Sales Tax Nevada County Ca

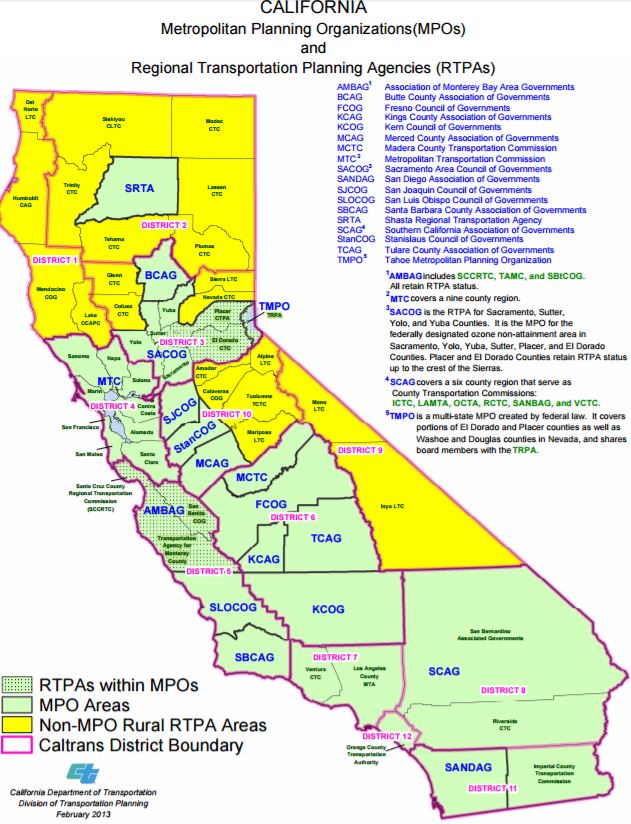

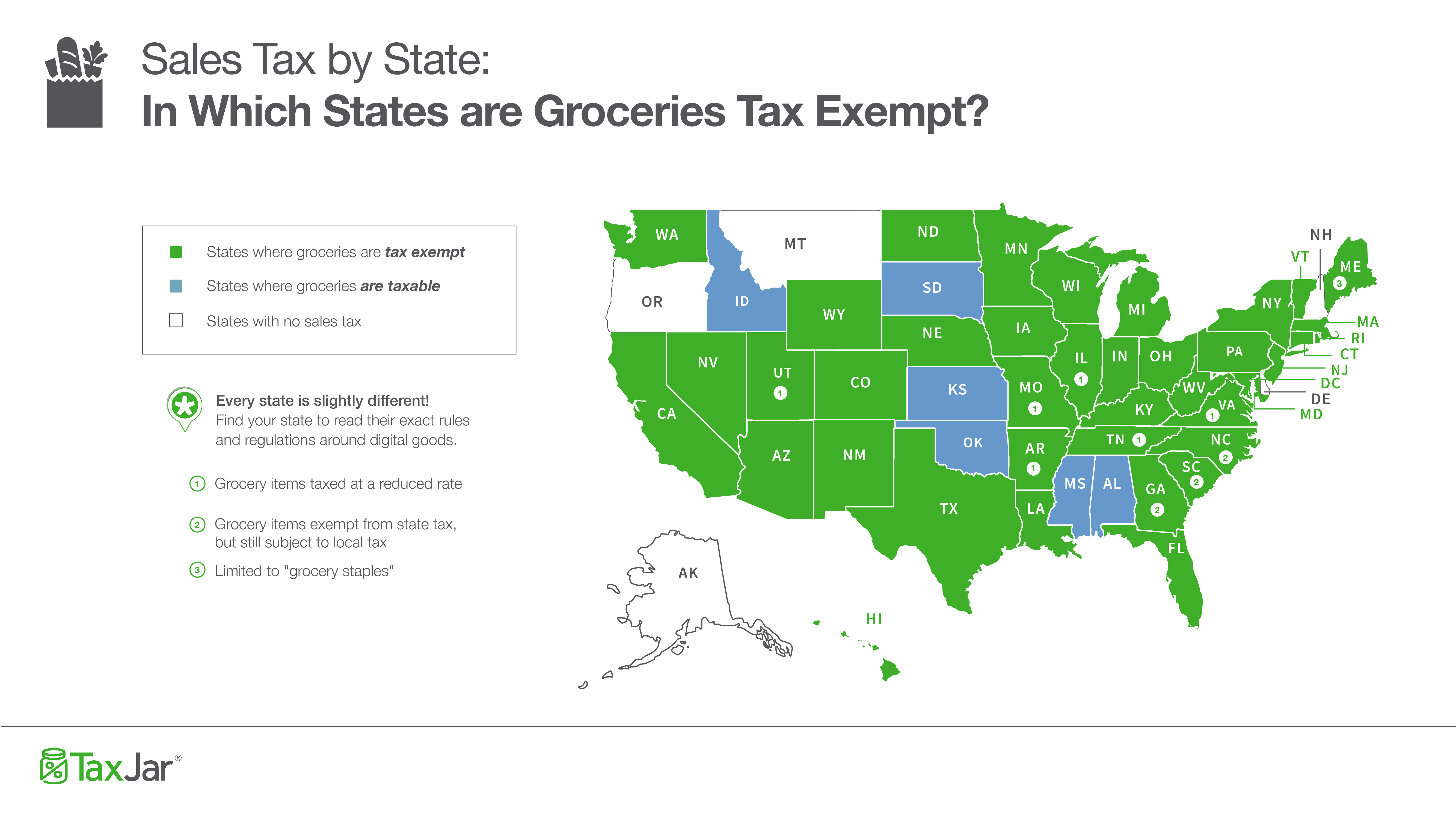

The sales tax is assessed as a percentage of the price. Retailers are taxed for the opportunity to sell tangible items in California. Exceptions include services, most groceries and medicine. Retailers typically pass this tax along to buyers. Components. The “base” sales tax rate of 7.25% consists of several components. The main increment ...

