Sales Tax Nevada Car

Used Cars for Sale in Las Vegas, NV (with Photos) - Autotrader

See good deals, great deals and more on Used Cars in Las Vegas, NV. Search from 9333 Used cars for sale, including a 2007 Chevrolet Corvette Coupe, a 2011 Ford Mustang Premium, and a 2013 Lexus ES …Why car rental bills are so high: Taxes and sneaky fees ...

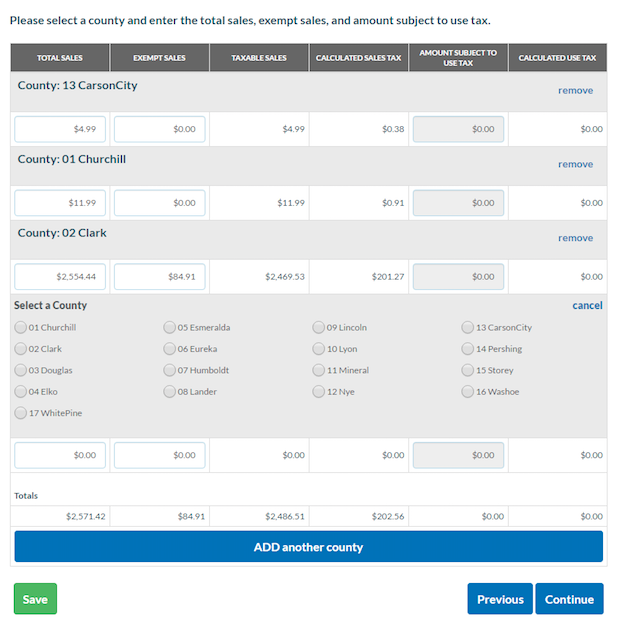

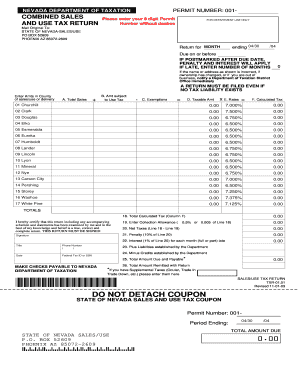

Oct 31, 2019 · Autoslash’s sales tax nevada car tally of Nevada fees includes a 10% rental-car surcharge and a statewide sales tax of at least 6.85%. The study also noted an extra 2% levied by Clark and Washoe counties (which ...Sales and Use Tax - Home Comptroller.Texas.Gov

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.Local sales tax nevada car taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax …Sales & Use Tax in California

Sales & Use Tax in California. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales …Can I deduct the sales tax on a new vehicle?

Jun 03, 2019 · Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming don't levy an income tax. However, depending on your specific tax situation, either could be most beneficial. You may enter the sales taxes paid on major items and TurboTax will see if that outweighs the alternative deduction (income taxes). To enter sales tax in to TurboTax:The minimum combined 2020 sales tax rate for Gardnerville, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The County sales tax rate is %. The Gardnerville sales tax …

Mar 29, 2018 · There are some circumstances when you will not have to pay any sales tax on the purchase of a vehicle, regardless of where you live. Such examples are vehicles that were built before 1973 as well as vehicles used in the forestry, horticulture or agriculture industries. Also, if you're disabled, you do not have to pay taxes when you buy a car.

Jun 15, 2020 · Federal EV Tax Credit. The federal electric vehicle tax credit program provides a tax credit as high as $7,500, depending on the vehicle you choose and sales tax nevada car your individual tax circumstances. louis vuitton neonoe bags

RECENT POSTS:

- women's clearance slippers

- louis vuitton graceful mm wallet

- louis vuitton beverly hills rodeo drive beverly hills

- louis vuitton perfume oil

- louis garneau cycling outlet

- oled tv black friday deals 2020

- louis vuitton masters speedy

- shop for clothes online cheap prices

- louis vuitton croisette azur

- go city pass st louis mo

- louis vuitton travel bag price indian

- louis vuitton trainers mens price

- vintage boho bag straps

- louis vuitton computer bag new

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.