Salesperson Salary Structure

Updating Salary Structure: When, Why and How?

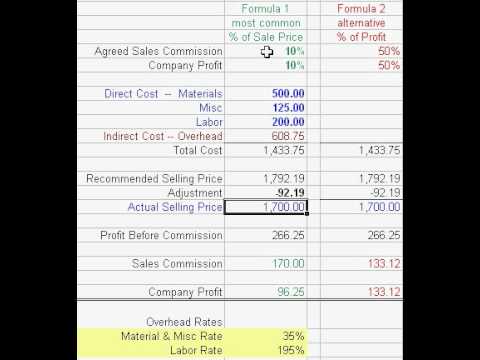

Link the salary structure back to HR strategy and the market. If the salary structure salesperson salary structure does get out of alignment, it may not be tied closely enough to the company’s total rewards and HR strategy.How to Create a Sales Incentive Compensation Plan. There are many parts that come together to form your sales incentive compensation plan. It's important that as a whole, your plan can be easily communicated and the structure of reps' pay is simple and easy to understand.

Before we get into the details of the best way to compensate salespeople, let’s run down the basic compensation structures for sales employees. Straight Salary: This plan offers no commission. Employees get a regular salary every paycheck. Salary Plus Bonus: This plan provides a straight salary plus bonuses when company-defined targets are met.

What Is the Average Salary, Commission and Benefits for a ...

A median salary means that half of all sales engineers earn more per year and half earn less. At the upper reaches of the industry, salaries exceed $162,740. Telecommunications is the most lucrative market, with median annual wages of $109,880. A major part of any sales job is commission. According to the Harvard Business Review, technical ...Variable Pay Compensation Structure For Sales Teams ...

Dec 12, 2017 · Why salesperson salary structure Variable Pay Compensation Structure For Salespeople? Queue the picture of the stereotypical salesperson on stage with a massive check. Most people think it’s that extroverted cutthroat personality that fits with variable compensation, but allow me to …How to Set Up a Sales Compensation Plan | comicsahoy.com

Dec 16, 2009 · A straight base salary guarantees that valued sales staff members are compensated even during an economic downturn, when a lack of sales is attributable to factors outside the salesperson's -- …Pay Scale of an RV Sales Associate | Work - comicsahoy.com

Pay Scale of an RV Sales Associate. RV sales salesperson salary structure associates sell dreams to those who want to travel the United States in style. Recreational vehicles can cost tens of thousands of dollars -- and even over $100,000 -- so many customers have substantial incomes. RV sales associates show the vehicles to potential customers, ... one savvy girl sling backpackEvery employer needs to pay 13.35% of employee basic salary towards EPF account of employee and 4.75% of employee gross salary as ESIC contribution. Categories Soft Skills Tags Salary Breakup Calculator Excel , Salary Structure Calculator Post navigation

RECENT POSTS:

- st louis cardinals top 30 prospects 2017

- louis vuitton maison seoul opening

- supreme lv air maximum

- when is macys one day sale

- lv neo noe bb price

- cheap louis vuitton wallet mens

- louis vuitton top selling purses

- cathedral basilica of st louis new orleans

- clutch purse with hand strap

- virgil lv box bagger

- st louis cardinals baseball jerseys

- 2019 louis vuitton spring/summer handbags

- michael kors small purse greensboro

- light brown leather belt mens

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.