Nevada State Sales Tax Form 2020

Nevada | Internal Revenue Service

Dec 03, 2020 · Small Business Administration - Nevada State Agencies and Departments Nevada Small Business Development Center Nevada State Purchasing Division Nevada Code and Statutes. 0's Business Licenses and Permits Search Tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business.State Tax Exemption Information for Government Charge ...

Sep 15, 2020 · When you use a government purchase card such as the "GSA SmartPay" travel card for business travel, your lodging and rental car costs may be exempt from state sales tax. Centrally Billed Account (CBA) cards are exempt from state taxes in EVERY state. Certain states require forms for CBA purchase cards nevada state sales tax form 2020 and CBA travel cards.ST-58, Reciprocal - Non-Reciprocal Vehicle Tax Rate Chart ...

ST-58, Reciprocal - Non-Reciprocal Vehicle Tax Rate Chart January 2020 Residents of states other than Illinois may not claim the nonresident purchaser exemption (Section 5, Box A of Form ST-556, Sales Tax Transaction Return) on purchases of motor vehicles or trailers thatNevada State Tax Forms | 2020 NV Income Tax Return Forms

2020 Nevada state tax forms for income tax returns and refunds, withholding tax, filing a tax extension and special 1040\1099 forms for NV residents.FAQ - Nevada Tax Center

a service of the Nevada Department of Taxation. Home; How-To Videos; nevada state sales tax form 2020 FAQ; About; Contact Us; Log In; Sign Up; FAQCurrent Forms | Utah State Tax Commission

Current Utah State Tax Commission forms. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically, beginning with returns due Nov. 2, 2020.Steamlined Certificate of Exemption

Streamlined Sales Tax Agreement Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Send the completed form to the seller and keep a copy for your records. This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to2020 Instructions for Form 593 | 0

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. ... Report real estate withholding on sales closing in 2020, installment payments made in 2020, or exchanges that were completed or failed in 2020. ... county, province ...RECENT POSTS:

- louis vuitton discounts

- louis vuitton m60017 fake

- louis vuitton rose neverfull

- louis vuitton neverfull mm my lv world tour

- st. louis cardinals football 1974

- gucci red wallet with chainsaw

- how to authenticate louis vuitton wallet

- personalised leather laptop bags indianapolis

- name brand knock off purses

- saint laurent outlet stores usage

- louis vuitton rose perfume price

- six flags st louis 2020 season pass cost

- sale in macy

- louis vuitton mens runway 2020

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

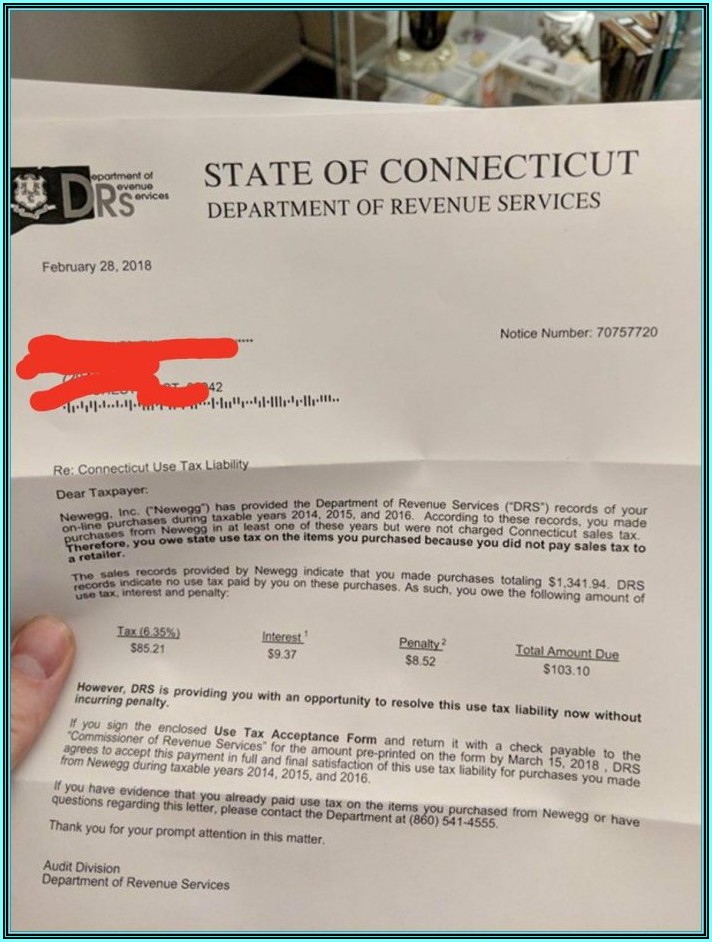

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.