Nevada Sales Tax Rates By County

State and Local Sales Tax Rates | Sales Taxes | Tax Foundation

Jul 08, 2020 · Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate differentials can induce consumers to shop across borders or buy products online. ... and Taney County increased its sales tax …The median property tax (also known as real estate tax) in Clark County is $1,841.00 per year, based on a median home value of $257,300.00 and a median effective property tax rate of 0.72% of property value.. Clark County collects relatively high property taxes, and is ranked in the top half of all counties in the United States by property tax …

Nevada Gaming Control Board : License Fees and Tax Rate ...

Feb 06, 2020 · (NRS 463.370) based on gross gaming revenue - payable on or before the 15th day of each month covering the preceding calendar month at the following rates. 3.5% of the first $50,000 during the month, plus ; 4.5% of the next $84,000 plus ; 6.75% of revenue exceeding $134,000. Live Entertainment Tax …My Tax Bill | Nevada County, CA

WE ARE AVAILABLE TO ASSIST YOU BY PHONE OR EMAIL DURING NORMAL BUSINESS HOURS. PLEASE EMAIL US AT [email protected] OR CALL US AT (530) 265-1285. Important Dates. Property tax …Sales tax calculator for 89103 Las Vegas, Nevada, United ...

How 2020 Sales taxes are calculated for zip code 89103. The 89103, Las Vegas, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89103's county rate (3.775%). Rate variation The 89103's tax rate …Tax Sale | Nevada County, CA

Nov nevada sales tax rates by county 12, 2018 · Properties in Nevada County that have had tax delinquencies for five or more years may be offered for sale by the Tax Collector. The primary purpose of the tax sale is to return the tax defaulted property to the tax rolls. Offering the property for sale …Sep 03, 2019 · The tax increase will take the sales tax in Clark County from 8.25 percent to 8.375 percent. The bill allows money to be used to address homelessness, prevent truancy and chronic absenteeism … leather mickey mouse bag charm

Property Tax Allocation View the Property Tax Allocation Overview (PDF). Assessed Value by District View the list of assessed values by Tax Rate area within the district. Secured Tax Rates View the list of 1% Ad Valorem and other Voter approved bond rates by Tax Rate area. Assessed Value by Tax Rate Area List of assessed value by Tax Rate …

RECENT POSTS:

- neverfull gm dupes

- small crossbody phone bags

- lv zippy compact wallet review

- wholesale lv bags china

- louis vuitton card holder keychain cheap

- louis armstrong biografia espanol

- louis vuitton rose ballerine alma bb

- louis vuitton retailmenot

- louis vuitton eva size

- outlet louis vuitton n41125 porte-documents voyage briefcase damier graphite canvas

- baguette tasche louis vuitton

- louis vuitton handbag raincoat

- louis mall movies

- lv leather wallet size 12/x 7

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

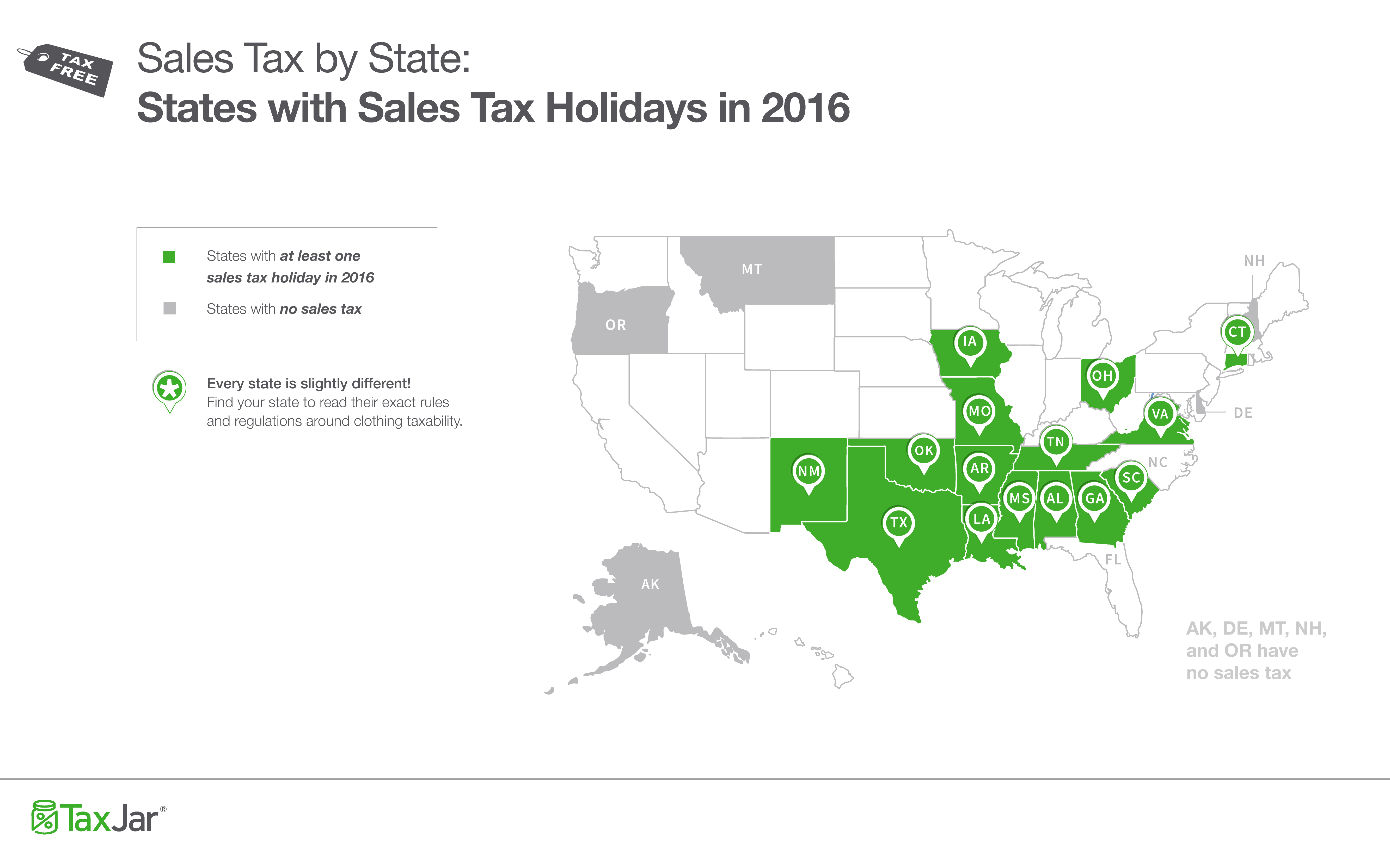

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.