Sales Tax Nevada

Sales & Use Tax Information. 2nd Quarter Estimated Payments Still Due on June 15, 2020 Estimated tax payments for the 2nd quarter are still due on June 15 for both Income Tax and Corporation Business Tax taxpayers. Any 2nd quarter payments made after June 15 will be considered late and may be subject to interest charges.

sales tax nevada Jan 12, 2018 · The Nevada Sales Tax FAQ also states that as of May 2009 transportation, shipping, and postage charges are not taxable if separately stated on the customer’s invoice. Sounds simple, right? As long as you don’t include the cost of shipping in the cost of the item on the invoice or packing slip, you don’t have to collect sales tax on shipping.

Nevada Tax Rates & Rankings | Nevada State Taxes | Tax ...

Taxes in Nevada. Each state’s tax code is a multifaceted system with many moving parts, and Nevada is no exception. The first step towards understanding Nevada’s tax code is knowing the basics. How does Nevada rank? Below, we have highlighted a number of tax rates, ranks, and measures detailing Nevada’s income tax, business tax, sales tax, and property tax systems.Fiscal Year 2020-21 Property Taxes- 2nd Installment Due 10/02/2020 NOTICE TO TAXPAYERS OF DOUGLAS COUNTY, NEVADA The second installment of the 2020-2021 property tax is due and payable on October 5, 2020.

Nevada Sales Tax: Small Business Guide | How to Start an LLC

Jul 29, 2020 · This includes Nevada’s state sales tax rate of 4.600%, Washoe county’s sales tax rate of 2.875%, and Mary’s local district tax rate of 0.250%. In-state Sales. The state of Nevada follows what is known as a destination-based sales tax policy. This means that long-distance sales within Nevada are taxed according to the address of the buyer.Sales tax vendors that sell tangible personal property in Albany County must collect the fee when they provide a paper carryout bag to a customer. View details. Registered distributors of alcoholic beverages. New for 2020 and 2021: Changes are coming for alcoholic sales tax nevada beverages tax (ABT) filers.

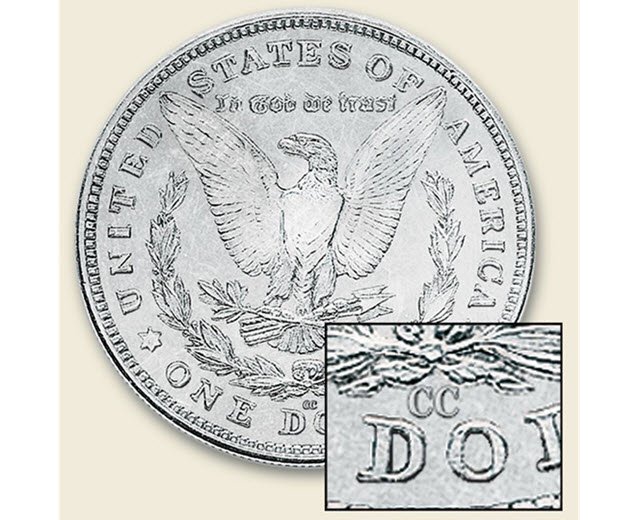

If sales tax is due, proof that sales tax was paid by an Off-Highway Vehicle Report of Sale from a Nevada dealer or a Use Tax Clearance Certificate (Form APP-08.01) from the Department of Taxation. If sales tax is not due (as in a private party sale), the affidavit available in Form OHV-001C must be completed.

Nevada Sales Tax | Sales Tax Institute

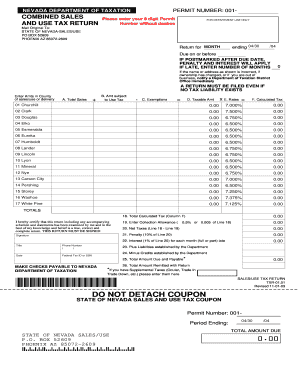

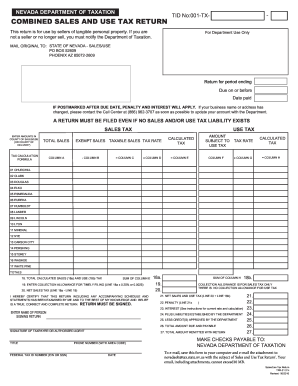

State Rate. 6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate of 4.6%. Two county taxes also apply — 0.50% Basic City-County Relief Tax and 1.75% Supplemental City-County Relief Tax equals an additional city/county rate of 2.25% for a total sales tax nevada of 6.85%.RECENT POSTS:

- prices of louis vuitton sneakers

- st louis cardinals schedule 2019 baseball

- louis vuitton florida

- lv womens bags

- louis vuitton hawaii collection 2019

- best leather computer bag

- minnesota state fair tickets for sale

- hot pink plastic bags

- lv purses and handbags

- louis vuitton outlet in nevada las vegas

- bulk book bags for nonprofits

- merchants bridge st louis mo

- louis vuitton damier ebene favorite mm

- custom vinyl zipper bags

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.