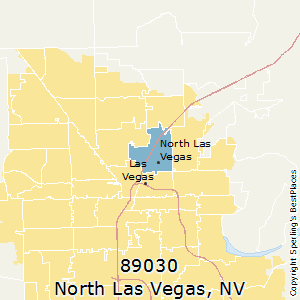

Sales Tax Rate For North Las Vegas Nv

Commission enacts taxes, financing for ... - Las Vegas News

That comes to about a penny for every $10 of sales and is expected to generate about $39 million in revenue, with $7.9 million going to the Las Vegas resort corridor for 66 new officers; $31.3 ...Sales Tax & Use Tax in Las Vegas(Nevada State)

The following approach is used to calculate the total Nevada Sales Tax due on a new car deal when a trade-in is involved: 1. Multiply the full retail price of the new car (including document, smog and other fees) by the Sales Tax rate applicable in the county of the sale. 2.North Las Vegas, Nevada Property Tax Law| LegalMatch Tax ...

Tax rates differentiate widely, but they typically run from less than 1% up to about 5%. To collect the property tax in a fair and consistent sales tax rate for north las vegas nv manner, North Las Vegas, Nevada tax authorities need to have an objective formula for deciding the value of land under its jurisdiction.Tax Rates for North Las Vegas (zip 89081) - The Sales Tax Rate for North Las Vegas (zip 89081) is 8.3%. The US average is 7.3%. - The Income Tax Rate for North Las Vegas (zip 89081) is 0.0%. The US average is 4.6%. - Tax Rates can have a big impact when Comparing Cost of Living. Income and Salaries for North Las Vegas (zip 89081) - The average ...

Zillow has 1,028 homes for sale in North Las Vegas NV. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place.

Once you have an understanding of your property sales tax rate for north las vegas nv tax rates, you will be able to more effectively plan your payments in your budgeting strategy. The following example of calculating property taxes has been done using district # 200 rates ( Las Vegas )and is assuming a property value of $ 250,000.

NV Avg Real Estate Commission Rate in Las Vegas, Henderson ...

NV Avg Real Estate Commission Rate in Las Vegas, Henderson, Paradise, Nevada. Las Vegas, officially the City of Las Vegas and often known simply as Vegas, is the 28th-most populated city in the United States, the most populated city in the state of Nevada, and the county seat of Clark County.The city anchors the Las Vegas Valley metropolitan area and is the largest city within the greater ...ONLY FOR MEDICAL MARIJUANA SALES PRIOR TO JULY 1, 2017. An excise tax on the wholesale and retail sale of Medical Use Marijuana and Marijuana Products. The rate is 2% of the sales price every time it is sold regardless if sold sales tax rate for north las vegas nv for wholesale or retail. The tax return is due monthly and is imposed on the person making the sale.

RECENT POSTS:

- bed sheets on sale online

- louis vuitton tasche will haben

- replica goyard small tote with zipper

- black women's sneakers on sale

- gucci monogram canvas bag

- louis vuitton pochette felicie zippered insert monogram brown

- buy wallet online bd

- louis vuitton nanogram bracelet reviewed

- lv belt price in bangladesh

- louis vuitton fanny pack 2020

- concerts in st louis 2020

- south coast plaza louis vuitton store

- farm for sale paris ky

- louis vuitton favorite mm like new

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.