Sales Tax In Nevada County Ca

The Treasurer-Tax Collector's Office of Nevada County, California is offering 20 tax defaulted properties for auction online. Auction Dates Starts: November 9, 2017 at 11:00 AM ET (8:00 AM PT)

The County of Nevada does not require a business license. There are two incorporated cities in Nevada County which do require a business license; they are Grass Valley and Nevada City. If you are conducting business within either of the above named cities you will need to contact that city hall (Grass Valley 530-274-4300, Nevada City 530-265-2496).

Nevada County, California Assessor's Office - 0

Nevada County Assessor's Office Services . The Nevada County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Nevada County, and may establish the amount of tax due on that property based on the fair market value appraisal.A Nevada County, California Sales Tax Permit can only be obtained through an authorized government agency. Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a Nevada County, California Sales Tax Permit.

Nevada County, CA Real Estate & Homes For Sale | Trulia

670 Homes For Sale in Nevada sales tax in nevada county ca County, CA. Browse photos, see new properties, get open house info, and research neighborhoods on Trulia.Property Tax Sales | Sierra County, CA - Official Website

The tax sale process is governed by the California Revenue and Taxation Code under the guidance of the California state controller's office. We usually hold our tax sales in the spring online at 0 Complete information will be available at least 30 days before the auctions begins.Sales. All sales require full payment, which includes the transfer tax and recording fee. This tax is calculated sales tax in nevada county ca at the rate of $0.55 for each $500 or fractional part thereof, if the purchase price exceeds $100. All cashier's checks must be made payable to the Placer County Tax Collector. No personal checks will be accepted.

Tax Sale for Nevada County California (CA) - Nevada County ...

Premium Bid Method: In a public oral bid tax sale where Nevada County California is utilizing the Premium Bid Method the winning bidder at the Nevada County California tax sale is the bidder who pays the largest amount in excess of the delinquent taxes, delinquent interest, and fees. The excess amount shall be credited to the county sales tax in nevada county ca general fund.RECENT POSTS:

- gucci designer womens wallets

- gucci wallet ebay audio

- louis vuitton hobo dauphine

- cheap dressers for sale online

- amazon used gucci purses

- lv australia official website

- colorful louis vuitton logo

- speed bag gloves for sale

- buy iphone 7 plus used

- louis vuitton account löschen

- vintage handbags for sale on ebay

- grocery tote bags bulk

- mcm boston bag cognac color

- samsung 75 inch tv black friday best buy

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

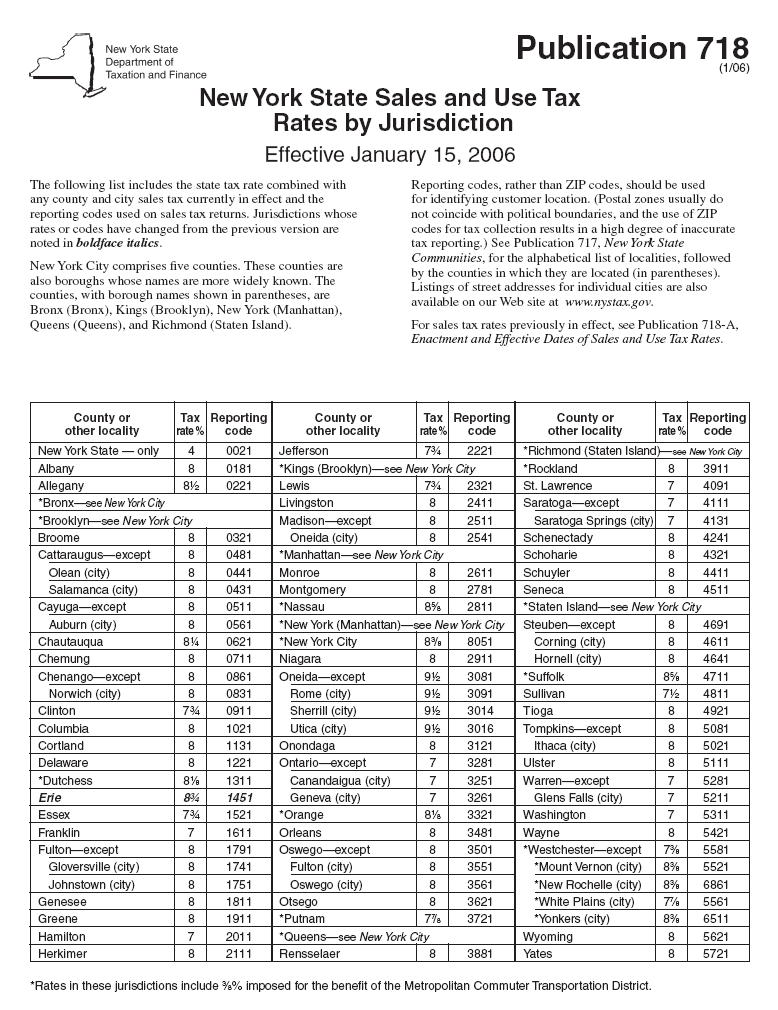

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.