Total Sales Tax Rate Nevada Turbotax

Know Your Sales and Use Tax Rate

Jul 01, 2019 · The sales and use tax rate varies depending where the item is bought or will be used. A base sales and use tax rate of 7.25 percent is applied statewide. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. District tax areas consist of both counties and cities.Aug 30, 2016 · Sales Tax Overview. The federal government applies a sales tax, called the Goods and Services Tax, to most purchases in Canada. The current GST rate is 5%. Most provinces apply an additional sales tax, either separately as a provincial sales total sales tax rate nevada turbotax tax, or together with the GST as a Harmonized Sales Tax. As of 2019, the HST rate is:

Easy income tax calculator for an accurate Manitoba tax return estimate. Your 2019 Manitoba income tax refund could be even bigger this year. Enter your annual income, taxes paid & RRSP contribution into our calculator to estimate your return.

Arizona Sales Tax Rate & Rates Calculator - Avalara

The Arizona (AZ) state sales tax rate is currently 5.6%. Depending on local municipalities, the total tax rate can be as high as 11.2%. Sales tax is a tax paid to a governing total sales tax rate nevada turbotax body (state or local) for the sale of certain goods and services.Nevada Income Taxes, NV State Tax Return

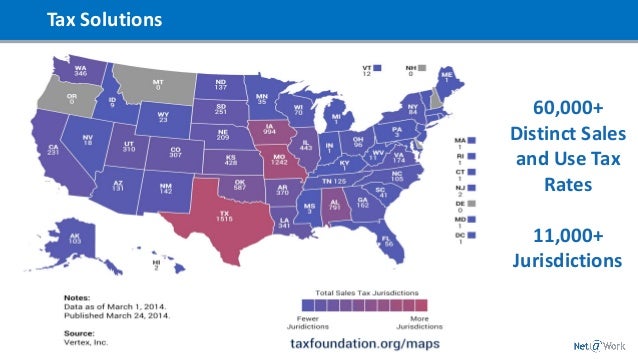

Oct 15, 2020 · Nevada has various sales tax rates based on county. Counties can also collect option taxes. This can make the combined county/state sales tax rate as high as 8.10% in some areas.Look at where you live. If you live in a state that doesn’t have a sales tax, then the income tax deduction is probably for you. The same goes for people in high income-tax states, Riker says.

Jul 06, 2012 · Hey All: So I was vacationing in the Reno area these past couple of days and did some shopping. After looking over my receipts, I saw that a store I bought from at The Summit broke down the sales tax as follows: State: 6.25% Washoe County: 3.125% District 0.500% = Total: 9.875% WTF?!! Has it really become this much?

For the most part, Use Tax rather than Sales Tax, applies to property purchased ex-tax outside of Nevada for storage, use or other consumption in Nevada from other than a seller registered in Nevada. Use Tax, applies to mail order, out-of-state, toll-free “800” numbers, purchases made on the internet and other purchases of tangible personal ...

RECENT POSTS:

- lv artsy empreinte reviewed

- will louis vuitton repair zipper

- lv martin

- best black friday tv deals 65 inch

- louis vuitton unisex monogram abbesses monogram brown canvas messenger bag

- louis vuitton artist bags

- louis vuitton monogram neverfull mm rose ballerine

- price of hermes birkin bag in south africa

- lv new wave camera bag m53682

- supreme box logo t shirt replica

- mens double zip wallet organizer

- custom printing services louisville ky

- louis vuitton iphone x case amazon

- dkny mini leather backpack/handbag with removable straps and top handle

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

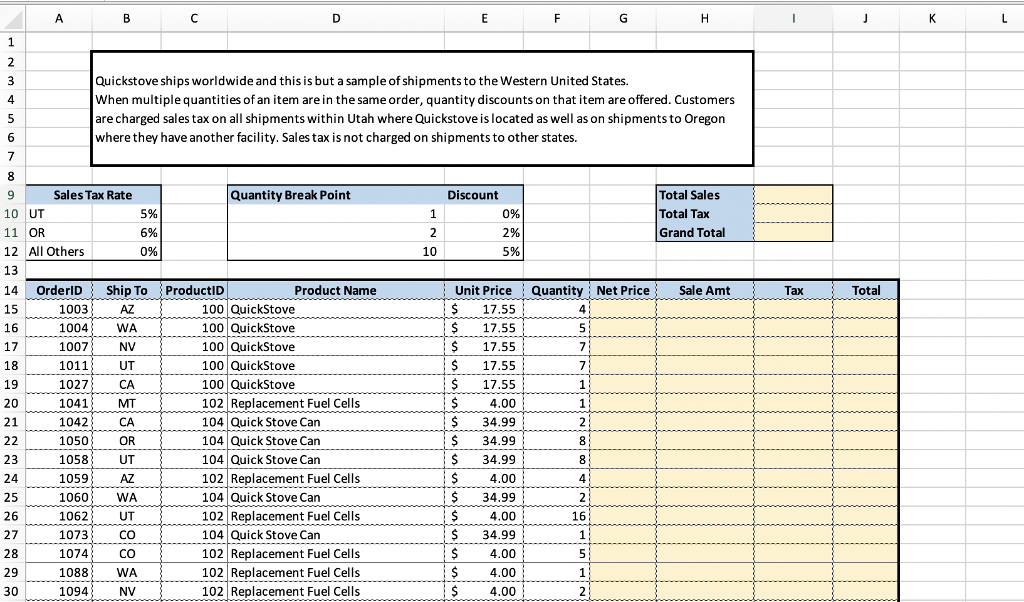

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.