Nevada Sales Tax Rate Lookup

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)

NCDOR: Tax Rates & Charts

nevada sales tax rate lookup County and Transit Sales and Use Tax Rates for Cities and Towns. Sorted by 5-Digit Zip. Sorted Alphabetically by City. E-502H: 6.75% Sales and Use Tax Chart: E-502J: 7% Sales and Use Tax Chart: E-502N: 7.25% Sales and Use Tax Chart: E-502K: 7.5% Sales and Use Tax Chart: E-502R: 2% Food Sales and Use Tax …Sales & use tax rates | Washington Department of Revenue

Look up a tax rate on the go. Download our Tax Rate Lookup App to find WA sales tax rates on the go, wherever your business takes you. Our mobile app makes it easy to find the tax rate for your current location. Just "tap to find the rate." List of sales and use tax rates. Download the latest list of location codes and tax rates.Apply For Your Nevada Tax ID Now: Get Your Nevada Tax ID Online . You can easily acquire your Nevada Tax ID online using the NevadaTax website. If you have quetions about the online permit application process, you can contact the Department of Taxation via the sales tax permit hotline (800) nevada sales tax rate lookup 992-0900 or by checking the permit info website .

Total General State, Local, and Transit Rates Tax Rates Effective 10/1/2020 By 5-Digit Zip By Alphabetical City Historical Total General State, Local, and Transit Rate Tax Rates & Tax Charts County Rates

Origin-based and Destination-based Sales Tax Collection ...

1.) Charge sales tax at the rate of your buyer’s ship to location. 2.) Charge a flat 9.25%. Rule of thumb: States treat in-state sellers and remote sellers differently. Most of the time, if you are considered a “remote seller” in a state, that state wants you to charge the sales tax rate at your buyer’s destination.The Nebraska state sales and use tax rate is 5.5% (.055). , Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1, 2021 Updated 09/03/2020 Effective January 1, 2021, the local sales and use tax rates for Gordon, Greeley, and Juniata will each increase from 1% to 1.5%. These cities have complied with the notification requirements

City Sales and Use Tax - Home Comptroller.Texas.Gov

Name Local Code Local Rate Total Rate; Abbott: 2109064.015000.082500: Hill Co: 4109000.005000 : Abernathy: 2095024.015000.082500: Hale Co: 4095006.005000 : AbernathyJan 16, 2020 · Small Business Administration - Nevada State Agencies and Departments Nevada Small Business Development nevada sales tax rate lookup Center Nevada State Purchasing Division Nevada Code and Statutes. 0's Business Licenses and Permits Search Tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business.

RECENT POSTS:

