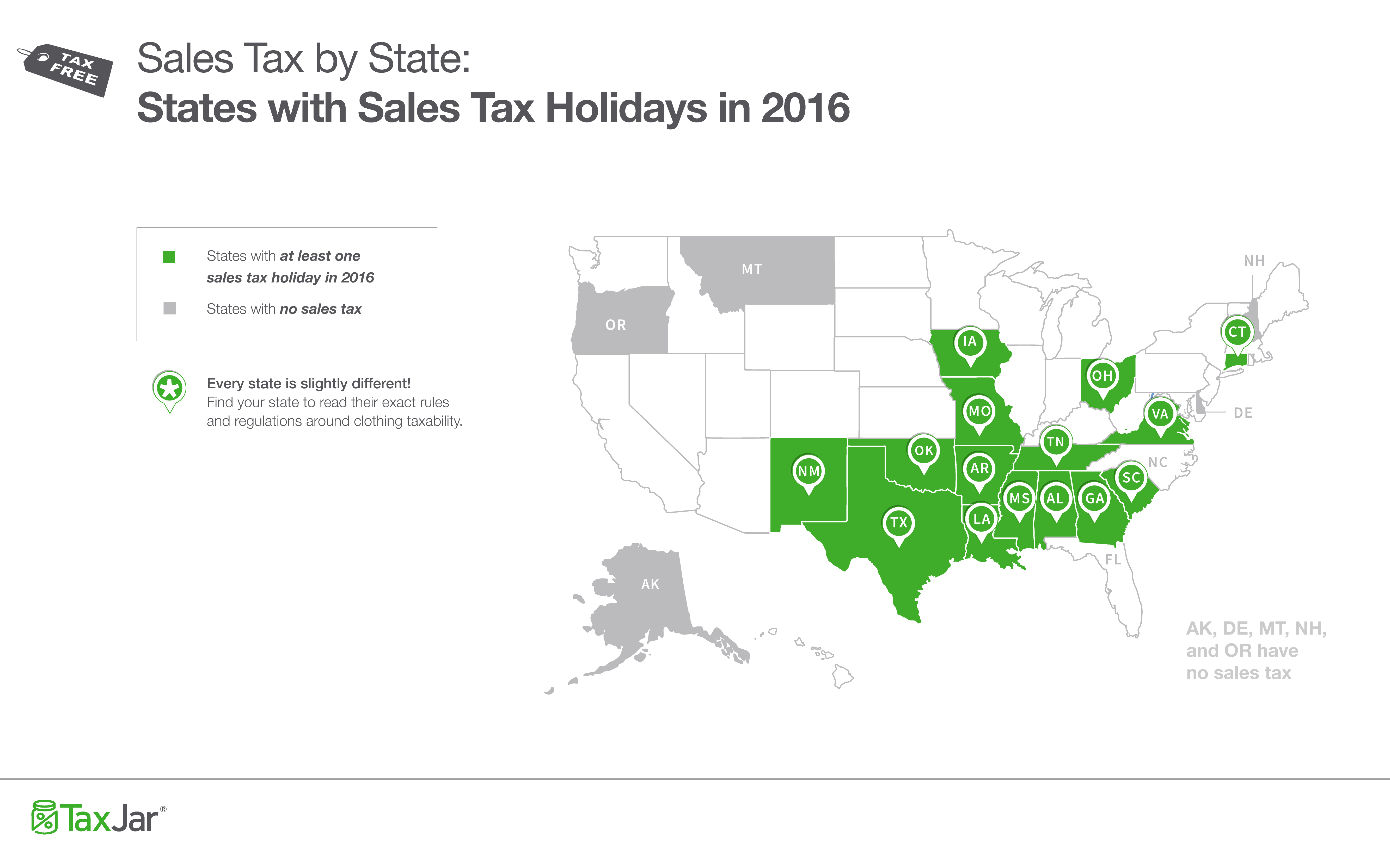

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.