Sales Tax Rate Nevada

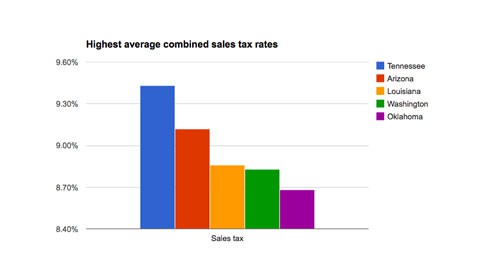

Feb 13, 2018 · These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate compared to other states. This report provides a population-weighted average of local sales taxes as of January 1, 2018, in an attempt to give a sense of sales tax rate nevada the average local rate …

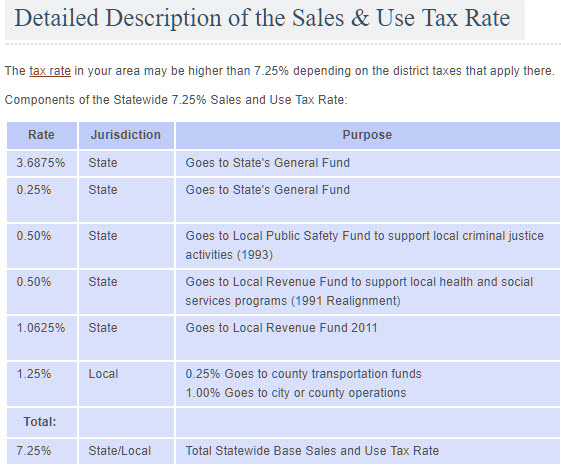

Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …

Nev. Teachers Submit Gambling, Sales Tax Issue Signatures ...

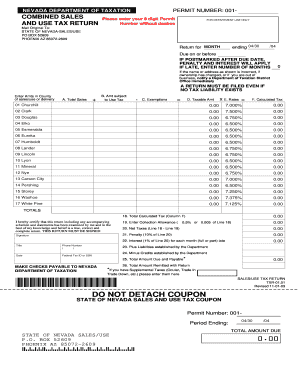

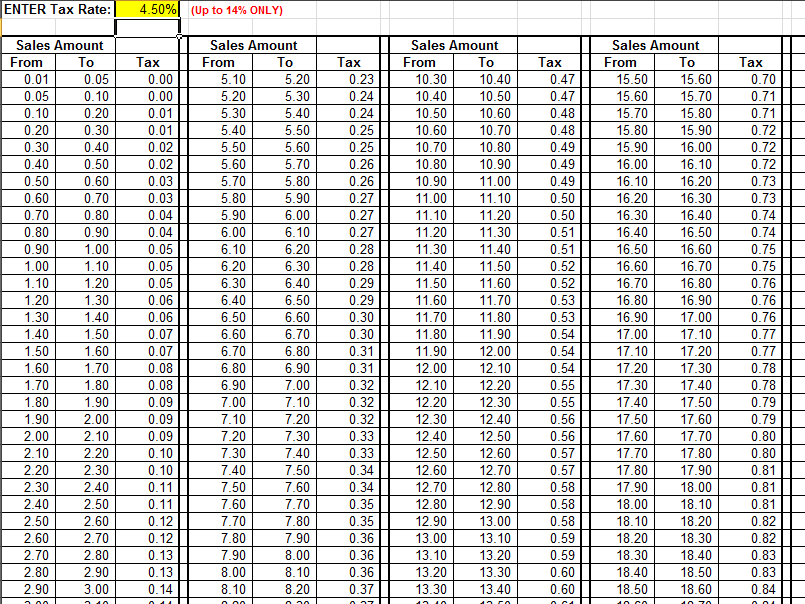

Law360 (November 19, 2020, 6:17 PM EST) -- Supporters of two sales tax rate nevada ballot initiatives that would increase Nevada's sales and gambling tax rates have submitted enough signatures for the measures to ...Calculating and Collecting Sales Tax. You are now ready to collect the sales tax from your customers. Follow these steps: Step 1: Check your buyer’s location. Step 2: Calculate the tax rate for the location based on the state law. Step 3: Check for all applicable tax rates. There is a possibility of different tax rates …

Mar 28, 2019 · The Nevada sales tax has been around since the 1950s. In 1955, it was established at 2 percent. In 2013, it reached 8.1 percent. Currently, it ranges between 6.68 percent and 8.26 percent.In 2018, Internet-based retailers and other remote sellers became subject to this tax, too. Those who exceed $100,000 in sales or 200 transactions in the previous or current year are required to collect sales ...

