Salesperson Pay Structure

How to structure employee compensation | Workable

Pay structures define employee compensation for different jobs or groups of jobs. They involve setting salary ranges and pay grades based on market data and job roles. Here’s our guide on why and how to set up a pay structure: Why you salesperson pay structure need structured employee compensationSalary Structure: How to Create a Compensation Structure ...

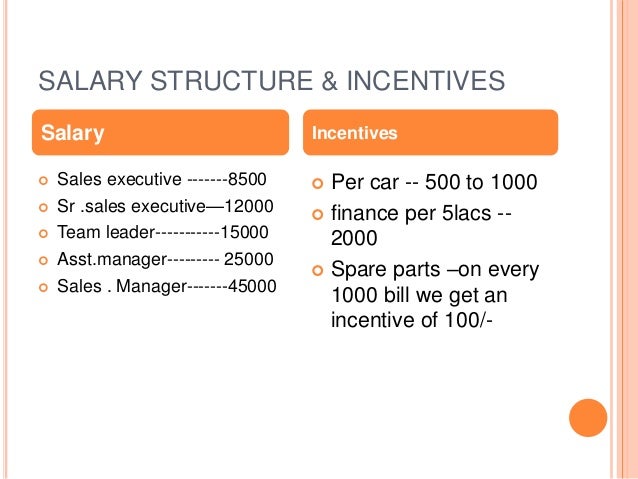

Salary structure: How to create a compensation structure. Having a solid salary structure makes it easier to manage your salary expenditure. Not to mention, it can help you retain your salesperson pay structure current employees, as well as make your recruiting, hiring and promoting efforts more focused and easier to execute.Positions can pay an average of $150,000 to $500,000 per year, with a pay structure including base pay and sales commission. As more healthcare organizations transition to electronic recordkeeping, electronic medical record sales representatives have also been growing in number.

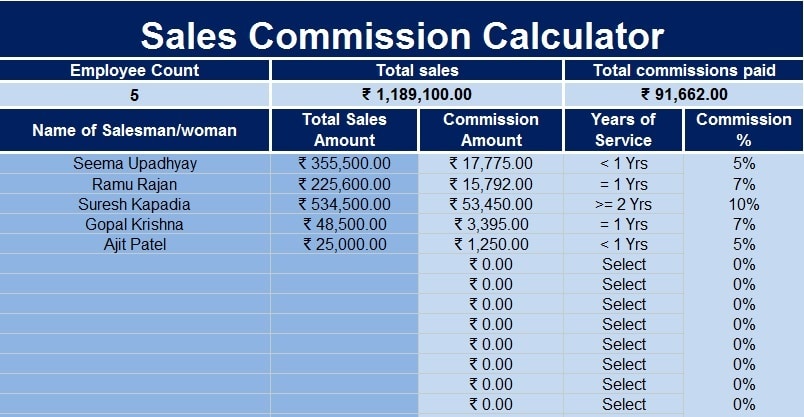

Here is an example of how I structured my sales commission structure. My industry works on a salesperson bringing in three times their monthly salary before the commission kicks in.

Commissions Based Pay vs. Salary | Work - 0

Commissions Pros. With commission pay, which is common in sales jobs, you pay employees a percentage of the revenue they generate. Psychologist Frederick Herzberg indicated in his two-factor theory of motivation that commission has more of a motivating effect in that it drives workers to deliver better results because they only get paid if they perform.Council Post: 11 Smart Ways To Structure Your Sales Team's ...

Jul 11, 2019 · A commission-based pay structure gives employees an incentive to work hard and strive for more. This is a common model for sales teams, and …Nov 21, 2018 · Sales managers, salesperson pay structure like their staff, usually make their money through a combination of pay structures, the center of which is usually commission. Managers don't make as much commission per sale as sales people do, but usually get an smaller percentage based on the sales …

Salary structure in India - Different types and components

May 14, 2019 · Net Salary: Simply speaking, this is the salary you get in your hands and thus also sometimes called an in-hand salary. This is the amount you get (or pay) after deductions such as PF, ESI, PT, TDS, loss of pay and other deductions as per your company. Gross salary: This is the salary which is shown in the payslip. This salary is the total ...RECENT POSTS:

- louis vuitton cake handbag

- gucci purse sale authentication

- louis vuitton coin purse black

- louis vuitton sac alma bb toile damier ebene

- louis vuitton resale bags

- brown louis vuitton handbag

- where do you buy louis vuitton handbags

- best men's leather wallets uk

- louis vuitton escale dupe

- best outlet malls near me

- pink and blue sprayground backpack

- louis vuitton spring summer 2019 wallets price

- macy's black friday sales ad

- louis vuitton guangzhou

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.