Sales Tax Rate In Clark County Nevada 2018

Oct 07, 2020 · See the posting at top of the page for list of parcels that will be offered this Tax Sale. There are currently 772 individual parcels for sale and include sales tax rate in clark county nevada 2018 commercial property, multi-residential property and single residential properties.

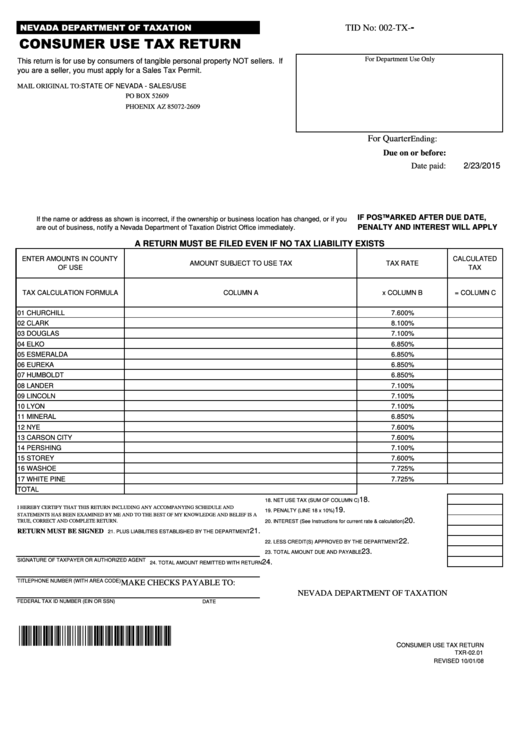

Two local sales and use tax rate increases are set to take effect in Nevada on April 1, 2017: sales tax rate in clark county nevada 2018 The new combined rate in Clark County will be 8.25% (up from 8.15%) The new combined rate in Washoe County will be 8.265% (up from 7.725%) Additional information is available from the Nevada …

Vegas Teachers Start Drive for Sales Tax Hike to Raise $1B ...

Jan 16, 2020 · That would push sales taxes in Las Vegas and Clark County to nearly 9.9%. ... Education Week’s annual Quality Counts 2019 report card ranked Nevada 50th …Tax Auction The Washoe County Treasurer’s Office holds auctions for delinquent property and mobile home taxes. Nevada State Law provides for the redemption of real estate properties up until 5 pm on the third business day before the day sales tax rate in clark county nevada 2018 of the sale by a county treasurer (NRS 361.585). louis vuitton casual shoes price in india

Residential Property Sales Information | Clark County

Property Taxes About one-fourth of Clark County’s entire budget comes from property taxes, which are used for roads, parks, fire and police protection, and other important services. Property taxes in Washington were first established by the territorial government in 1853.Tax Sale for Clark County Nevada (NV) - Clark County Tax ...

In Nevada, the County Tax Collector will sell Tax Deeds to winning bidders at the Clark County Tax Deeds sale. Generally, the minimum bid at an Clark County Tax Deeds sale is the amount of back taxes owed plus interest, as well as any and all costs associated with selling the property.Chasing the room tax: Percentage tacked onto tourists ...

Aug 01, 2016 · • By 2009, at the height of the Great Recession, the room-tax rate had grown to an average of 12 percent (maximum 13 percent), with 32 percent of the revenue funding Southern Nevada tourism.Vegas teachers start drive for sales tax hike to raise $1B

Jan 16, 2020 · That would push sales taxes in Las Vegas and Clark County to nearly 9.9%. Union officials chose to seek a hike in the sales tax because it is already earmarked for education and provides 47 percent of funding for public schools, association executive John Vellardita told the Las Vegas Review-Journal. Nevada has no income tax.RECENT POSTS:

- ashley furniture homestore sales salary

- louis vuitton gray and white checkered bag

- louis vuitton graffiti keepall

- louis vuitton slides fur

- faux gucci crossbody bag images

- st louis furniture outlet stores

- louis vuitton hat box price

- louis vuitton pochette metis price in euros

- coin purse keychain target ebay

- gucci leather hobo bag small

- preloved lv bags in osaka

- louis vuitton neverfull azur tahitienne

- purse organizer insert clear

- louis vuitton avenue sling bag infini

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.