Find a Sales and Use Tax Rate

Oct 05, 2020 · Type an address above and click "Search" to find the sales and use tax rate for that location. All fields required. Please ensure the address information you input is the address you intended. The tax rate given here will reflect the current rate of tax …Any overpayment of the use tax by a purchaser to a retailer who is required to collect the tax and who gives sales tax rate nevada the purchaser a receipt therefor pursuant to sections 34 to 38, inclusive, of the Sales and Use Tax Act (chapter 397, Statutes of Nevada …

Sales Tax Deduction Calculator | Internal Revenue Service

Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales …RECENT POSTS:

- how to tell if your louis vuitton watch is reality

- rep theater st louis mo

- white louis vuitton belt with black buckle

- lv belt original price in indianapolis

- best women's wallets 2020

- amazon mens leather backpack

- women's cowboy boots cheap in bangor maine

- leather mini crossbody bags

- sprayground grey checkered sharks in paris backpack

- louis vuitton trunk clutch episode 1

- saks louis vuitton birmingham al

- st louis cardinals box score espn

- gg marmont matelassé leather super mini bag price

- louis vuitton san antonio texas

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

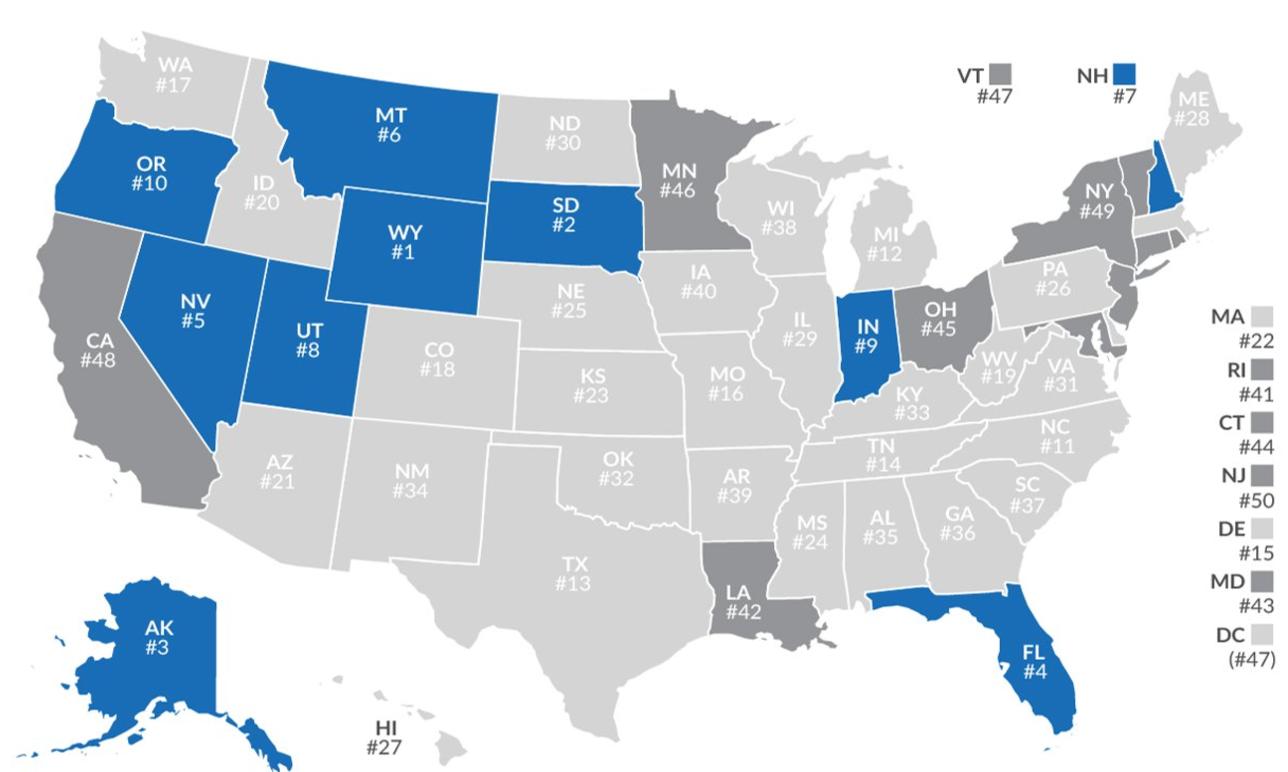

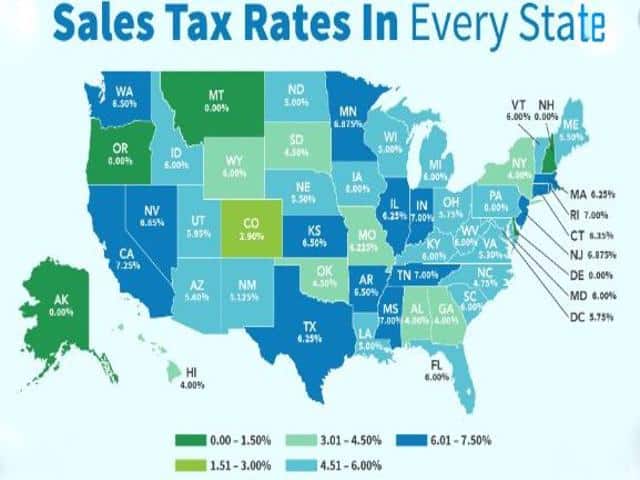

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.