Sales Tax Nevada Vs California

Jun 01, 2019 · I am a nevada resident, but work in California. I paid 803 dollars to California State income tax, but my California refund shows 101 dollar refund.

Cost of Living in Texas vs. California: What's the Difference?

Feb 05, 2020 · According to its 2019 figures, an individual has to have 27.2% more income to earn a living wage in California than in Texas. Key Takeaways California is one of the most expenses states to live in.How State Sales Tax Applies to Etsy Orders – Etsy Help

Based on applicable tax laws, Etsy will calculate, collect, and remit sales tax for orders shipped to customers in the following state(s): Alabama, as of 07/01/2019; Arizona, as of 10/01/2019; Arkansas, as of 07/01/2019; California, as of 10/01/2019; Colorado, as of 10/01/2019; Connecticut, as of 02/01/2019; District of Columbia, as of 06/01/2019; Hawaii, as of 01/01/2020Sales taxes in the United States - Wikipedia

As of 2017, 5 states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not levy a statewide sales tax. California has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in Arab, Alabama, 13.50%. Sales tax is calculated by multiplying the purchase price by the applicable tax rate.Marketplace Sales Tax: Where Etsy Collects and Remits ...

Marketplace Sales Tax: Where Etsy Collects and Remits State Sales Tax. Etsy collects state sales tax on some orders. Learn more and join us in advocating for a simpler federal solution. By Margo Gorski Sep 30, 2020. Tweet; Pin It; Photo by Recneps sales tax nevada vs california Design. Some states in the United States have introduced laws that affect online marketplaces such ...Cannabis was supposed to be a tax windfall for states. The ...

Oct 14, 2019 · The Golden State taxes marijuana on three separate levels, charging a 15 percent excise tax on purchases on top of the statewide 7.25 percent sales tax, as well as a variety of taxes …FAQ - Nevada Tax Center

a service of the Nevada Department of Taxation. Home; How-To Videos; FAQ; About; Contact Us; Log In; Sign Up; FAQWhat are the Laws for Collecting Internet Sales Tax in ...

As of June 21, 2018, the United States Supreme Court changed the sales tax nevada vs california laws regarding the collection of sales tax by internet sellers. The Supreme Court ruling in South Dakota v. Wayfair Inc., established that individual states can require ecommerce retailers to collect state sales tax on the goods they sell.RECENT POSTS:

- speedy 25 damier ebene satchel

- purseforum chanel woc

- neverfull mm damier ebene red

- lv felicie damier ebene reviewed

- clearance shoulder bags at macy's

- branded leather bags for ladies

- louis vuitton duffle bag repair cost

- louis vuitton v tote mm color:safran

- fake louis belt for sale

- louis vuitton keyring coin purse price

- cheap hotels downtown st louis mo

- centralia nike outlet store

- louis vuitton mother pearl necklace

- real louis vuitton shoes vs fake

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

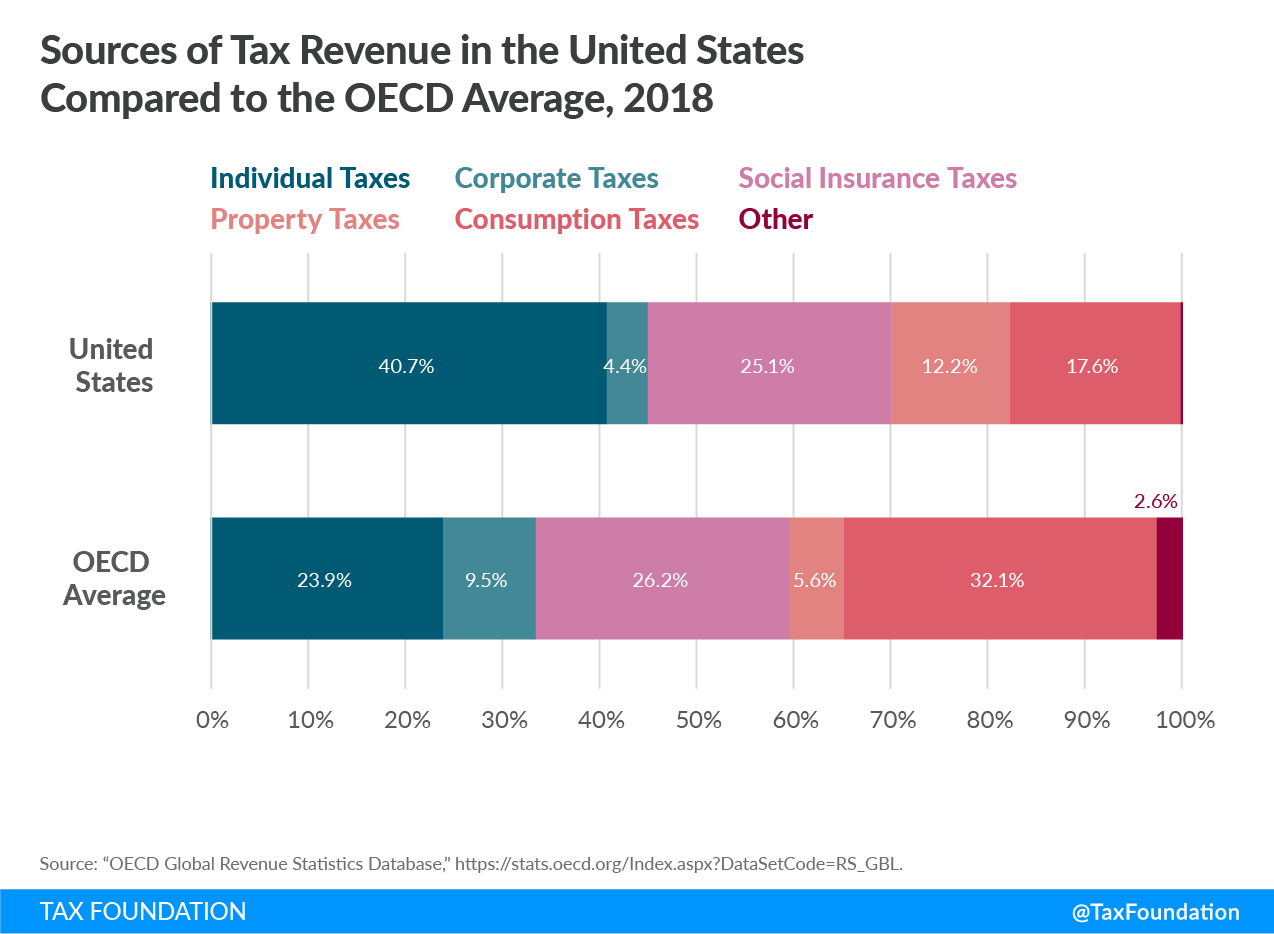

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.