- louis vuitton crossbody black knockoff purse

- sell louis vuitton gift card

- does stein mart sell louis vuitton handbags

- louis vuitton purses outlet online

- how can you tell a fake louis vuitton handbag

- 2013-14 louisville basketball schedule

- epi leather speedy bag

- lv bag gold

- cheap gucci belt for women

- lv new wave wallet price

- pope's cafeteria st louis mo

- lv sully mm bag

- lv bags for sale replica

- neiman marcus fendi bag sale

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

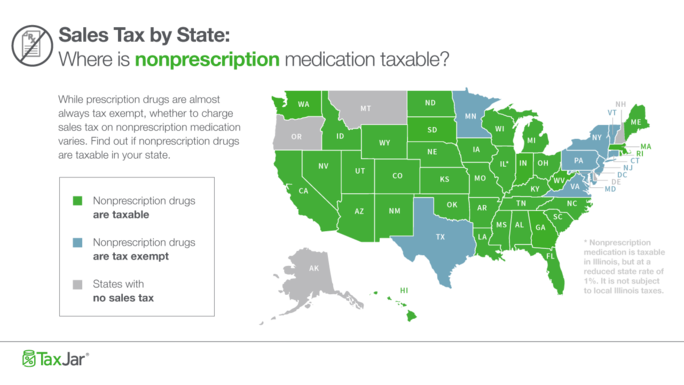

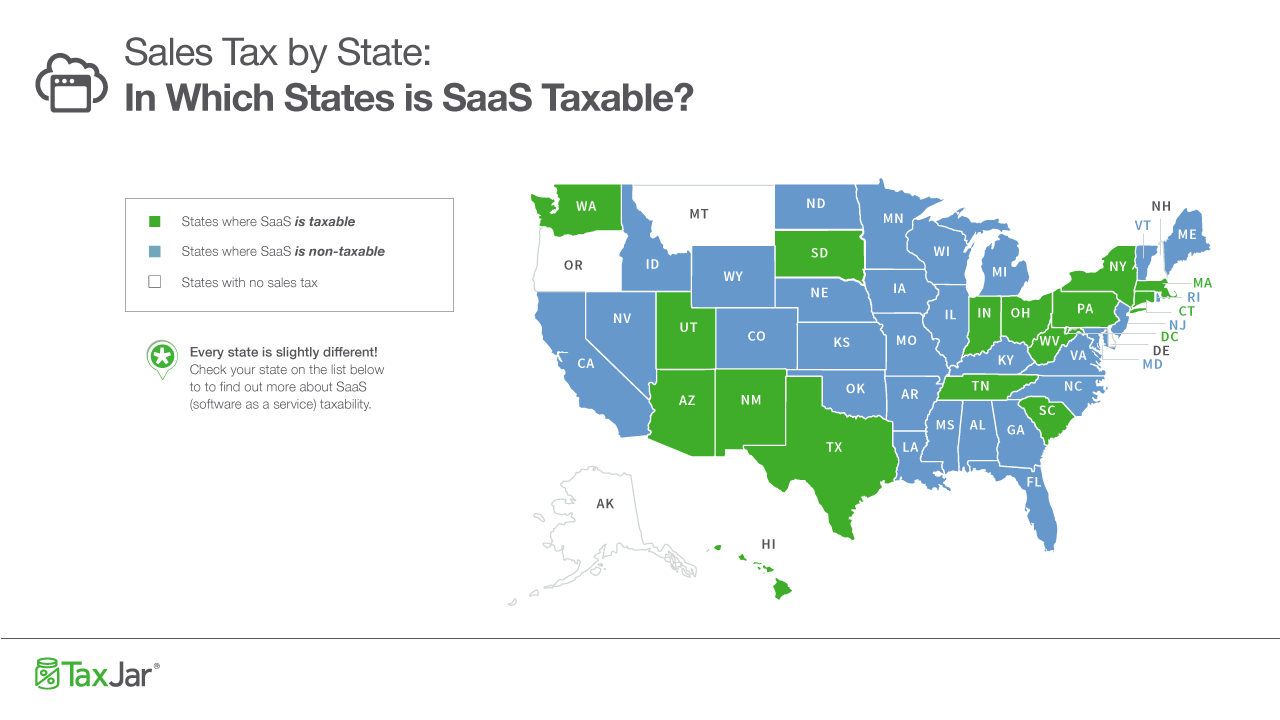

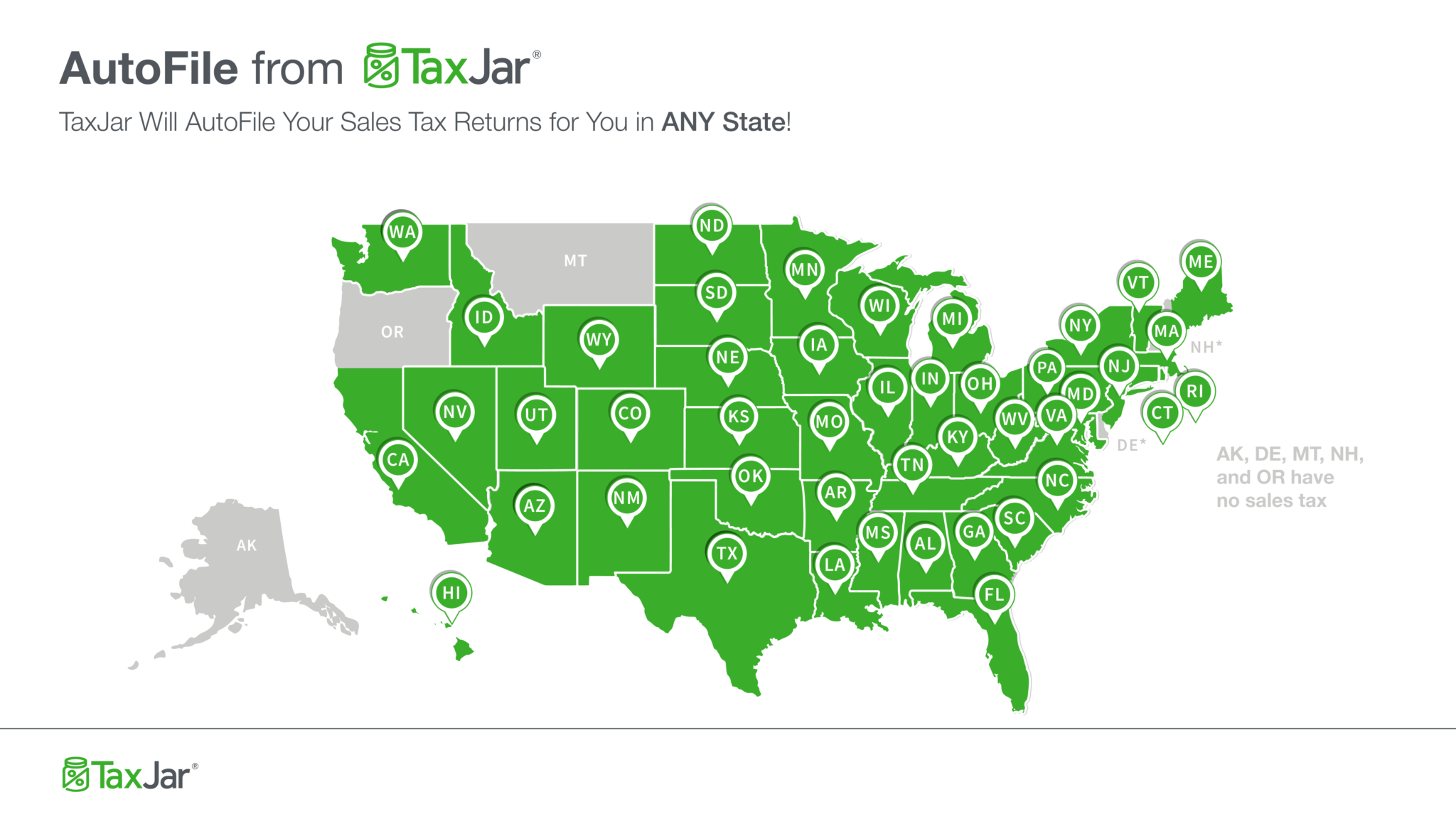

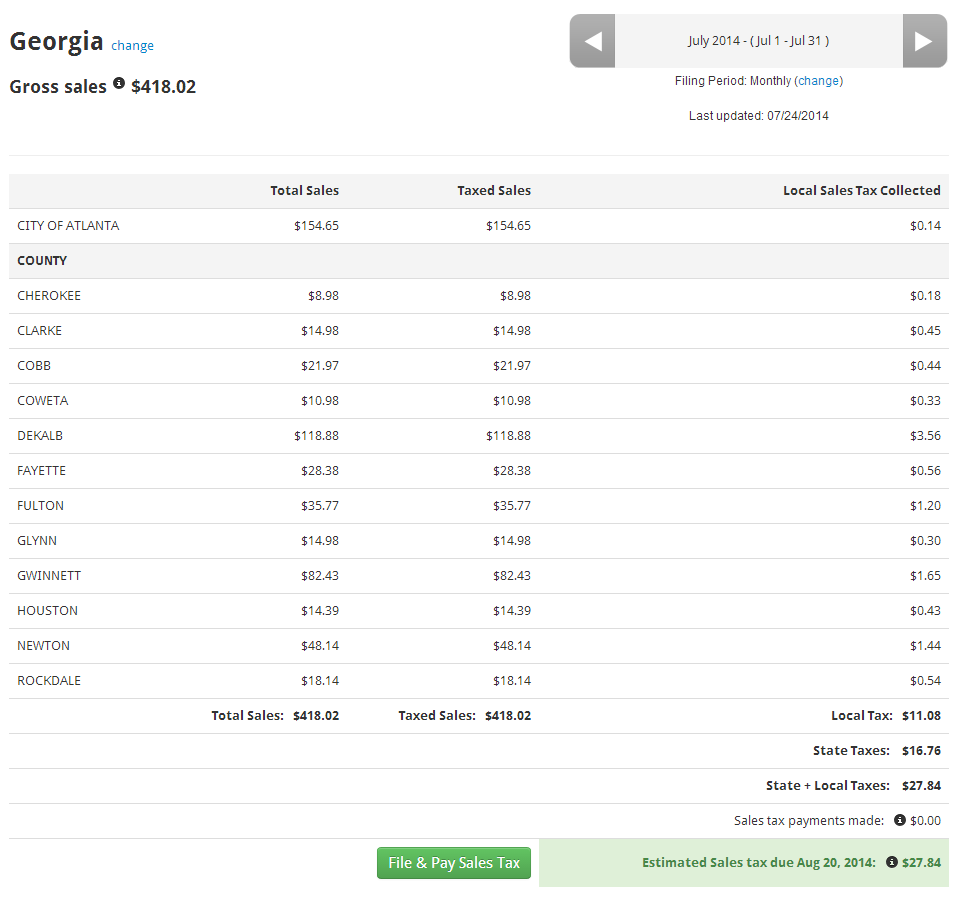

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.