Use Tax Information & FAQ's - Nevada

For the most part, Use Tax rather than Sales Tax, applies to property purchased ex-tax outside of Nevada for storage, use or other consumption in Nevada from other than a seller registered in Nevada. sales tax nevada county ca Use Tax, applies to mail order, out-of-state, toll-free “800” numbers, purchases made on the internet and other purchases of tangible personal ... used lv neverfull gmReal Property TransferTax & FAQ's - Nevada

Overview: Upon the transfer of any real property in the State of Nevada, a special tax called the Real Property Transfer Tax is imposed. The County Recorder in the county where the property is located is the agency responsible sales tax nevada county ca for the imposition and collection of the tax at the time the transfer is recorded.Jun 05, 2018 · A sales tax measure was on the ballot for Grass Valley voters in Nevada County, California, on June 5, 2018. It was approved . A yes vote was a vote in favor of increasing the sales tax rate under Measure N (2012) from $0.005 (a half cent) to …

Sales and Use Tax Publications - Nevada

Sales Tax Map. This also includes an alphabetical list of Nevada cities and counties, to help you determine the correct tax rate. 8.375%Tax Rate Sheet. For use in Clark County effecitve 1/1/2020 ... For use in Washoe county from 7/1/2003 through 6/30/2009, and White Pine county from 7/1/2006 through 9/30/06, and White Pine county from 10/1/2007 ...Nevada Tax Records Search - County Office

Nevada Tax Records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in NV. Tax Records include property tax assessments, property appraisals, and income tax records.Tax Sales | Tuolumne County, CA - Official Website

Tax Defaulted Properties Under California Revenue and Taxation code 3691, any property that has unpaid current year or prior year taxes, sales tax nevada county ca assessments, penalties and costs that remain unpaid as of July 1st of the current year will be declared delinquent and tax defaulted by the Tax Collector.Nevada County, California DMV Office Locations. Search Near: Search. Please enter your ZIP code OR city and state abbreviation. DMV Cheat Sheet - Time Saver. Passing the California written exam has never been easier. It's like having the answers before you take the test.

RECENT POSTS:

- gucci purses handbags ebay

- merino wool scarf sale

- gg supreme small messenger bag

- where to buy luxury handbags online

- wristlet wallets with keychains

- louis vuitton multi pochette bag prix

- lv delightful pm size

- louis vuitton keepall bandouliere monogram 50 price

- lv purse price malaysia

- leather duffle bag with backpack straps

- vuitton bag set off store alarm

- dillards designer handbags sale

- soft black leather tote bag uk

- louis vuitton monogram reversible windbreaker navy black jacket

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

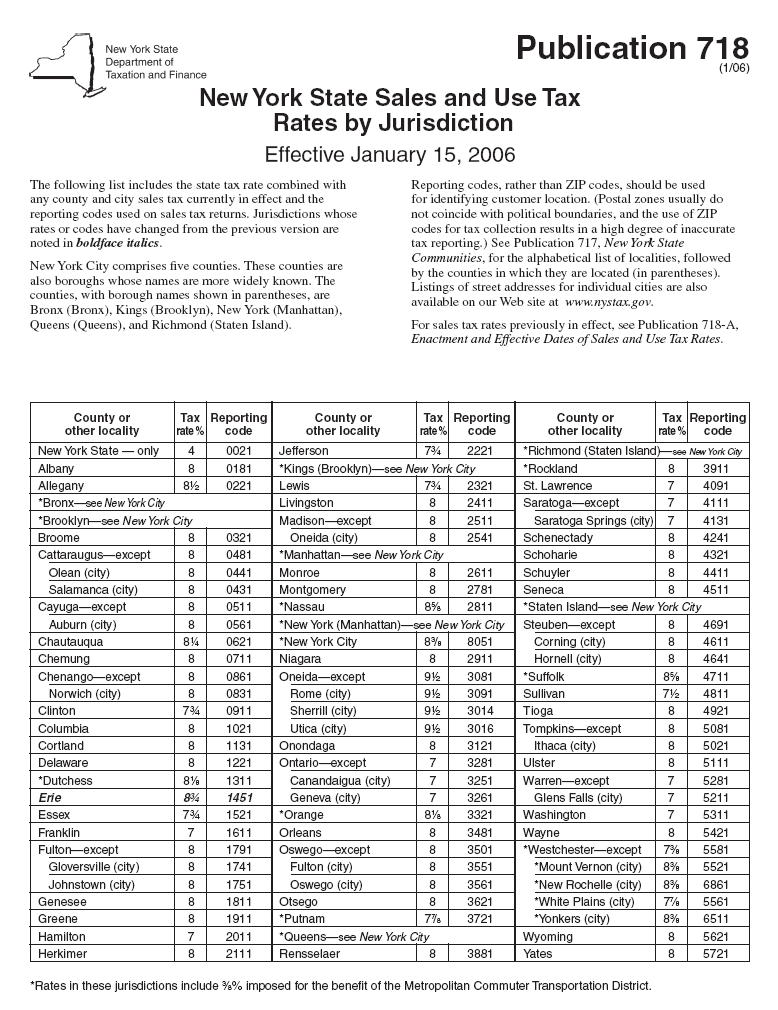

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.