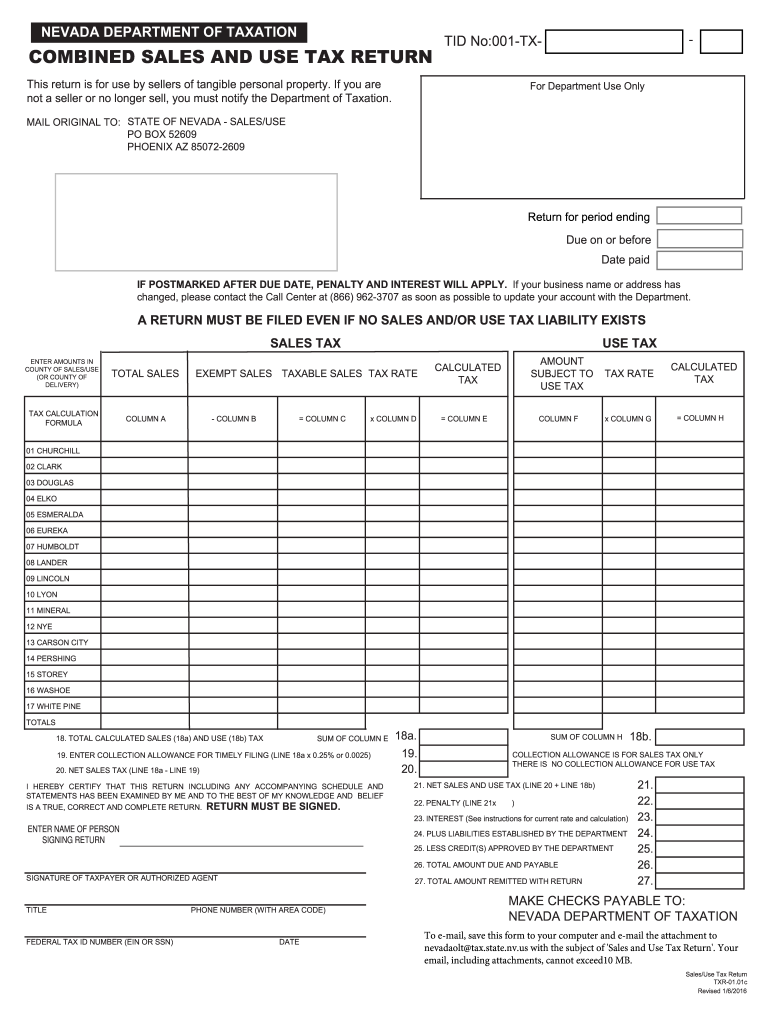

Nevada State Reno Sales Tax

State of Nevada

Job Growth 1st For the past 8 consecutive months October 2018 - May 201912 states that have either no income or sales taxes | Newsday

While tourists come to Nevada to gamble and experience Las Vegas, residents pay no personal income tax, and the state offers no corporate tax, no franchise tax, and no inventory tax. The Silver ...Official Nevada Department of Motor Vehicles Website ...

The Nevada Department of Motor Vehicles issues drivers licenses, vehicle registrations and license plates in the Silver State. It also licenses, regulates and taxes the …State sales and use tax is by far the largest tax in Nevada, making up almost 30% of general fund tax revenue. Gaming taxes are the second largest tax revenue source, followed by modified business tax (a payroll tax), cigarette tax (an excise tax), commerce tax (gross receipts tax on businesses) and live entertainment tax.

2020 Cost of Living Calculator for Taxes: Reno, Nevada and ...

2020 Cost of Living Calculator for Taxes: Reno, Nevada and Las Vegas, Nevada ... Close. Our Premium Cost of Living Calculator includes, State and Local Income Taxes, State and Local Sales Taxes, Real Estate Transfer Fees, Federal, State, and Local Consumer Taxes (Gasoline, Liquor, Beer, Cigarettes), Corporate Taxes, plus Auto Sales, ...Nevada Department of Taxation | Marijuana Agent Portal

Welcome to nevada state reno sales tax the Marijuana Agent Portal The easiest way to apply for your marijuana agent card with the Nevada Department of Taxation.Individuals who are considered nevada state reno sales tax "domiciled" in Nevada generally escape taxation. A corporation organized and domiciled in Nevada can also significantly reduce its state tax burden by shifting its corporate level of activity to the state of Nevada. Owning real estate in the state of Nevada is key factor when considering such tax advantages. For ...

Nov 20, 2020 · Everybody wants a lower tax bill. One way to accomplish that might be to live in a state with no income tax. As of 2020, seven states—Alaska, Florida, Nevada, South Dakota, Texas, nevada state reno sales tax Washington ...

RECENT POSTS:

- how to authenticate a louis vuitton backpack

- france louis vuitton store

- merry christmas and happy 2020 pictures

- spy camera store in st louis mo

- sarah compact wallet lv

- louis vuitton vogue runway fall 2020

- lv cherrywood bb review

- louis vuitton zippy coin purse damier ebene

- amazon prime black friday sales 2019

- vera bradley small crossbody bags

- nordstrom chicago louis vuitton handbags

- louis vuitton shoe cleaning kit

- louis vuitton birmingham saks

- are italian handbags cheaper in italy

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.