Sales Tax Nevada Mo

Welcome to the Office of the Treasurer for Vernon County, Missouri. sales tax nevada mo I am your Treasurer/ex-Officio Collector Brent Banes. The Vernon County Treasurer is required to maintain current balances in …

NEVADA, MISSOURI THAT: Section 1. SALES TAX FOR TRANSPORTATION. To permit the voters to determine this issue, the Council hereby continues a sales tax in the amount of $.005 for transportation purposes in accordance with Section 94.700 sales tax nevada mo – Section 94.755, RSMo., louis vuitton outlet

Sales and Use Tax Filing Due Dates Affected by COVID ...

Businesses with sales tax, use tax and other business tax due in the months of March, April, and May 2020 may now file and pay those tax returns by July 15, 2020. According to a press release, “The agency has set up a dedicated email address — www.bagssaleusa.com — to assist businesses with extension-related questions.Dec 27, 2019 · Our ranking: Most tax-friendly State income tax: None Average property tax: $1,234 in taxes per $100,000 of assessed home value Average state and local sales tax: 1.76% Gas taxes …

Precious Metals Sales Tax Rules & Regulations by State ...

NEVADA. NO sales tax will be charged for bullion or coins used as a medium of exchange as they are exempt from sales tax when shipping to a Nevada address. The state of Nevada does require the collection of sales taxes on some products sold by BGASC and delivered to a Nevada address.Vendors contracting with the State of Missouri are required to be properly registered and have all sales/use taxes paid, if applicable. Tax Clearance A tax clearance is a certificate stating that a corporation has no taxes owed.

eBay is required to charge internet sales tax on purchases in 34 states. If a shipping address is in one of the marketplace responsibility states within the U.S., the applicable tax will be collected by eBay and included in the order total at checkout. Tax reports are available on Seller Hub.

Oct 28, 2020 · The laws governing sales tax and income tax are very different. Try to keep sales tax and income tax separate in your mind because the information that follows applies only to sales and use tax. A Brief Lesson in Sales Tax History. Sales tax has been around for a while! Believe it or not, sales tax can be traced back to Egypt, Athens, and Rome.

RECENT POSTS:

- sac a dos louis vuitton homme prix

- best designer handbags to buy in parish

- how to spot a fake goyard st louis bag

- louis vuitton bloomingdale's 59th street

- louis vuitton tasche speedy 25 preis

- seafood markets bay st louis ms

- neverfull mm price 2020 european

- when do arizona cardinal tickets go on sale

- louis vuitton holiday 2020

- bay of st louis la

- macys sale ugg boots

- louis vuitton sac noe mm

- louis vuitton favorite mm monogram crossbody bag

- lv bag original price malaysia

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

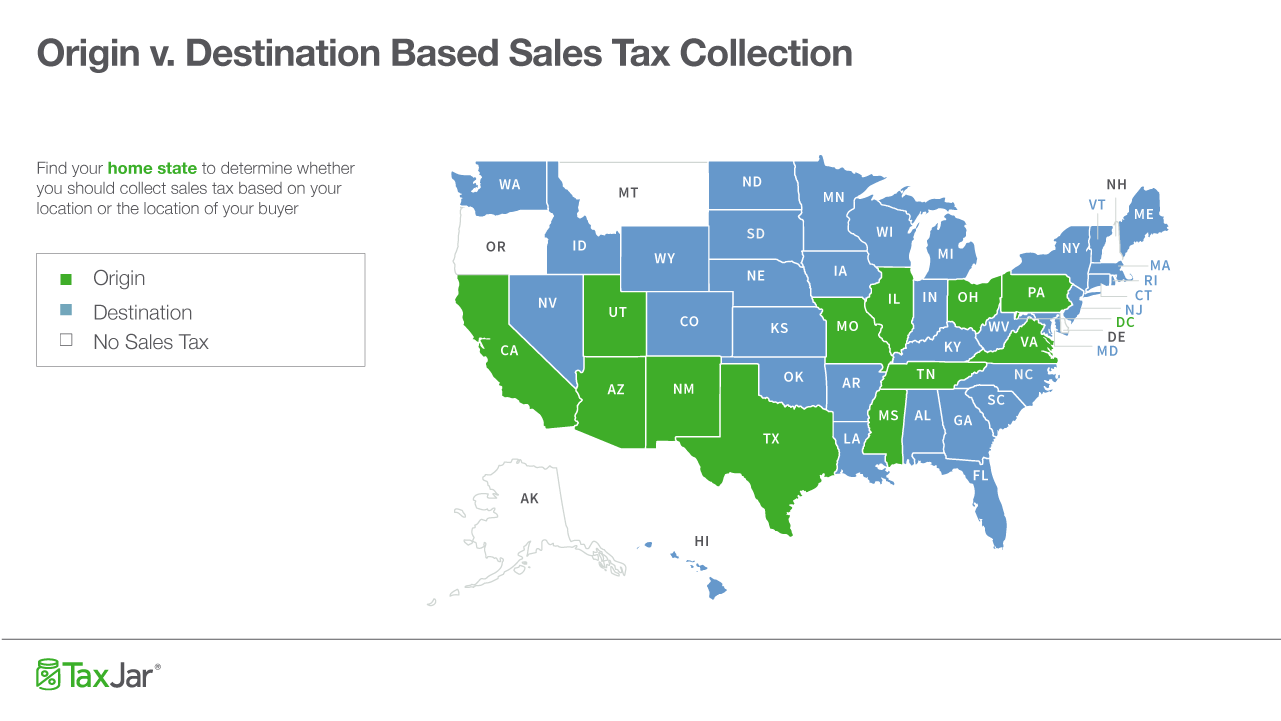

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.