State Of Nevada Sales Tax Rates By County

Jan 01, 2020 · Of course, you must still pay federal income taxes. Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county state of nevada sales tax rates by county and city rates for every county and the largest cities in the state.

Residents of Nevada Sales tax is charged on orders shipped to addresses within the state of Nevada at the Washoe County rate of 8.27% Residents of other states American Duchess has no physical presence outside of Nevada and therefore is not required to collect sales tax or use tax … louis vuitton speedy bags

Taxes and fees: Where marijuana money is going in Nevada ...

Jun 10, 2019 · Previously, the state was only sending revenue generated from a separate, 15% excise tax on wholesale marijuana to Nevada’s Distributive School Account. In fiscal year 2018, that revenue ...Nevada's sales tax consists of three separate taxes levied at different rates on the sale and use of state of nevada sales tax rates by county personal property in the state. The current total rate is 5.75 percent. The tax includes:

Oct 01, 2020 · STATE OF CALIFORNIA. SALES AND USE TAX RATES. CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION. California Sales and Use Tax Rates by County and City * Operative October 1, 2020 state of nevada sales tax rates by county (includes state, county, local, and district taxes) ... NEVADA COUNTY 7.50%. City of Grass Valley 8.50% City of Nevada …

Clark County teachers union proposes sales tax hike to ...

Sales tax rates in Nevada vary, depending on whether jurisdictions have added local taxes. In Clark County, the sales tax would increase from the current 8.375 percent to 9.875 percent.State and Local Sales Tax Rates, July 2018 | Tax Foundation

Jul 16, 2018 · Sales Tax Clearinghouse publishes quarterly sales tax data at the state, county, and city levels by ZIP code. We weight these numbers according to U.S. Census Bureau 2010 population figures in an attempt to give a sense of the prevalence of sales tax rates in a particular state.PROPERTY TAXES The Property Tax System - Nevada County, …

Nevada County’s real property tax is an “ad valorem tax,” a tax according to value. Proposition 13 established the tax rate as 1% of current assessed value, plus voter approved bonded indebtedness. …RECENT POSTS:

- lv pallas satchel

- supreme louis vuitton phone case iphone x

- supreme x louis vuitton hoodie blue

- supreme x louis vuitton wallpaper hd

- st louis cardinals newsletter

- lv pochette metis reverse made in usa

- dr louis cohen sarasota

- louis vuitton silk head scarf cheapest

- district pm monogram eclipse

- houston to st louis flight status

- louisiana state fair 2019 tickets

- model tas lv monogram

- small reusable tote shopping bags

- st. louis artists' guild

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

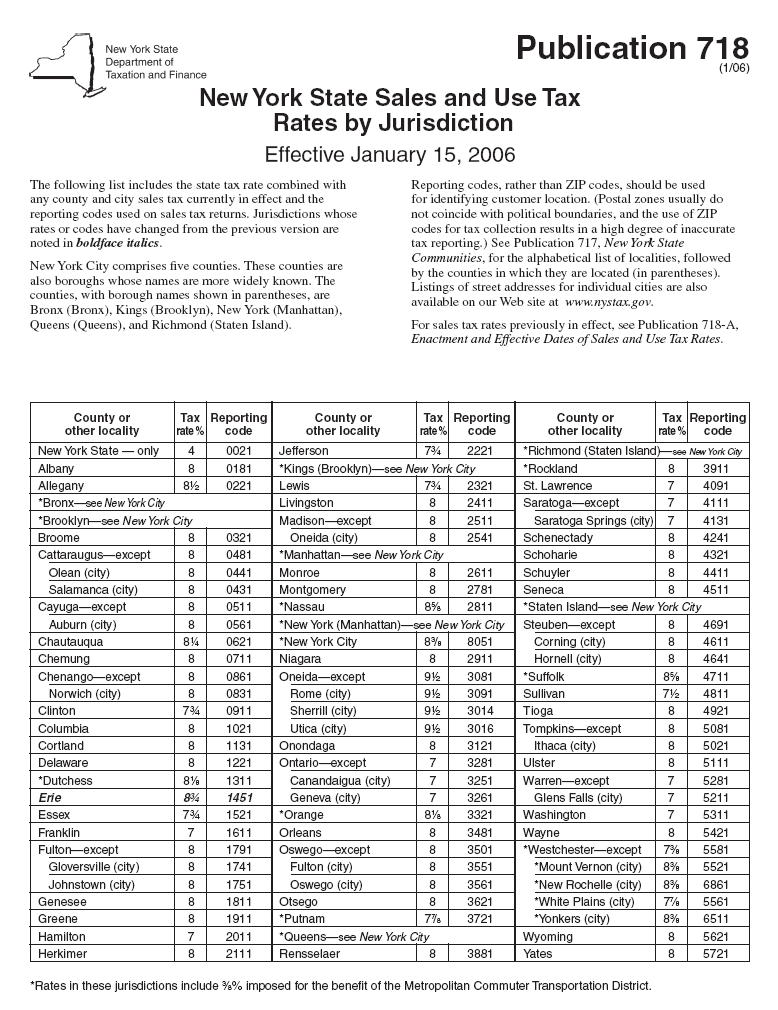

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.