Sales Tax Rate In Las Vegas Nevada 2020

Clark County Treasurer's Tax Rate By District

CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes. There are currently 111 separate tax districts in Clark County. The tax rate for each district is based on the amount of monies budgeted for government-provided services, such as schools, police, fire, sales tax rate in las vegas nevada 2020 parks, libraries, and capital projects, such as flood control and transportation.California City and County Sales and Use Tax Rates ...

Oct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by addressClark County Commission votes to raise sales tax, with conditions 0...

Nevada Retirement Tax Friendliness - SmartAsset

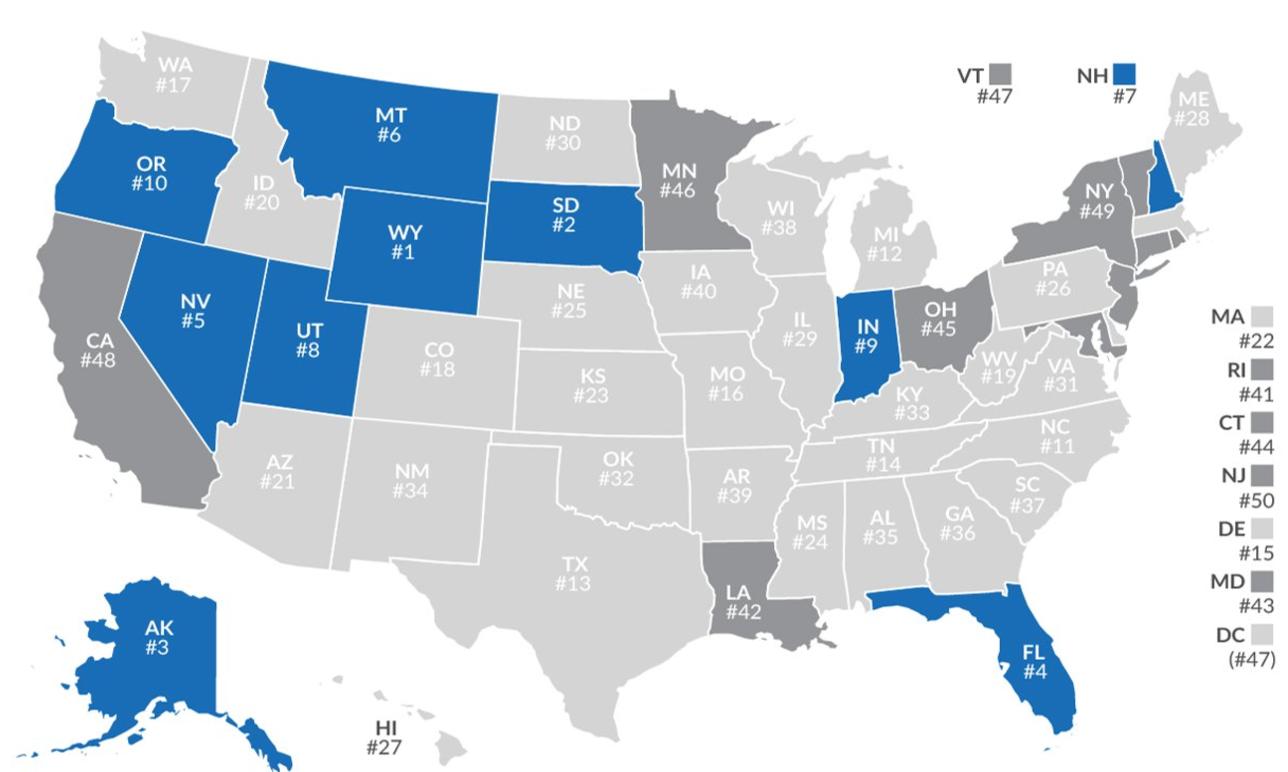

How high sales tax rate in las vegas nevada 2020 are sales taxes in Nevada? Sales tax rates in Nevada are somewhat higher than average. The statewide rate is 6.85%, which ranks seventh among all U.S. states. However, local rates are relatively low, averaging slightly more than 1%. Combined, the overall state average is 8.14%.Contact Us - Nevada Tax Center

Carson City Department of sales tax rate in las vegas nevada 2020 Taxation 1550 College Parkway Suite 115 Carson City, Nevada 89706 (775) 684-2000 (voice) (775) 684-2020 (fax)Free Nevada Payroll Calculator | 2020 NV Tax Rates | OnPay

Nevada Unemployment Insurance & Modified Business Tax. As an employer, you have to pay the state’s unemployment insurance. For 2020, Nevada unemployment insurance rates range from 0.3% to 5.40% with a taxable wage base of up to $32,500 per employee per year. If you’re starting a new small business (congratulations!), you should use 3%.Jul 01, 2019 · Las Vegas Realtors reported that short sales and foreclosures combined accounted for 2.7% of all existing local property sales in January 2020. That compares to 2.8% of all sales one year ago, 4.3% two years ago, and 11% three years ago.

A Quick Guide to Understanding Hotel Occupancy Tax ...

Jan 14, 2017 · The Las Vegas Strip, where the current tax is a flat rate of 12.0%, will see a rise with rates going up to 13.38% by March 2017. Travelers might or might not decide on what city they want to visit based on hotel taxes, but the table below provides useful information.RECENT POSTS:

- cardinals tickets flash ticket sale

- macy's furniture sale dates 2020

- lv keepall 55

- supreme louis vuitton adidas yeezy boost 350

- discounted six flags st louis tickets

- louis vuitton miroir alma bag

- salary louis vuitton sales associate

- lv bags wholesale

- 2018 st louis cardinals schedule

- louis vuitton collectors item

- louis vuitton olx portugal

- black leather crossbody bag with silver hardware

- gucci soho hobo bag large

- louis vuitton speedy 25 poshmark

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.